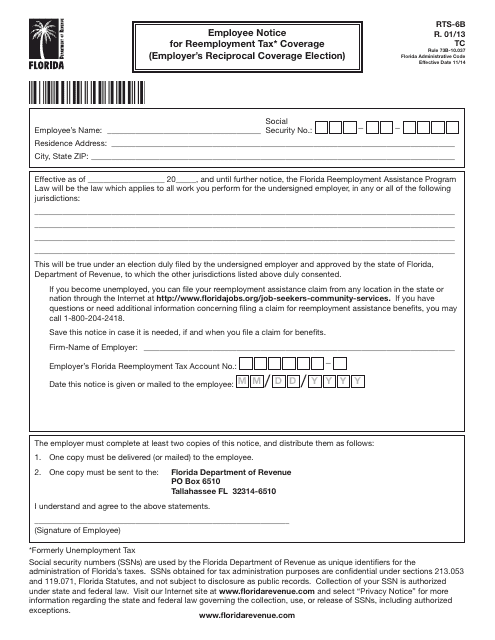

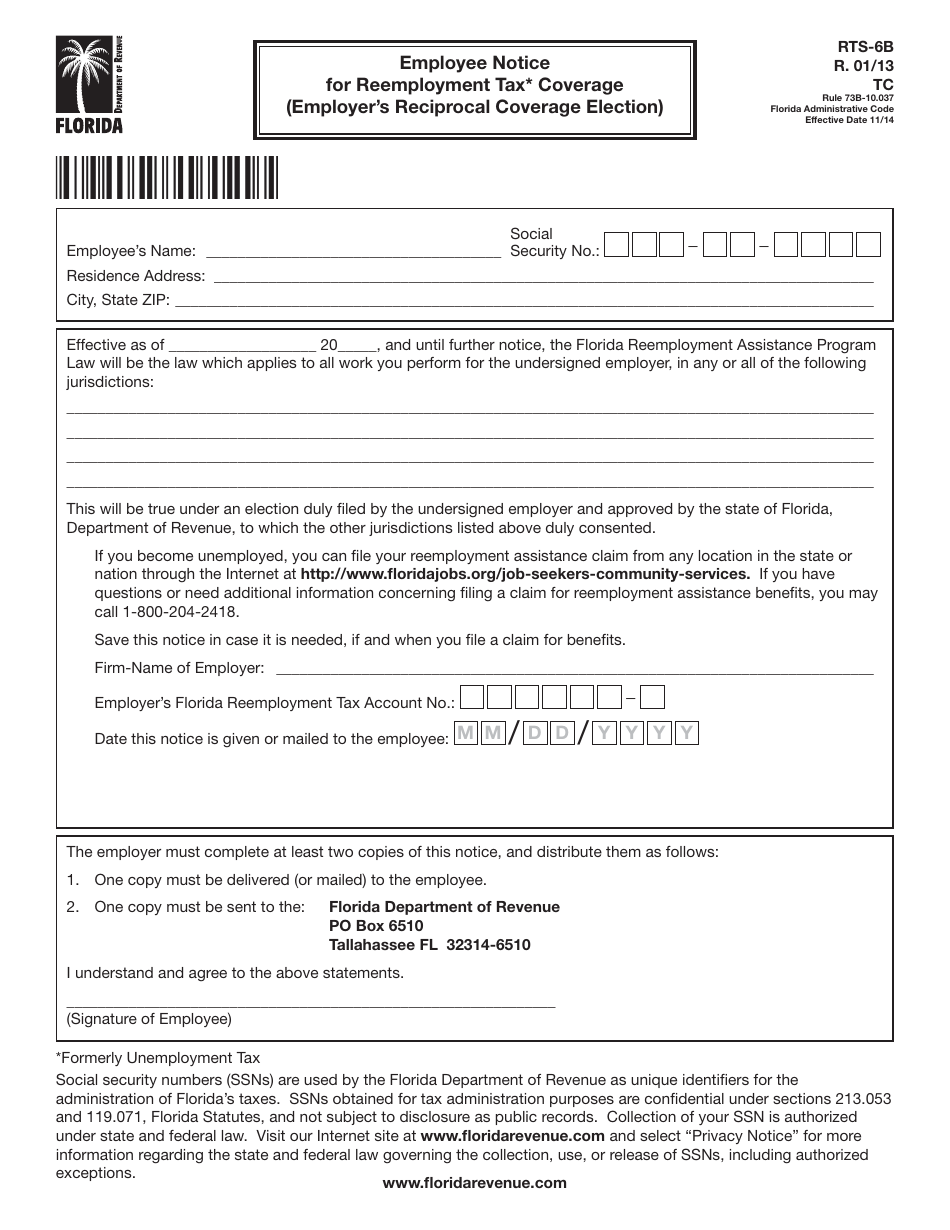

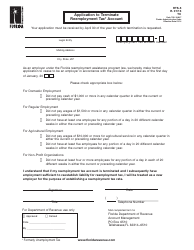

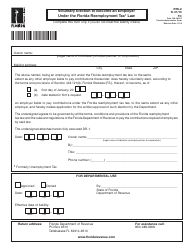

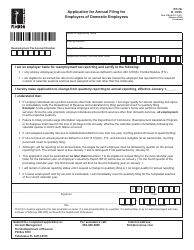

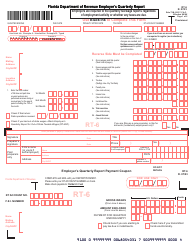

Form RTS-6B Employee Notice for Reemployment Tax Coverage (Employer's Reciprocal Coverage Election) - Florida

What Is Form RTS-6B?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RTS-6B?

A: Form RTS-6B is the Employee Notice for Reemployment Tax Coverage (Employer's Reciprocal Coverage Election) in Florida.

Q: What is the purpose of Form RTS-6B?

A: The purpose of Form RTS-6B is to inform employees about the employer's election for reciprocal coverage under the reemployment tax in Florida.

Q: What is reemployment tax?

A: Reemployment tax is a tax that employers in Florida must pay to fund unemployment compensation.

Q: What is reciprocal coverage?

A: Reciprocal coverage is an option for employers to provide reemployment tax coverage to their employees in another state, if that state has a similar provision.

Q: Who needs to fill out Form RTS-6B?

A: Employers in Florida who elect reciprocal coverage for their employees need to fill out Form RTS-6B.

Q: Is there a deadline for submitting Form RTS-6B?

A: Yes, employers must submit Form RTS-6B to the Florida Department of Revenue by the due date specified on the form.

Q: What happens if an employer does not fill out Form RTS-6B?

A: If an employer does not fill out Form RTS-6B, they will not be eligible for reciprocal coverage under the reemployment tax in Florida.

Q: Can an employee request a copy of Form RTS-6B?

A: Yes, employees have the right to request a copy of Form RTS-6B from their employer if they want to learn about the reciprocal coverage election.

Q: Are there any fees associated with filing Form RTS-6B?

A: There are no fees associated with filing Form RTS-6B.

Q: Is Form RTS-6B only applicable in Florida?

A: Yes, Form RTS-6B is specific to employers in Florida who are electing reciprocal coverage under the reemployment tax.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RTS-6B by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.