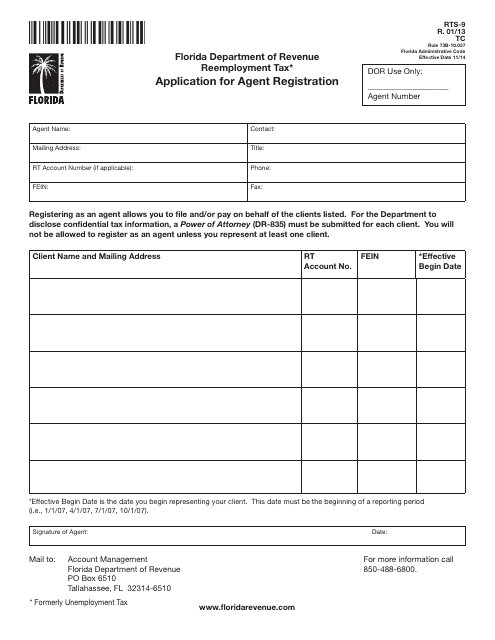

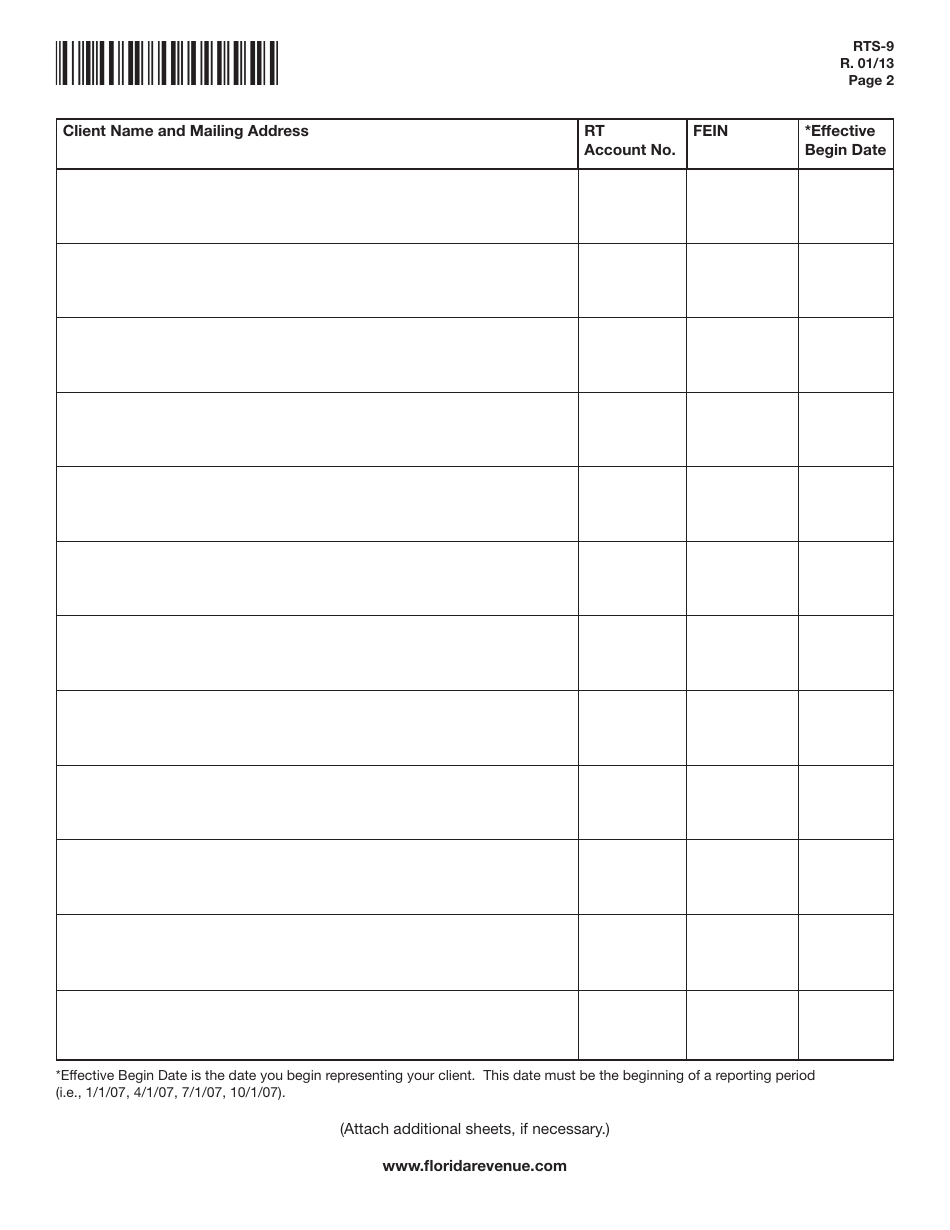

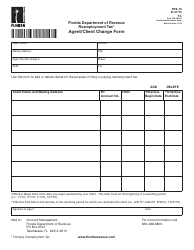

Form RTS-9 Reemployment Tax Application for Agent Registration - Florida

What Is Form RTS-9?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RTS-9?

A: Form RTS-9 is the Reemployment Tax Application for Agent Registration.

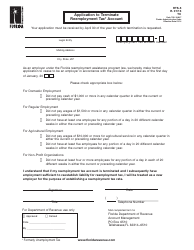

Q: What is the purpose of Form RTS-9?

