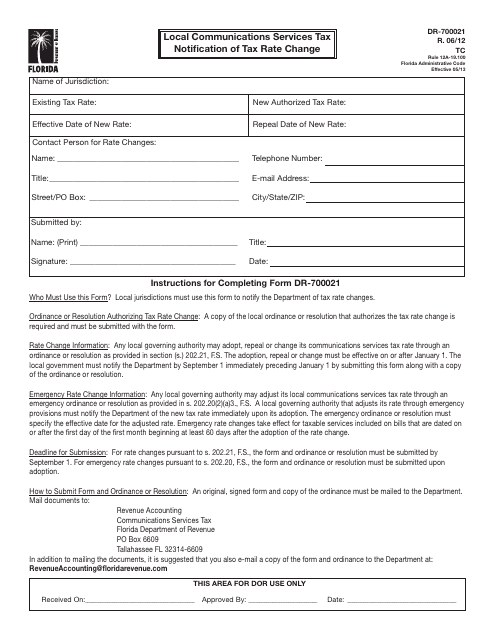

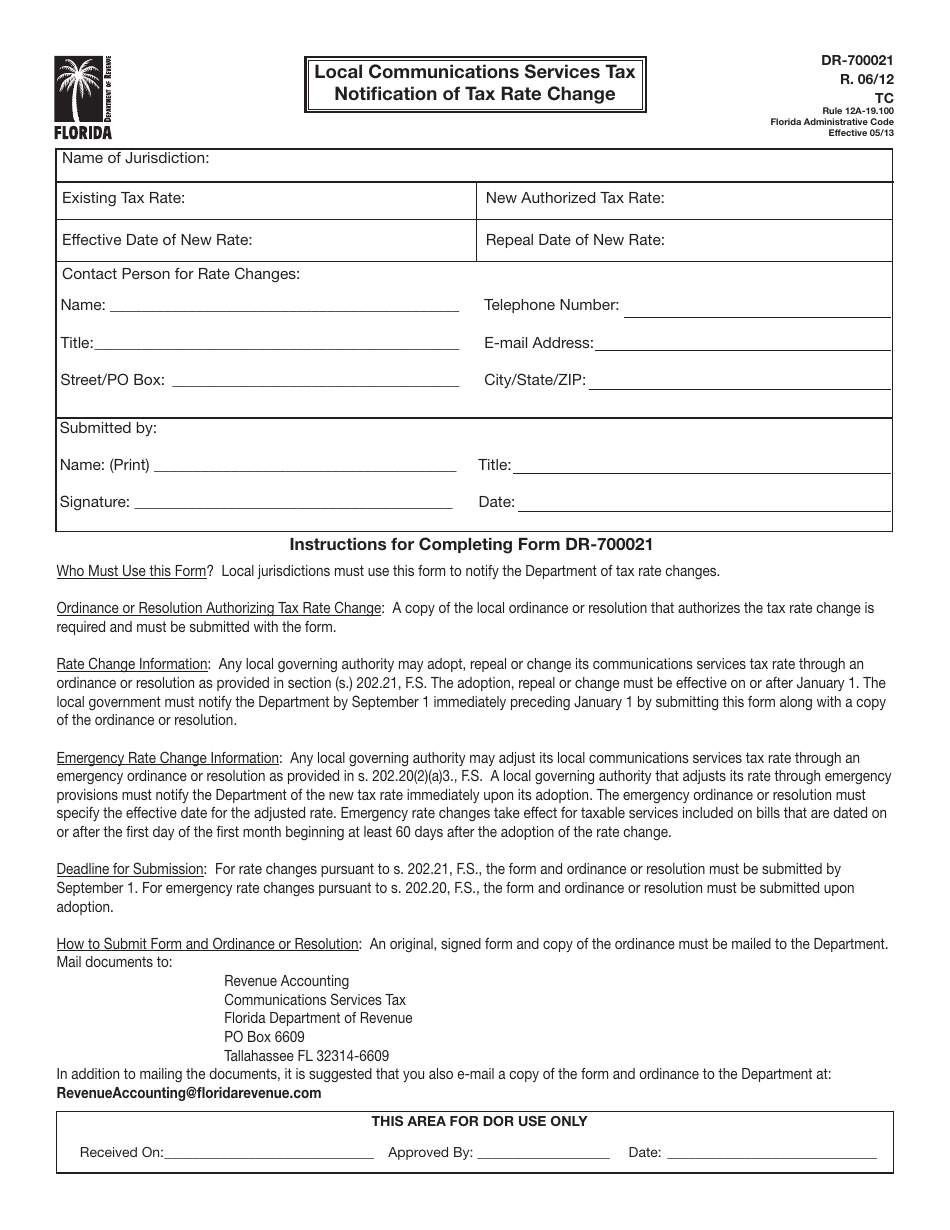

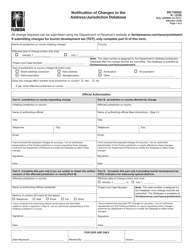

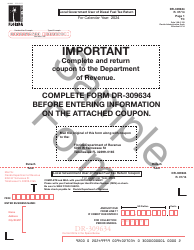

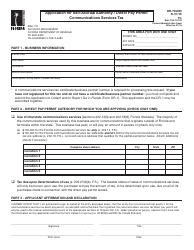

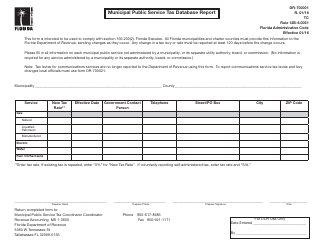

Form DR-700021 Local Communications Services Tax Notification of Tax Rate Change - Florida

What Is Form DR-700021?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-700021?

A: Form DR-700021 is a Local Communications Services Tax Notification of Tax Rate Change form in Florida.

Q: What is the purpose of Form DR-700021?

A: The purpose of Form DR-700021 is to notify taxpayers of changes in the tax rate for local communications services in the state of Florida.

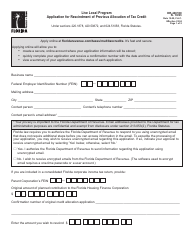

Q: Who needs to file Form DR-700021?

A: Taxpayers who provide local communications services in Florida and are affected by a change in tax rate need to file Form DR-700021.

Q: Is there a deadline for filing Form DR-700021?

A: Yes, there is a deadline for filing Form DR-700021. The specific deadline will be provided on the form or by the Florida Department of Revenue.

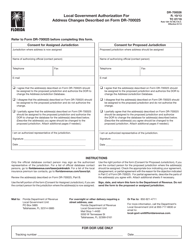

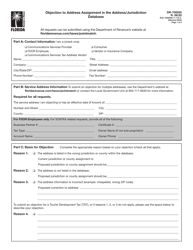

Q: What information is required to complete Form DR-700021?

A: To complete Form DR-700021, you will need to provide information about your business, the affected tax rate change, and any other required details as specified on the form.

Q: Are there any penalties for not filing Form DR-700021?

A: Failure to file Form DR-700021 or filing it late may result in penalties or interest charges, as per the laws of the state of Florida.

Q: What should I do if I have questions or need assistance with Form DR-700021?

A: If you have any questions or need assistance with Form DR-700021, you can contact the Florida Department of Revenue directly.

Q: Is Form DR-700021 applicable in other states?

A: No, Form DR-700021 is specific to the state of Florida and its local communications services tax rate changes.

Form Details:

- Released on June 1, 2012;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-700021 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.