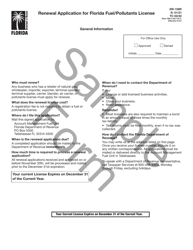

This version of the form is not currently in use and is provided for reference only. Download this version of

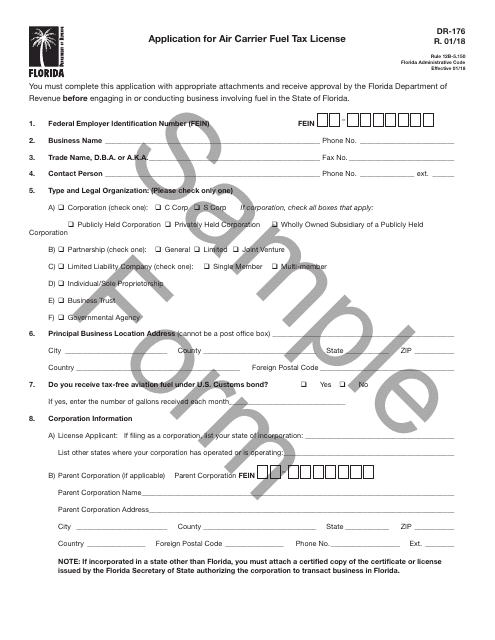

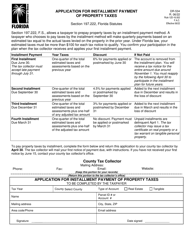

Form DR-176

for the current year.

