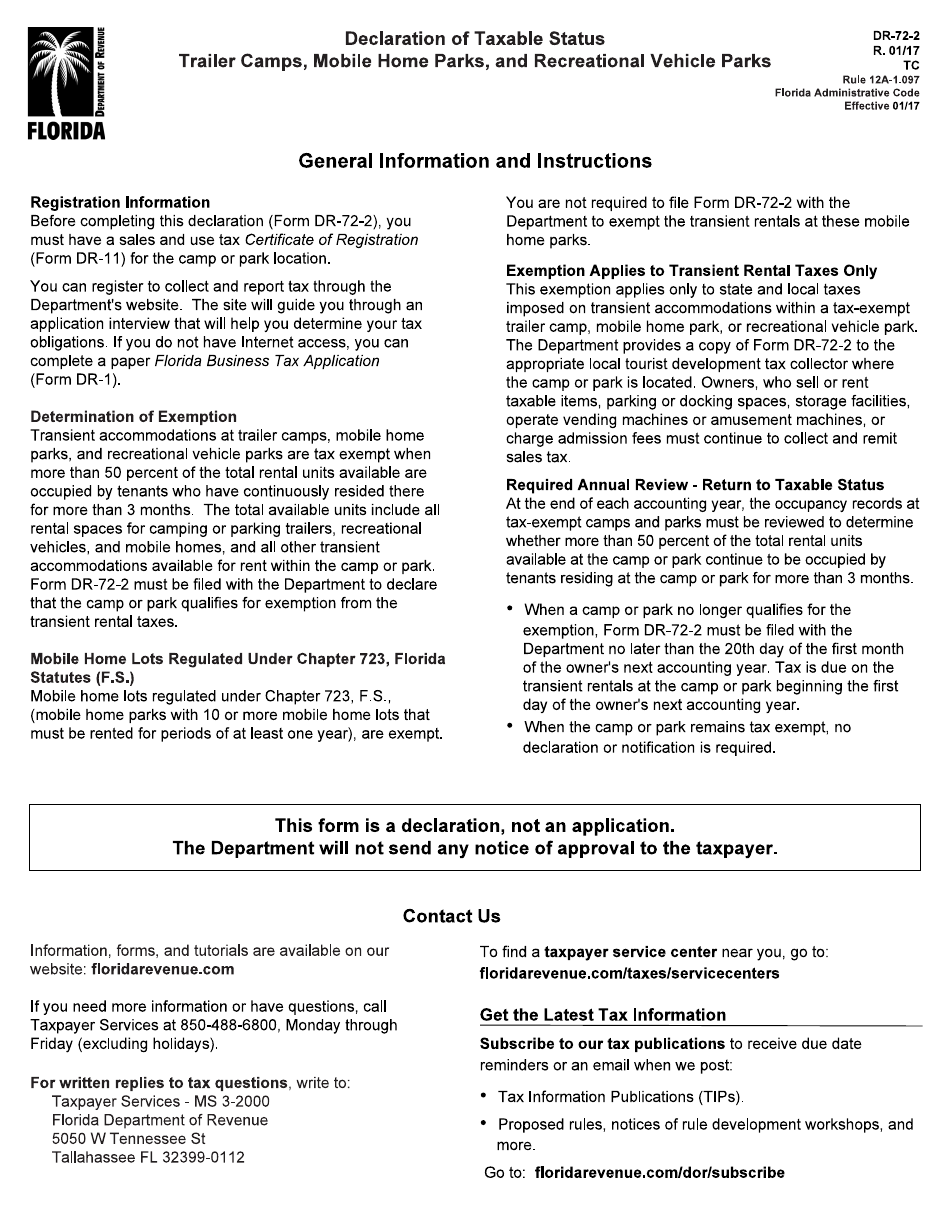

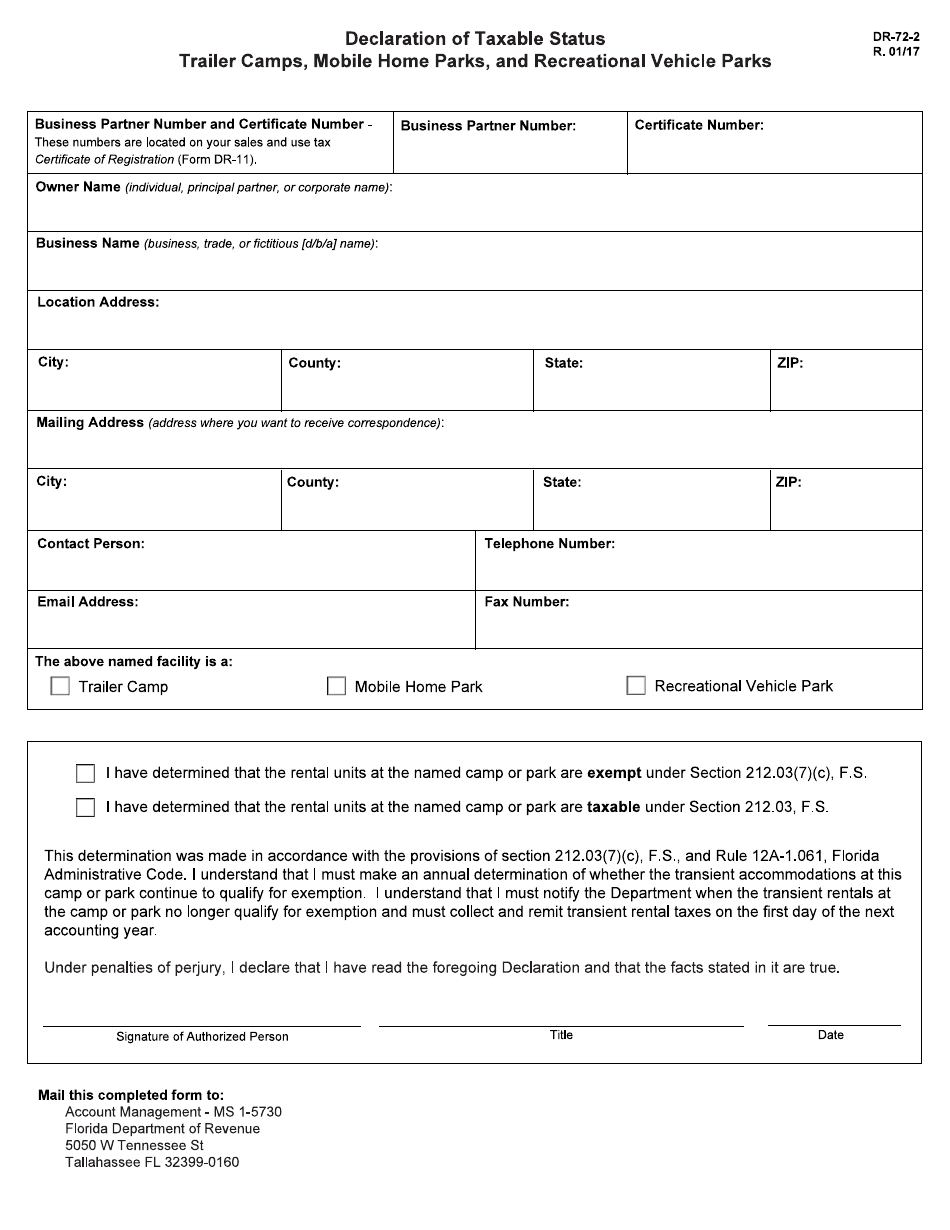

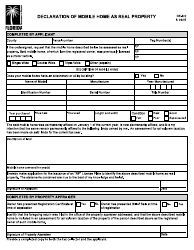

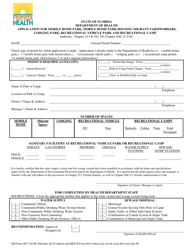

Form DR-72-2 Declaration of Taxable Status - Trailer Camps, Mobile Home Parks, and Recreational Vehicle Parks - Florida

What Is Form DR-72-2?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-72-2?

A: Form DR-72-2 is a declaration of taxable status specifically for trailer camps, mobile home parks, and recreational vehicle parks in Florida.

Q: Who needs to fill out Form DR-72-2?

A: Owners or operators of trailer camps, mobile home parks, and recreational vehicle parks in Florida need to fill out Form DR-72-2.

Q: What is the purpose of Form DR-72-2?

A: The purpose of Form DR-72-2 is to declare the taxable status of trailer camps, mobile home parks, and recreational vehicle parks in Florida.

Q: When is Form DR-72-2 due?

A: Form DR-72-2 is generally due by April 1st of each year.

Q: Are there any penalties for not filing Form DR-72-2?

A: Yes, there may be penalties for not filing Form DR-72-2 or for filing it late. It is important to submit the form on time to avoid penalties.

Q: What information is required on Form DR-72-2?

A: Form DR-72-2 requires information such as the park name, address, number of lots or spaces, and the name and address of the owner or operator.

Q: Is Form DR-72-2 specific to Florida?

A: Yes, Form DR-72-2 is specifically for trailer camps, mobile home parks, and recreational vehicle parks in Florida.

Q: Is there a fee for filing Form DR-72-2?

A: No, there is no fee for filing Form DR-72-2.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-72-2 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.