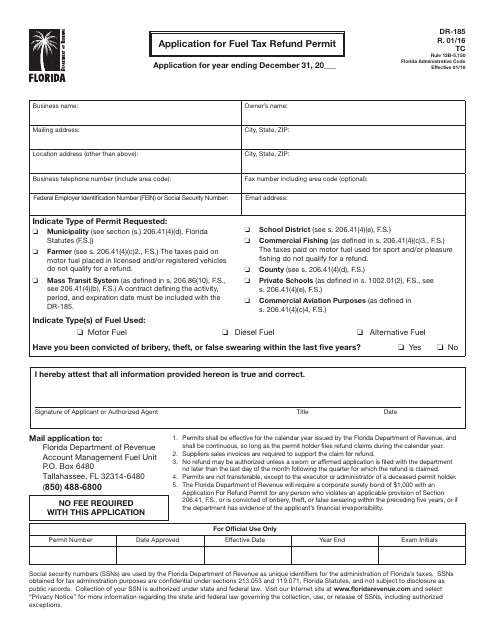

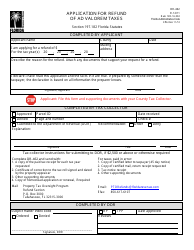

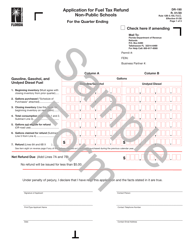

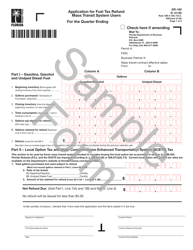

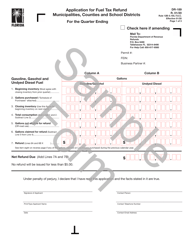

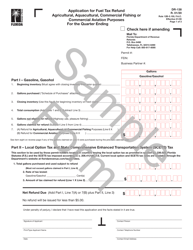

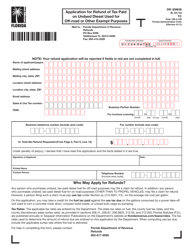

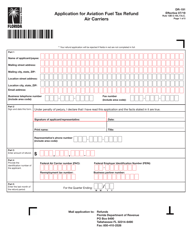

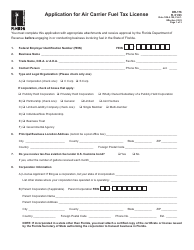

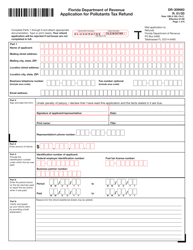

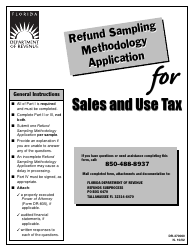

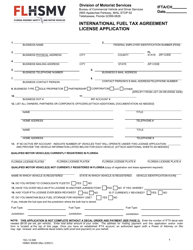

Form DR-185 Application for Fuel Tax Refund Permit - Florida

What Is Form DR-185?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-185?

A: Form DR-185 is the Application for Fuel Tax Refund Permit in Florida.

Q: What is the purpose of Form DR-185?

A: The purpose of Form DR-185 is to apply for a Fuel Tax Refund Permit in Florida.

Q: Who needs to fill out Form DR-185?

A: Anyone who wishes to obtain a Fuel Tax Refund Permit in Florida needs to fill out Form DR-185.

Q: What information is required on Form DR-185?

A: Form DR-185 requires you to provide personal information, business details, and information pertaining to your fuel tax refund eligibility.

Q: Are there any fees associated with Form DR-185?

A: Yes, there is a $50 application fee for obtaining a Fuel Tax Refund Permit in Florida.

Q: How long does it take to process Form DR-185?

A: The processing time for Form DR-185 may vary, but it generally takes a few weeks to review and approve the application.

Q: What should I do if I have questions about Form DR-185?

A: If you have any questions or need assistance with Form DR-185, you should contact the Florida Department of Revenue for guidance.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-185 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.