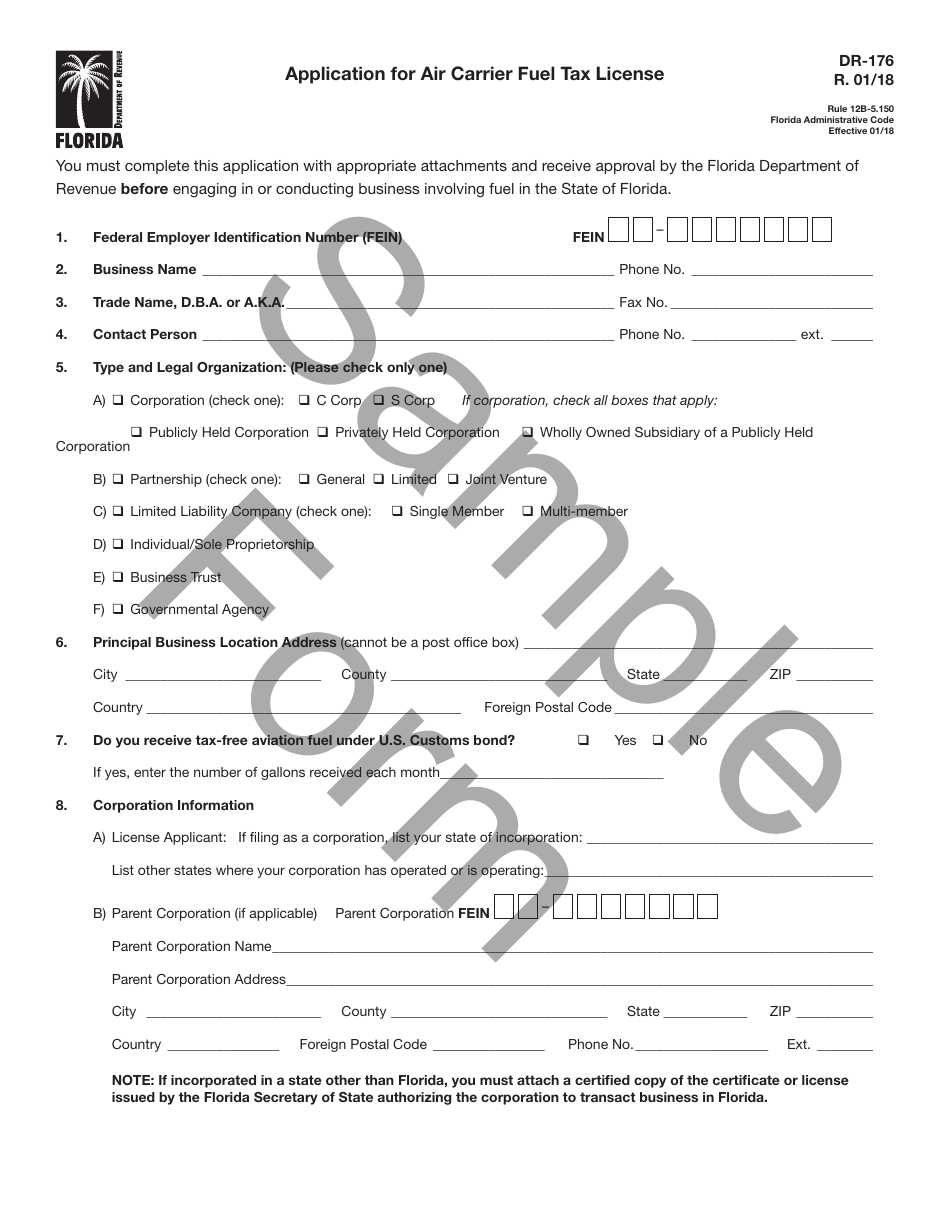

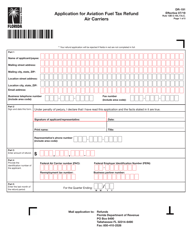

Sample Form DR-176 Application for Air Carrier Fuel Tax License - Florida

What Is Form DR-176?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

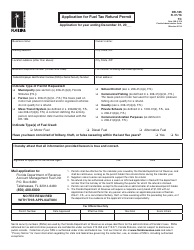

Q: What is Form DR-176?

A: Form DR-176 is the application form for an Air Carrier Fuel Tax License in Florida.

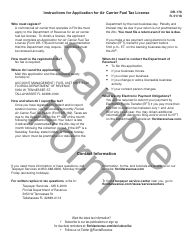

Q: Who needs to file Form DR-176?

A: Any air carrier operating in Florida and selling or using fuel for air transportation purposes needs to file Form DR-176.

Q: What is the purpose of Form DR-176?

A: The purpose of Form DR-176 is to apply for a license to sell or use fuel for air transportation purposes in Florida.

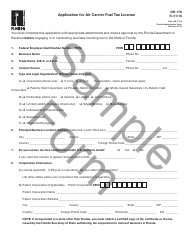

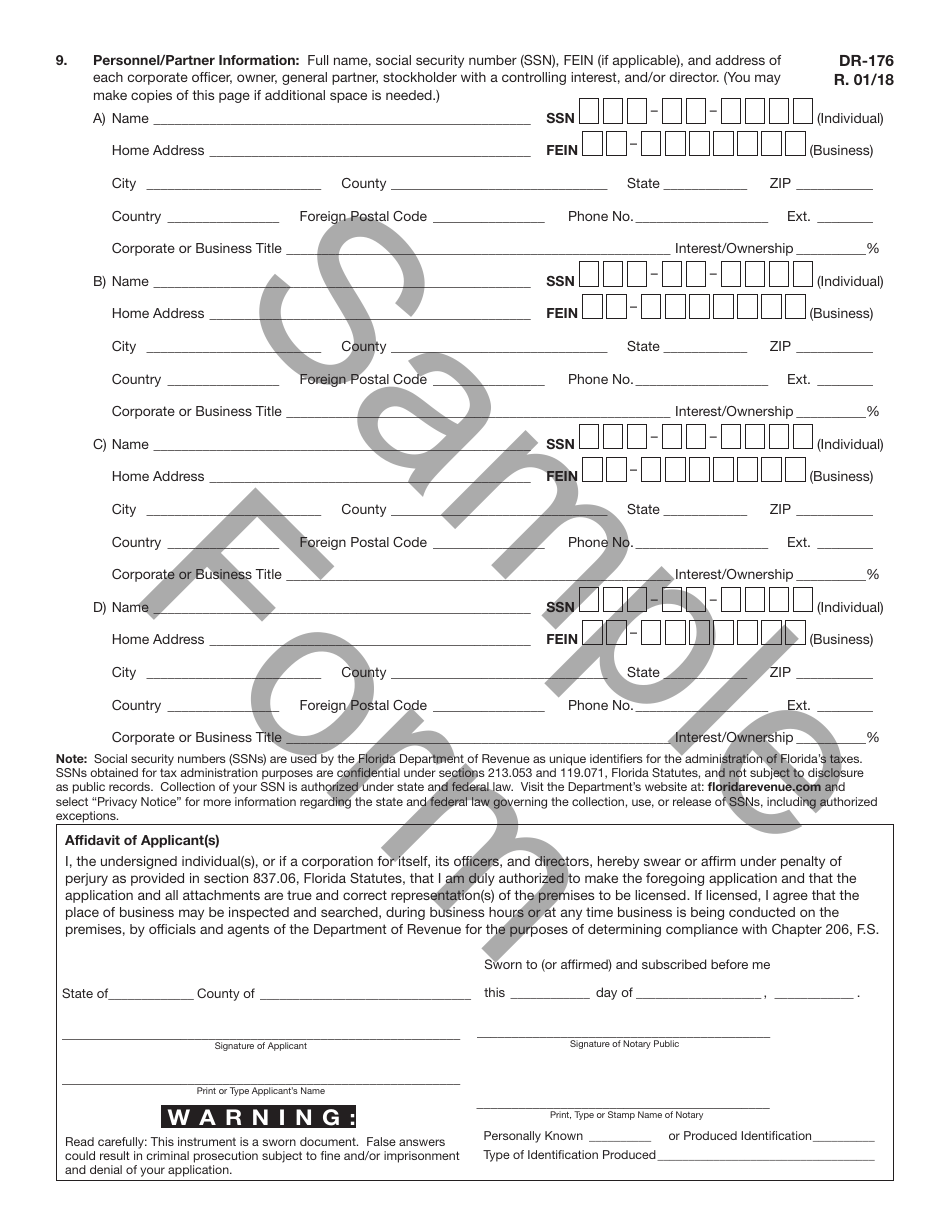

Q: What information is required on Form DR-176?

