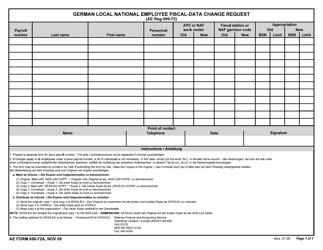

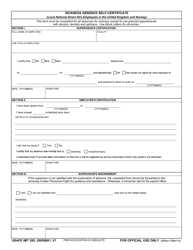

This version of the form is not currently in use and is provided for reference only. Download this version of

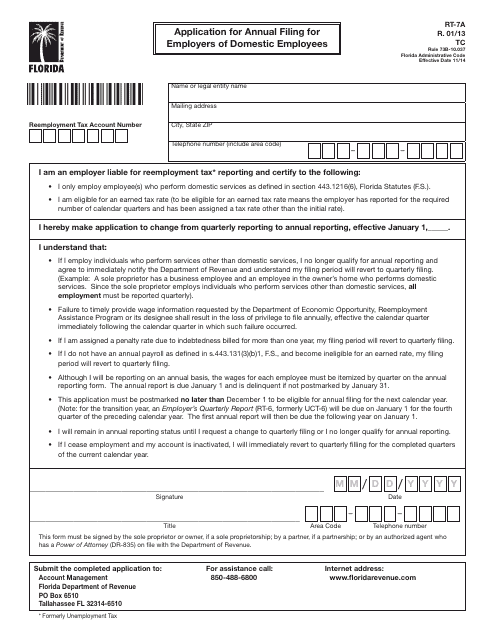

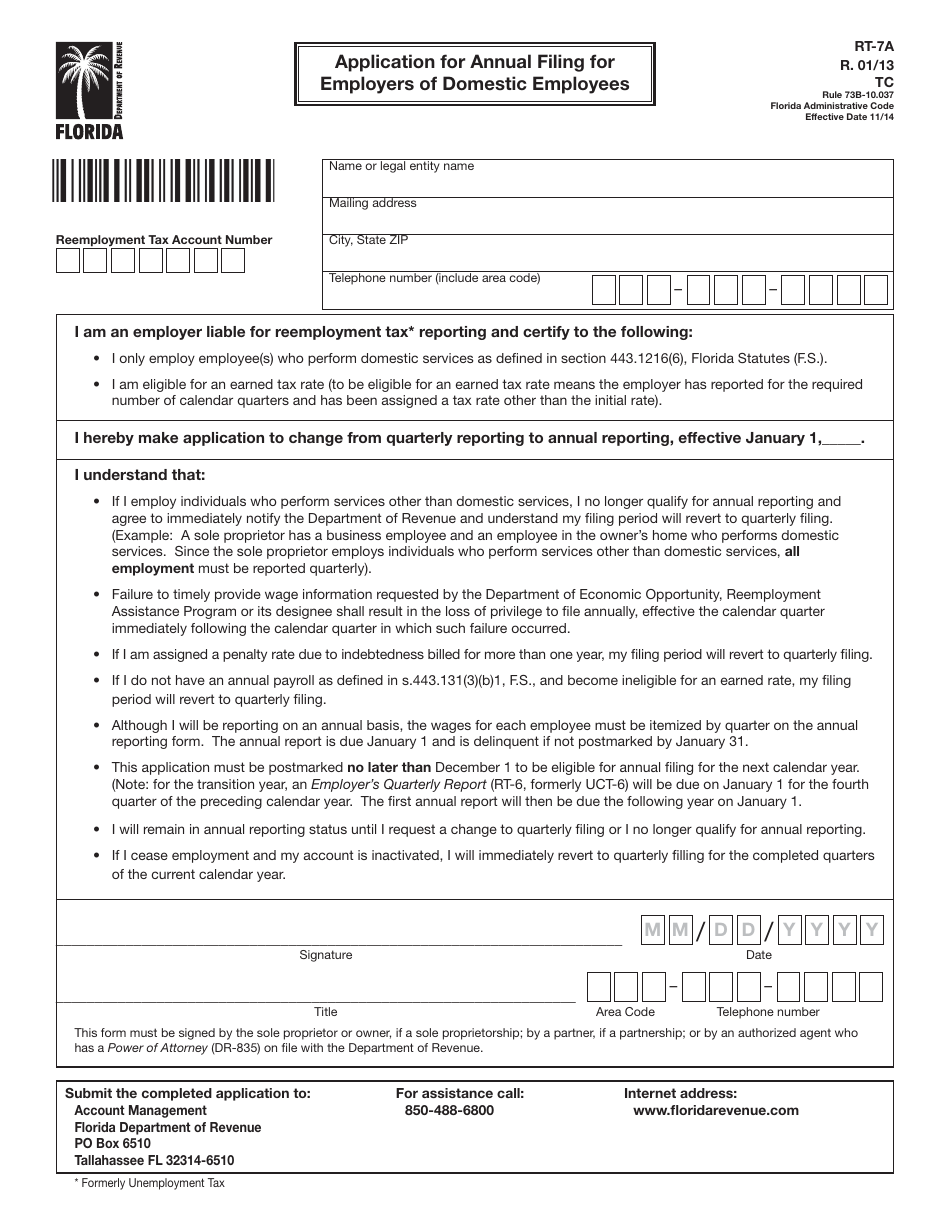

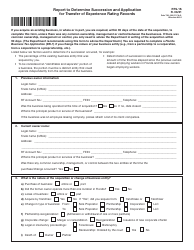

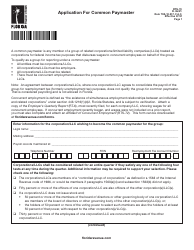

Form RT-7A

for the current year.

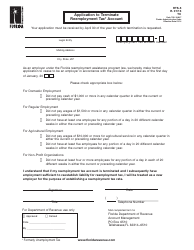

Form RT-7A Application for Annual Filing for Employers of Domestic Employees - Florida

What Is Form RT-7A?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RT-7A?

A: Form RT-7A is an application for annual filing for employers of domestic employees.

Q: Who should use Form RT-7A?

A: Employers of domestic employees in Florida should use Form RT-7A.

Q: What is the purpose of Form RT-7A?

A: The purpose of Form RT-7A is to report annual information about domestic employees.

Q: Do I need to file Form RT-7A every year?

A: Yes, employers of domestic employees in Florida need to file Form RT-7A annually.

Q: Are there any penalties for not filing Form RT-7A?

A: Yes, there may be penalties for not filing Form RT-7A or for filing it late.

Q: What information do I need to provide on Form RT-7A?

A: You need to provide information about the number of domestic employees and wages paid to them.

Q: When is the deadline to file Form RT-7A?

A: The deadline to file Form RT-7A is January 31st of the following year.

Q: Is there a fee for filing Form RT-7A?

A: No, there is no fee for filing Form RT-7A.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RT-7A by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.