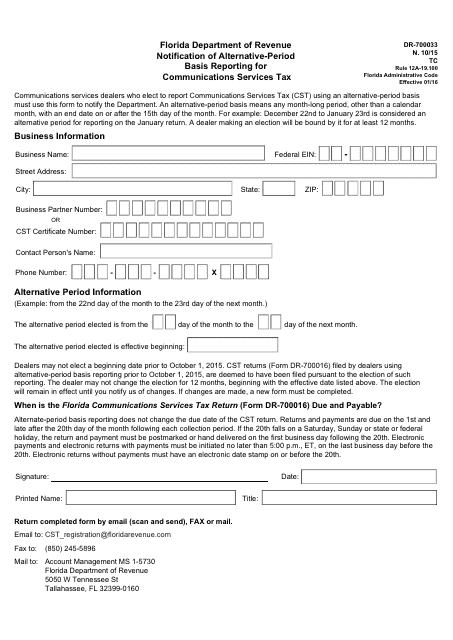

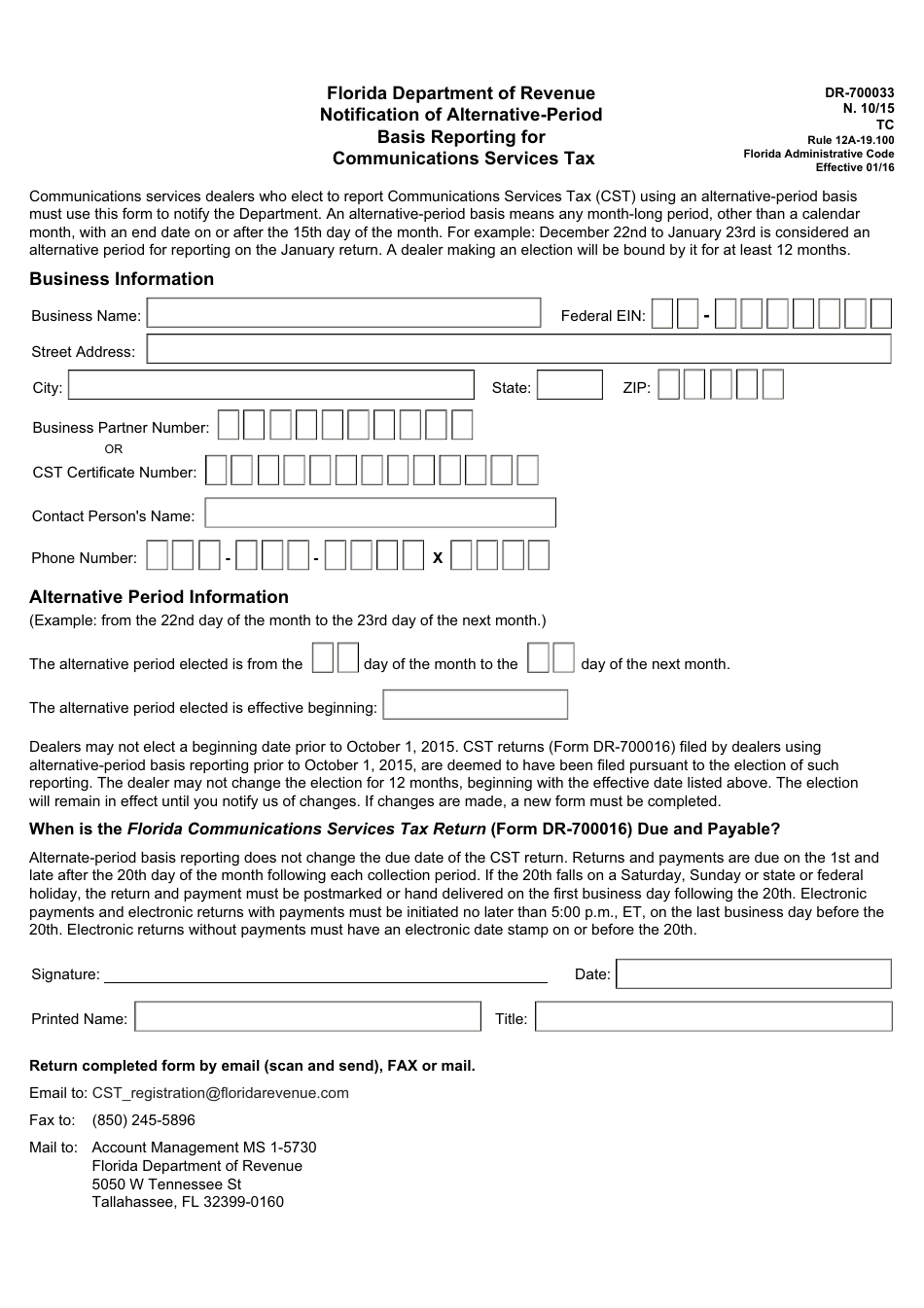

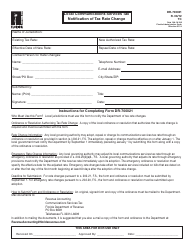

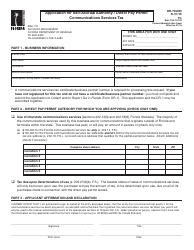

Form DR-700033 Notification of Alternative-Period Basis Reporting for Communications Services Tax - Florida

What Is Form DR-700033?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form DR-700033?

