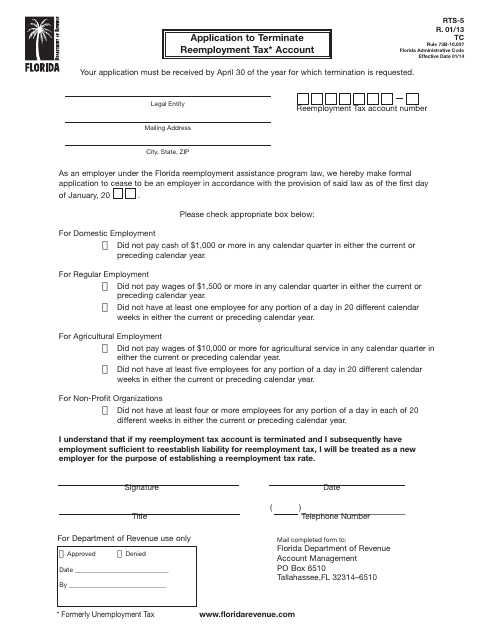

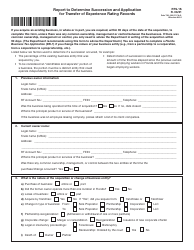

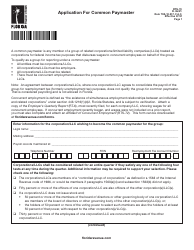

Form RTS-5 Application to Terminate Reemployment Tax Account - Florida

What Is Form RTS-5?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RTS-5?

A: Form RTS-5 is an application to terminate a reemployment tax account in Florida.

Q: What is a reemployment tax account?

A: A reemployment tax account is an account used for the payment of reemployment taxes in Florida.

Q: Who can use Form RTS-5?

A: Any business or employer in Florida who wants to terminate their reemployment tax account can use Form RTS-5.

Q: Are there any fees associated with submitting Form RTS-5?

A: No, there are no fees associated with submitting Form RTS-5.

Q: What information do I need to provide on Form RTS-5?

A: You will need to provide your business information, account number, and the reason for terminating your reemployment tax account.

Q: What happens after I submit Form RTS-5?

A: After you submit Form RTS-5, your reemployment tax account will be terminated, and you will no longer be responsible for paying reemployment taxes.

Q: Is there a deadline for submitting Form RTS-5?

A: There is no specific deadline for submitting Form RTS-5, but it is recommended to submit it as soon as you no longer need a reemployment tax account.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RTS-5 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.