A: The purpose of Form RTS-9 is to apply for agent registration for reemployment tax purposes in Florida.

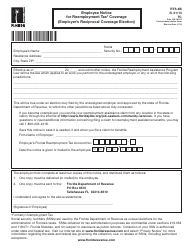

Q: Who needs to fill out Form RTS-9?

A: Anyone who wants to act as an agent for reemployment tax purposes in Florida needs to fill out Form RTS-9.

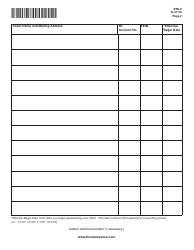

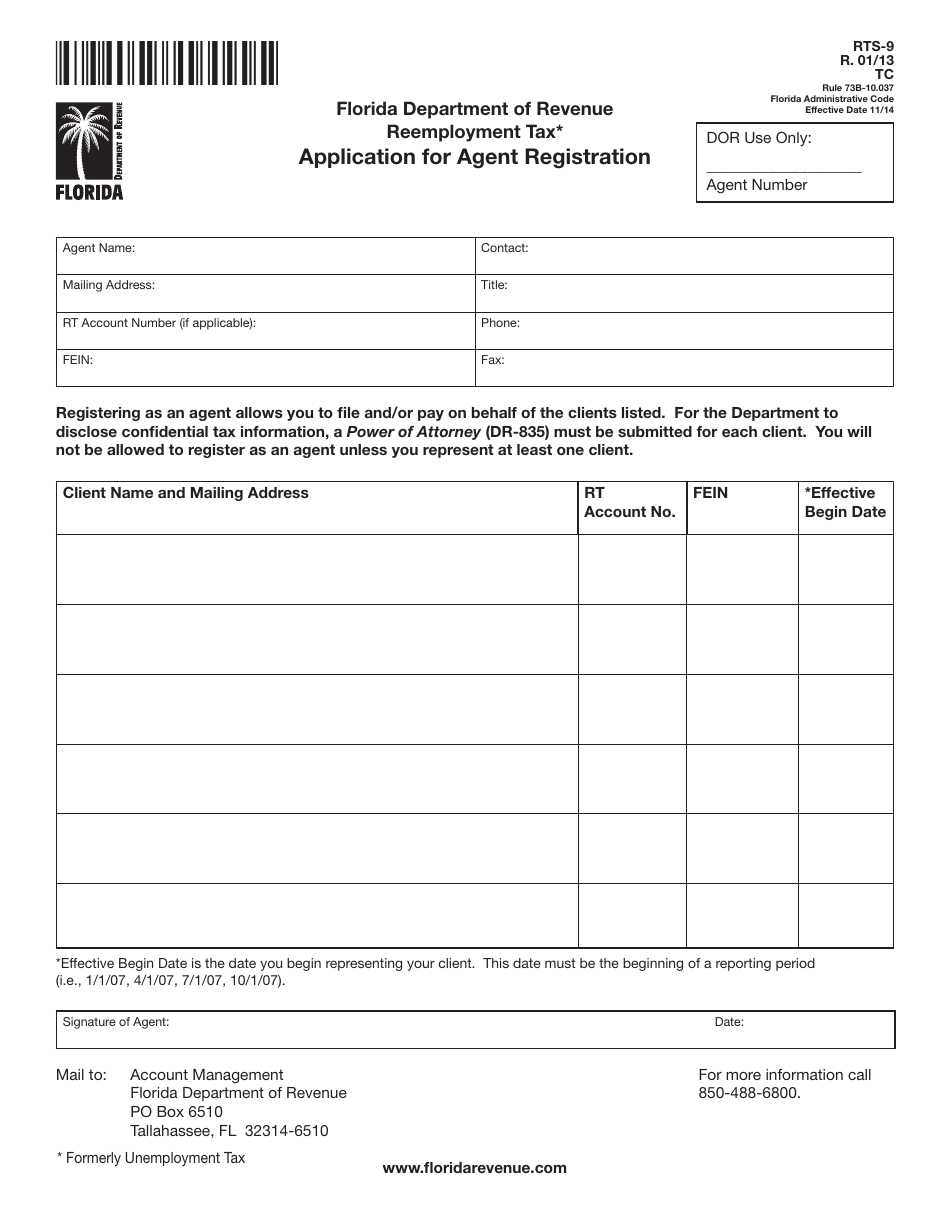

Q: What information is required on Form RTS-9?

A: Form RTS-9 requires information about the agent, including their name, address, contact information, and any previous agent registrations.

Q: Are there any fees associated with submitting Form RTS-9?

A: No, there are no fees associated with submitting Form RTS-9.

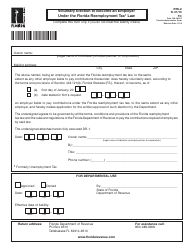

Q: Is Form RTS-9 specific to employers in Florida?

A: Yes, Form RTS-9 is specific to employers in Florida who are required to pay reemployment taxes.

Q: What is reemployment tax?

A: Reemployment tax, also known as unemployment tax, is a tax paid by employers in Florida to fund unemployment benefits for eligible workers.

Q: Why do agents need to register for reemployment tax purposes?

A: Agents need to register for reemployment tax purposes in order to act on behalf of employers who are required to pay reemployment taxes in Florida.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RTS-9 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.