A: The Form DR-700033 is the Notification of Alternative-Period Basis Reporting for Communications Services Tax in Florida.

Q: What is the purpose of Form DR-700033?

A: The purpose of Form DR-700033 is to notify the Florida Department of Revenue of alternative-period basis reporting for the Communications Services Tax.

Q: Who needs to file Form DR-700033?

A: Any person or entity subject to the Communications Services Tax in Florida who is seeking to report on an alternative-period basis needs to file Form DR-700033.

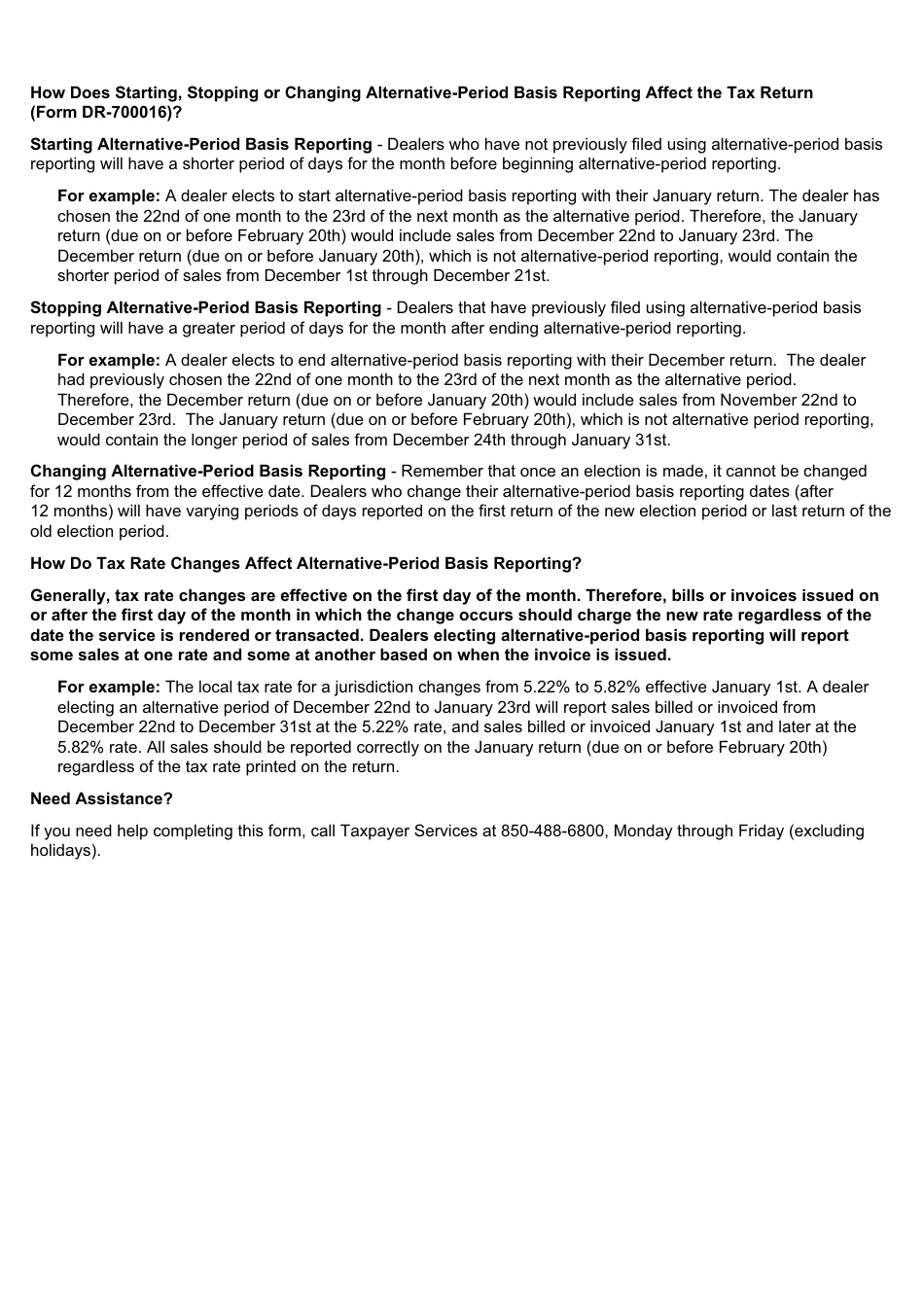

Q: What is alternative-period basis reporting?

A: Alternative-period basis reporting is when a person or entity reports their Communications Services Tax liability based on a frequency other than monthly.

Q: When should Form DR-700033 be filed?

A: Form DR-700033 should be filed at least 30 days before the desired alternative reporting period begins.

Q: Are there any penalties for not filing Form DR-700033?

A: Failure to file Form DR-700033 may result in penalties imposed by the Florida Department of Revenue.

Q: Is there a fee to file Form DR-700033?

A: There is no fee to file Form DR-700033.

Q: Are there any additional requirements for alternative-period basis reporting?

A: Yes, there are additional requirements outlined on Form DR-700033 that must be met for alternative-period basis reporting.

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-700033 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.