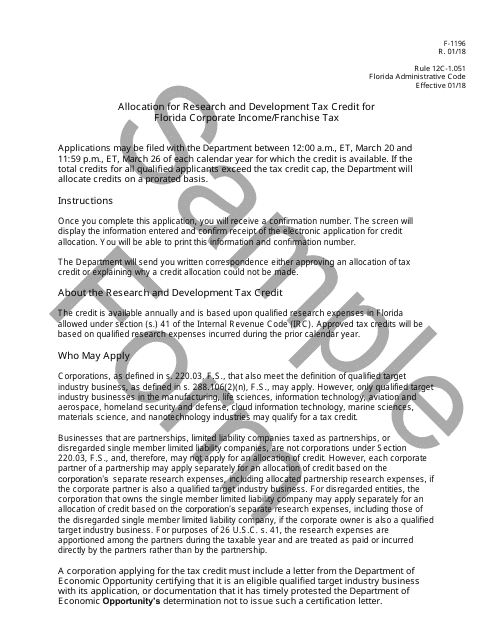

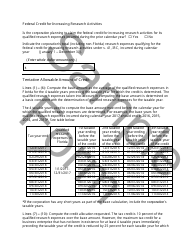

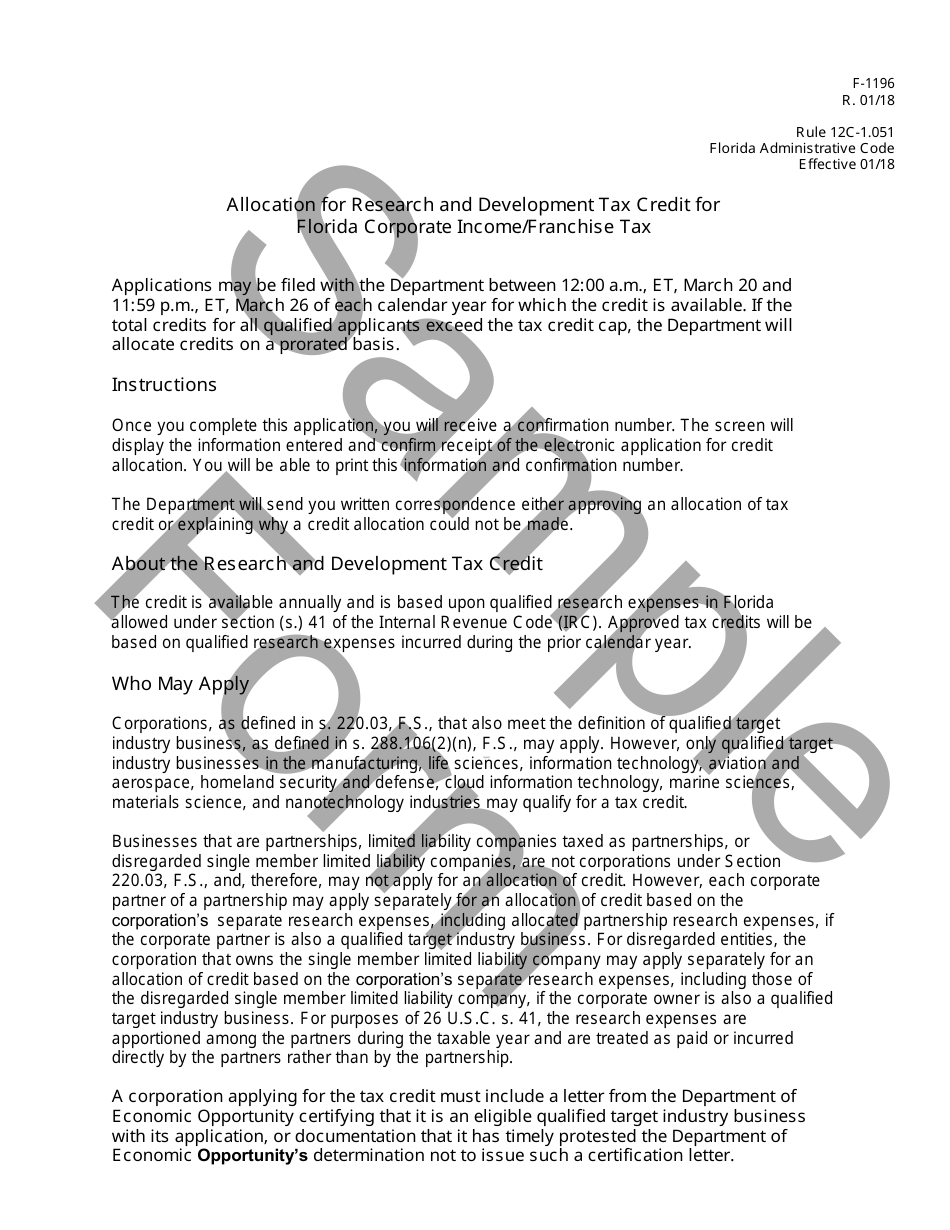

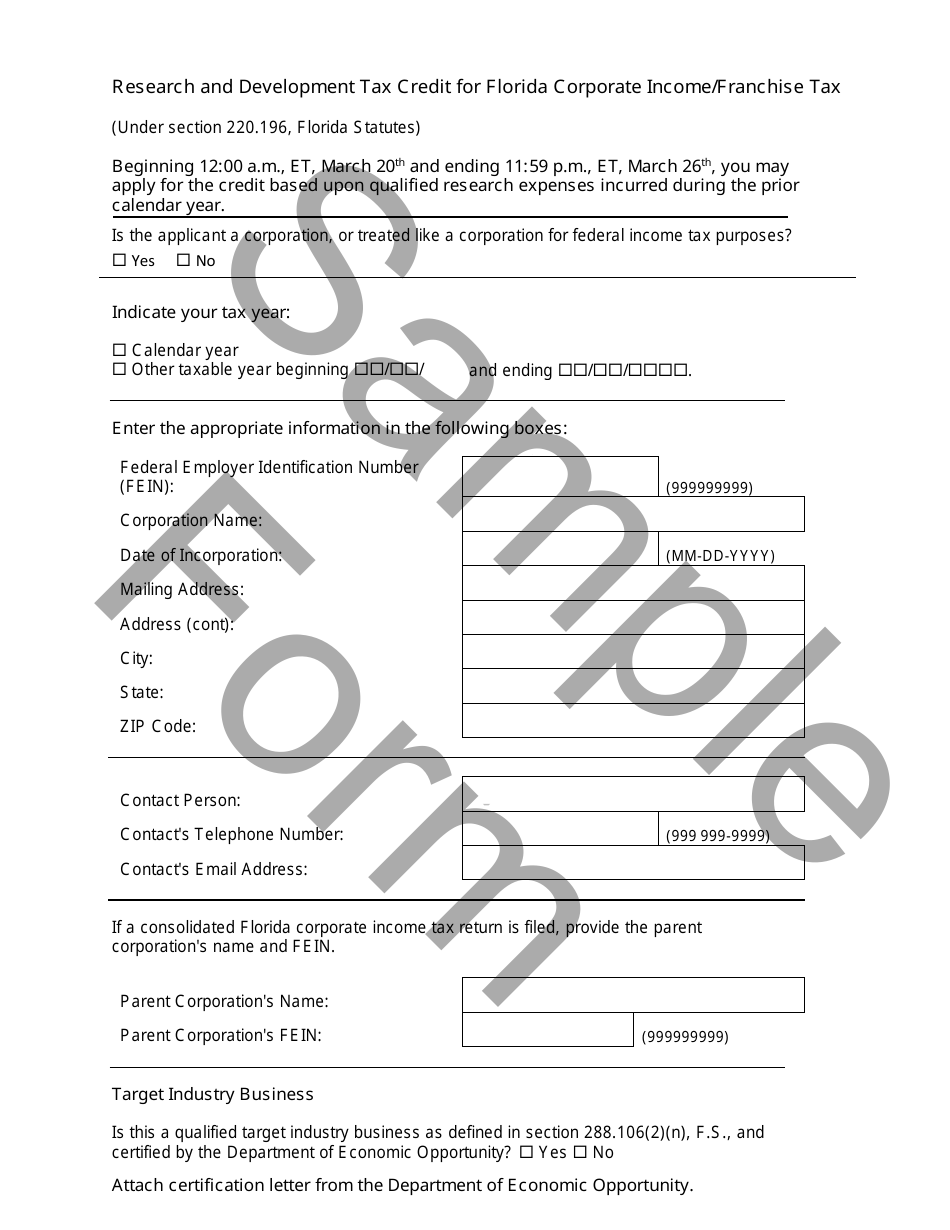

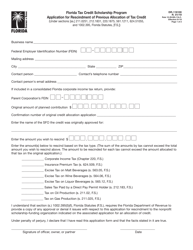

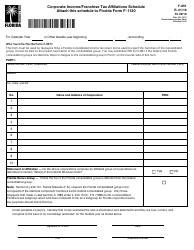

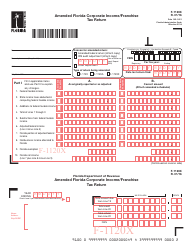

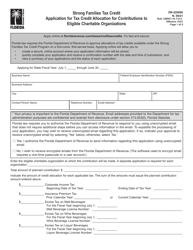

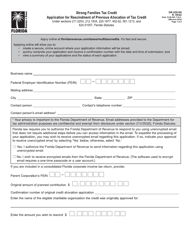

Sample Form F-1196 Allocation for Research and Development Tax Credit for Florida Corporate Income / Franchise Tax - Florida

What Is Form F-1196?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-1196?

A: Form F-1196 is the Allocation for Research and Development Tax Credit for Florida Corporate Income/Franchise Tax.

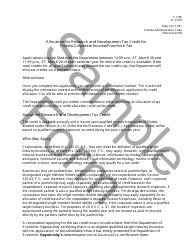

Q: Who should file Form F-1196?

A: Florida corporations claiming a research and development tax credit should file Form F-1196.

Q: What is the purpose of Form F-1196?

A: The purpose of Form F-1196 is to allocate the research and development tax credit among affiliated corporations.

