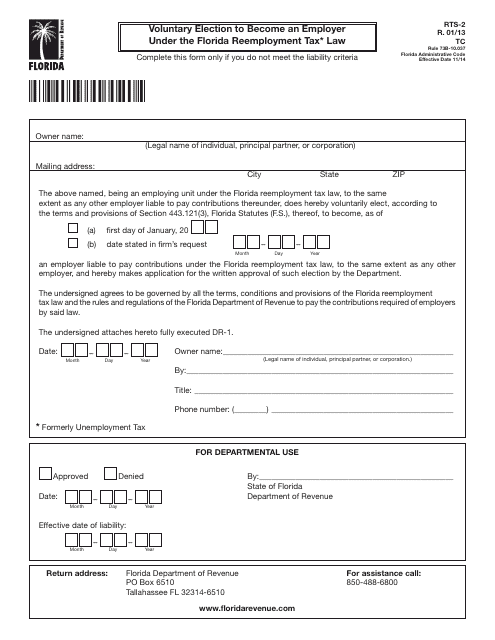

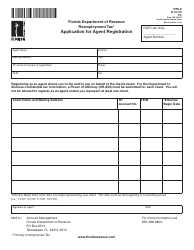

Form RTS-2 Voluntary Election to Become an Employer Under the Florida Reemployment Tax Law - Florida

What Is Form RTS-2?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RTS-2?

A: Form RTS-2 is the Voluntary Election to Become an Employer Under the Florida Reemployment Tax Law.

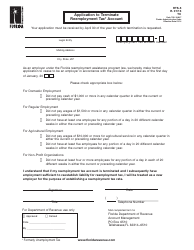

Q: What is the purpose of Form RTS-2?

A: The purpose of Form RTS-2 is to allow businesses to voluntarily elect to become an employer under the Florida Reemployment Tax Law.

Q: What is the Florida Reemployment Tax Law?

A: The Florida Reemployment Tax Law refers to the state law that requires employers to pay unemployment taxes on behalf of their employees.

Q: Who should use Form RTS-2?

A: Businesses that are not currently registered as employers under the Florida Reemployment Tax Law but wish to voluntarily become employers should use Form RTS-2.

Q: Is the completion of Form RTS-2 mandatory?

A: No, completion of Form RTS-2 is voluntary. Businesses have the option to elect to become employers under the Florida Reemployment Tax Law.

Q: Are there any fees associated with submitting Form RTS-2?

A: No, there are no fees associated with submitting Form RTS-2.

Q: What happens after submitting Form RTS-2?

A: After submitting Form RTS-2, the business will be registered as an employer and will be required to pay unemployment taxes on behalf of their employees.

Q: Can a business withdraw their election to become an employer?

A: Yes, a business can withdraw their election to become an employer by submitting a withdrawal request to the Florida Department of Revenue.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RTS-2 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.