A: Form DR-176 requires information such as the air carrier's name, address, contact information, aircraft details, and fuel usage.

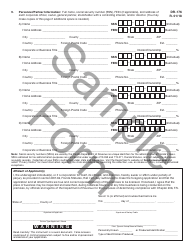

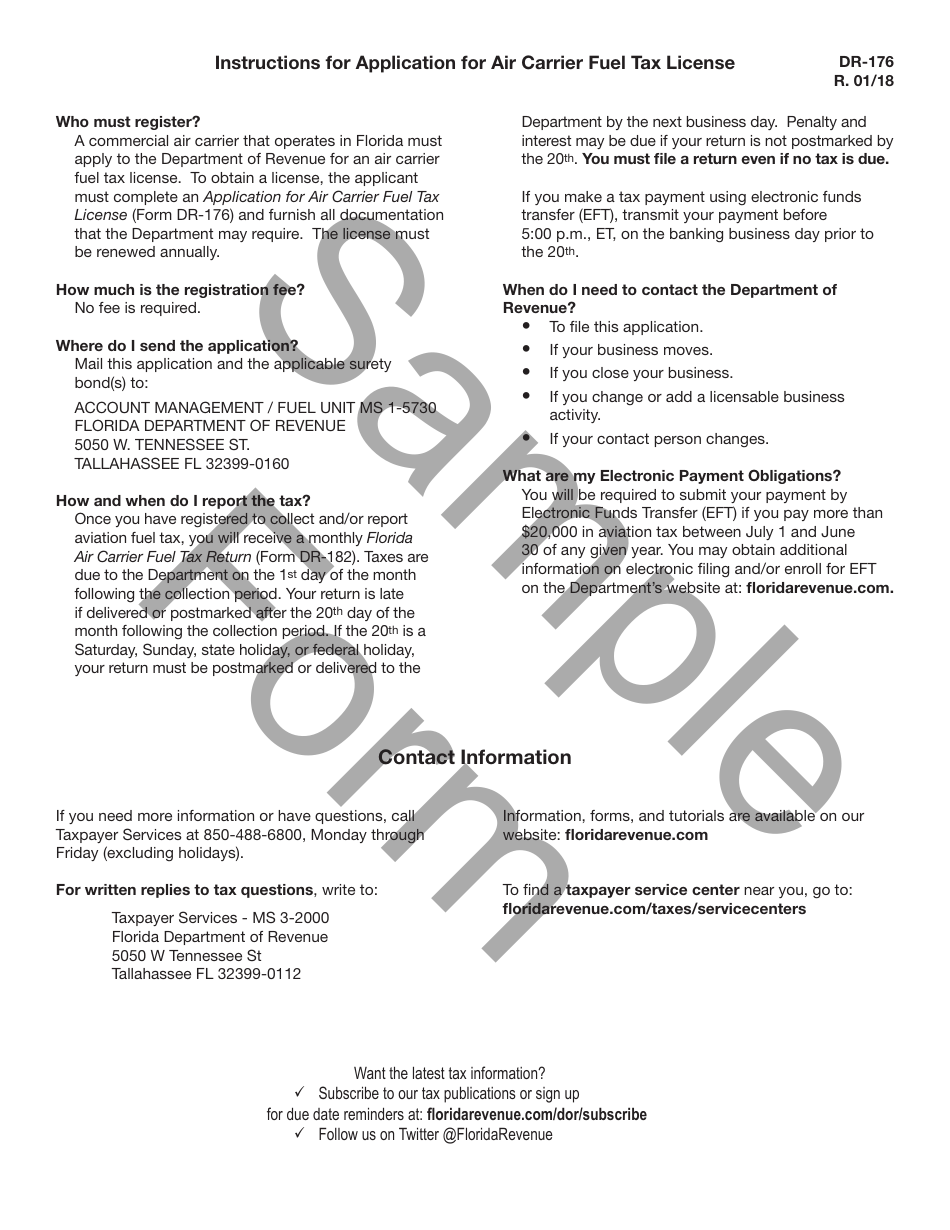

Q: Are there any fees associated with Form DR-176?

A: Yes, there is a fee associated with applying for an Air Carrier Fuel Tax License in Florida. The fee amount can be found on the application form.

Q: When should I file Form DR-176?

A: Form DR-176 should be filed at least 45 days before the air carrier intends to commence operations in Florida.

Q: What happens after I submit Form DR-176?

A: After submitting Form DR-176, the Florida Department of Revenue will review the application and issue the Air Carrier Fuel Tax License if approved.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Florida Department of Revenue;

- A printable and free sample of Form DR-176;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-176 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.