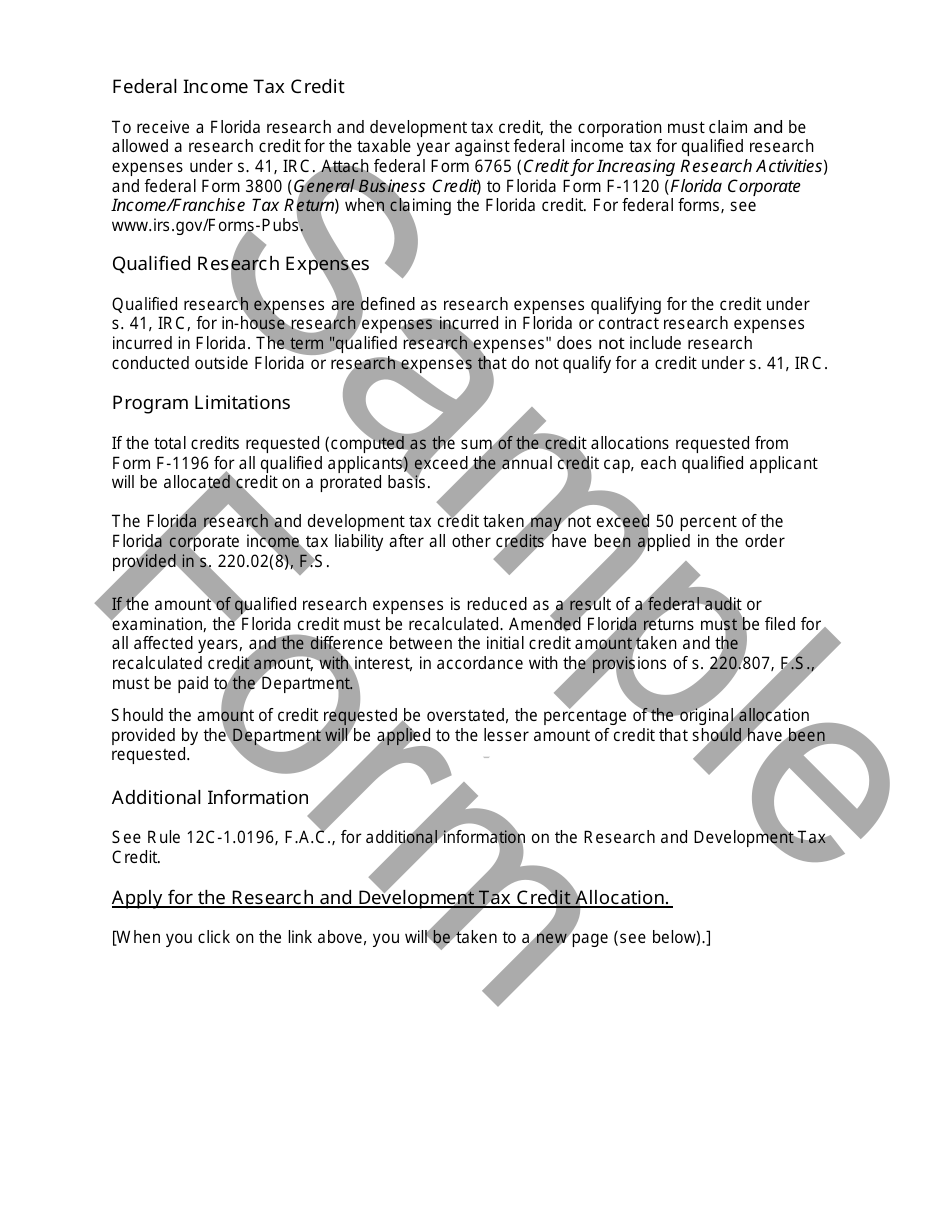

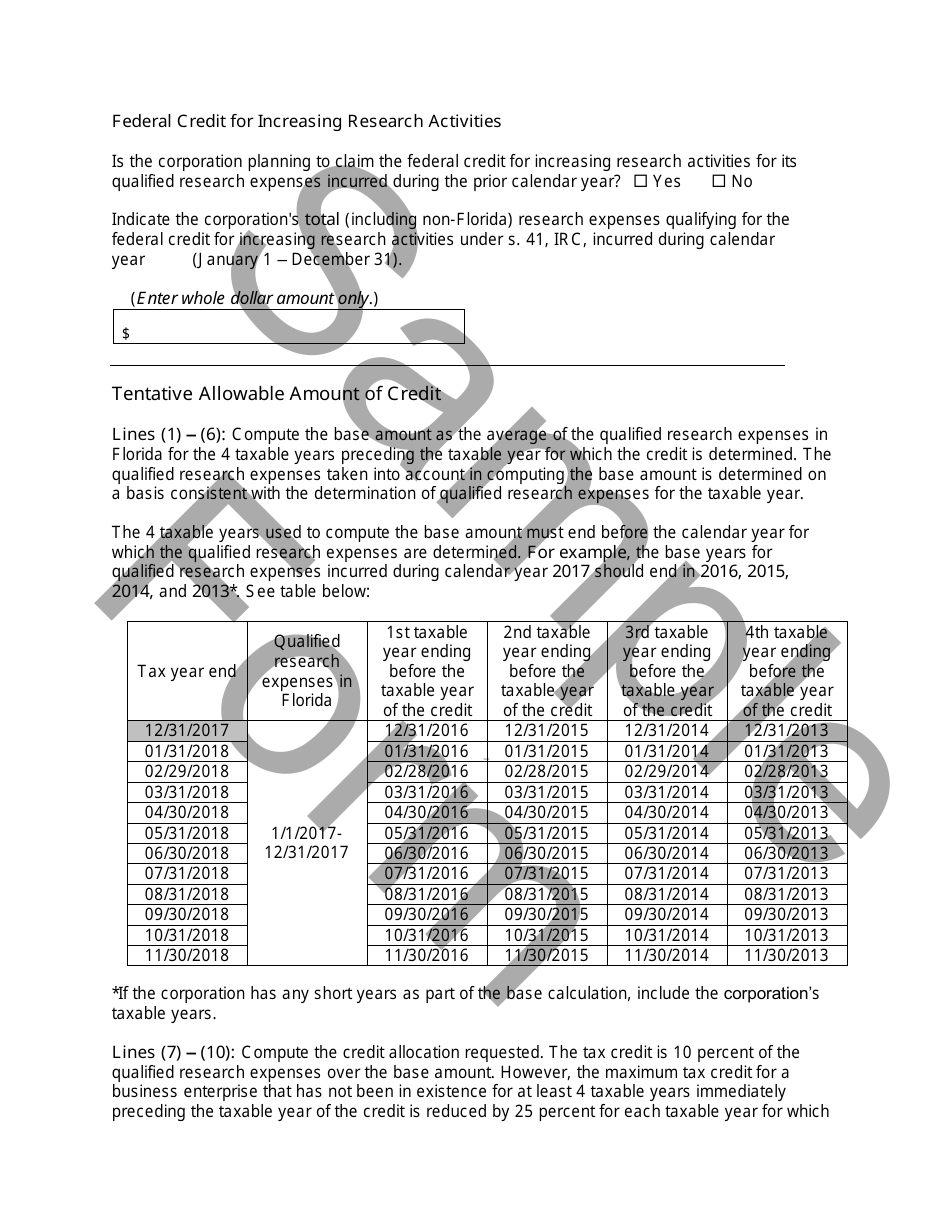

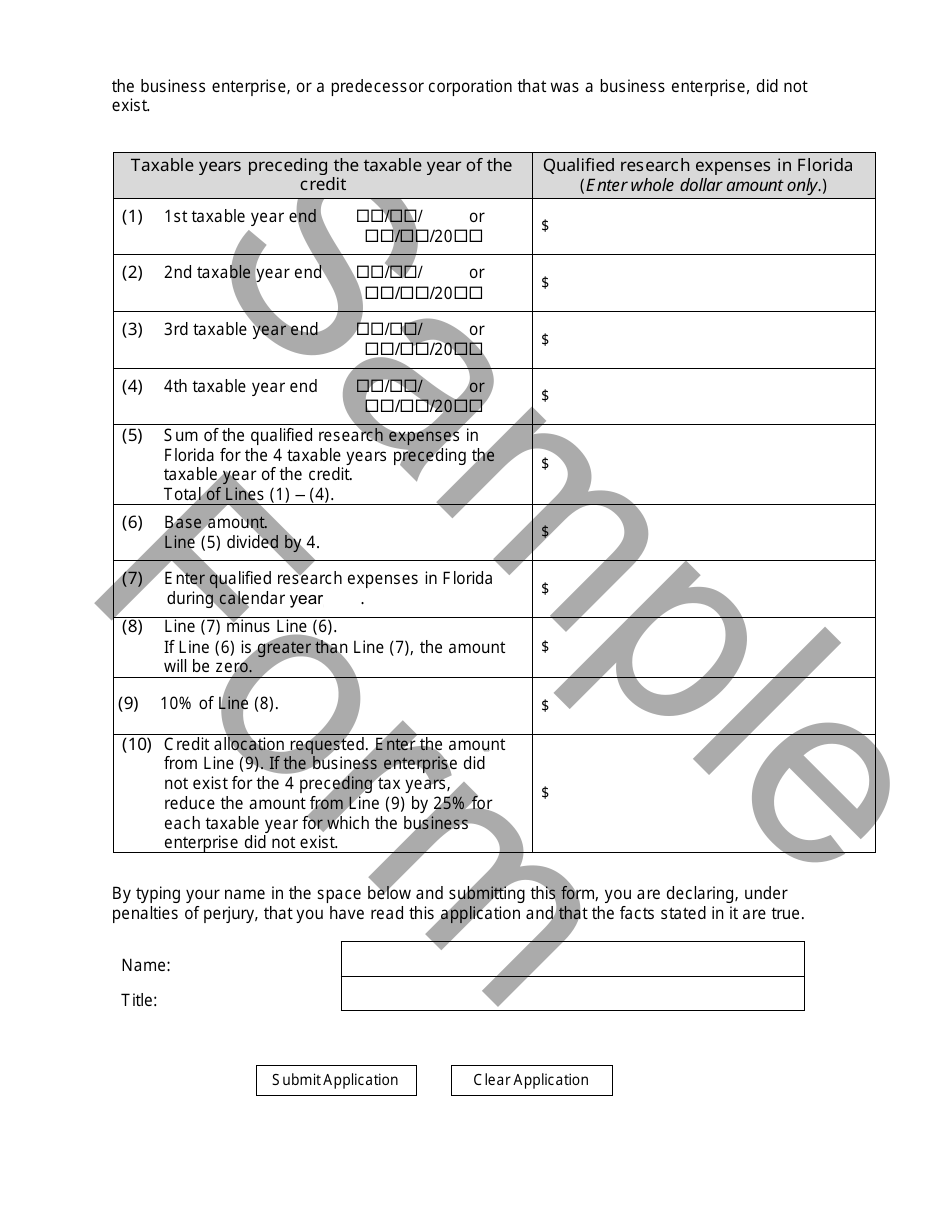

Q: What is the research and development tax credit?

A: The research and development tax credit is a tax incentive to encourage businesses to invest in research and development activities.

Q: How is the research and development tax credit allocated?

A: The research and development tax credit is allocated among affiliated corporations based on their respective qualified research expenses.

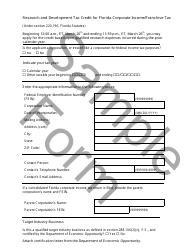

Q: When is Form F-1196 due?

A: Form F-1196 is due on or before the due date of the Florida corporate income/franchise tax return.

Q: Are there any penalties for not filing Form F-1196?

A: Yes, failure to file Form F-1196 may result in penalties and interest.

Q: Can I claim the research and development tax credit if I am not a Florida corporation?

A: No, the research and development tax credit is specifically for Florida corporations.

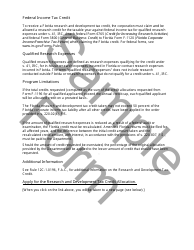

Q: Is the research and development tax credit refundable?

A: No, the research and development tax credit is non-refundable.

Q: Can I carry forward any unused research and development tax credit?

A: Yes, any unused research and development tax credit can be carried forward for up to five years.

Q: Is there a cap on the research and development tax credit?

A: No, there is no cap on the research and development tax credit.

Q: What documentation do I need to support my research and development tax credit claim?

A: You should maintain adequate records and documentation to support your research and development tax credit claim.

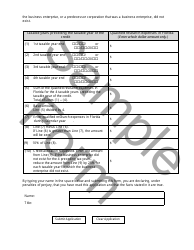

Q: Can I amend my Form F-1196?

A: Yes, you can amend your Form F-1196 within three years from the due date of the original return or within one year from the date the tax was paid, whichever is later.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F-1196 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.