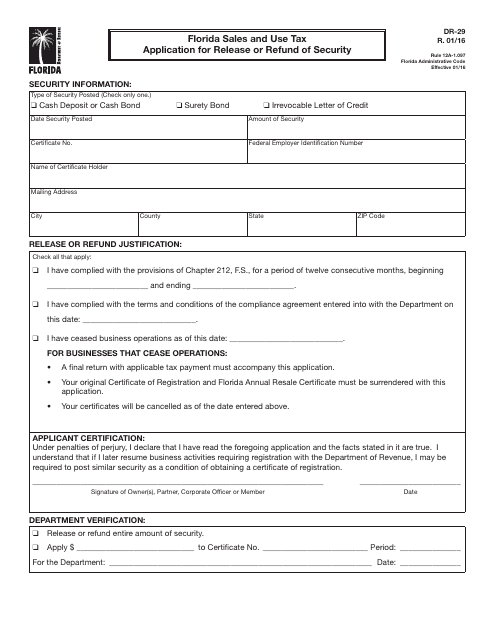

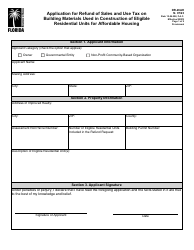

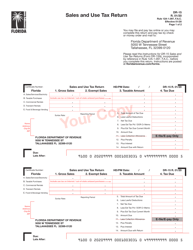

Form DR-29 Florida Sales and Use Tax Application for Release or Refund of Security - Florida

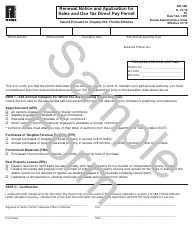

What Is Form DR-29?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-29?

A: Form DR-29 is the Florida Sales and Use Tax Application for Release or Refund of Security.

Q: What is the purpose of Form DR-29?

A: The purpose of Form DR-29 is to request a release or refund of security for sales and use tax in Florida.

Q: Who needs to fill out Form DR-29?

A: Businesses that have previously provided security for sales and use tax in Florida may need to fill out Form DR-29 to request a release or refund of that security.

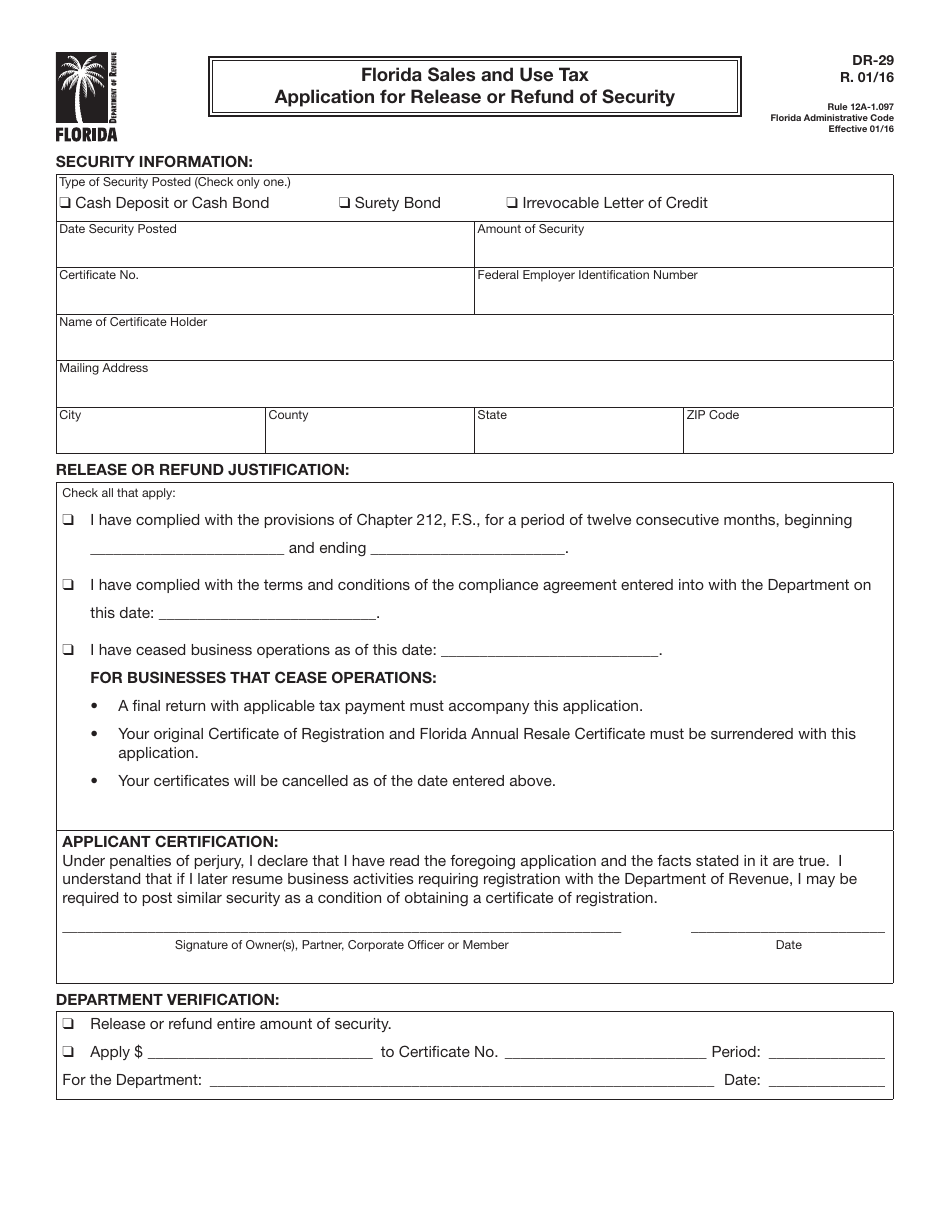

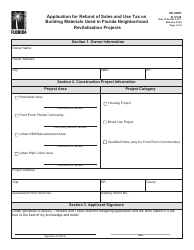

Q: What information is required on Form DR-29?

A: Form DR-29 requires information such as the taxpayer's name, address, and tax account number, as well as details about the security and the reason for the release or refund request.

Q: Are there any fees associated with filing Form DR-29?

A: There are no fees associated with filing Form DR-29.

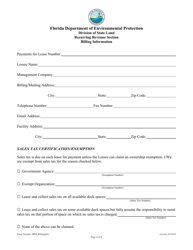

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-29 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.