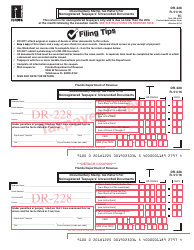

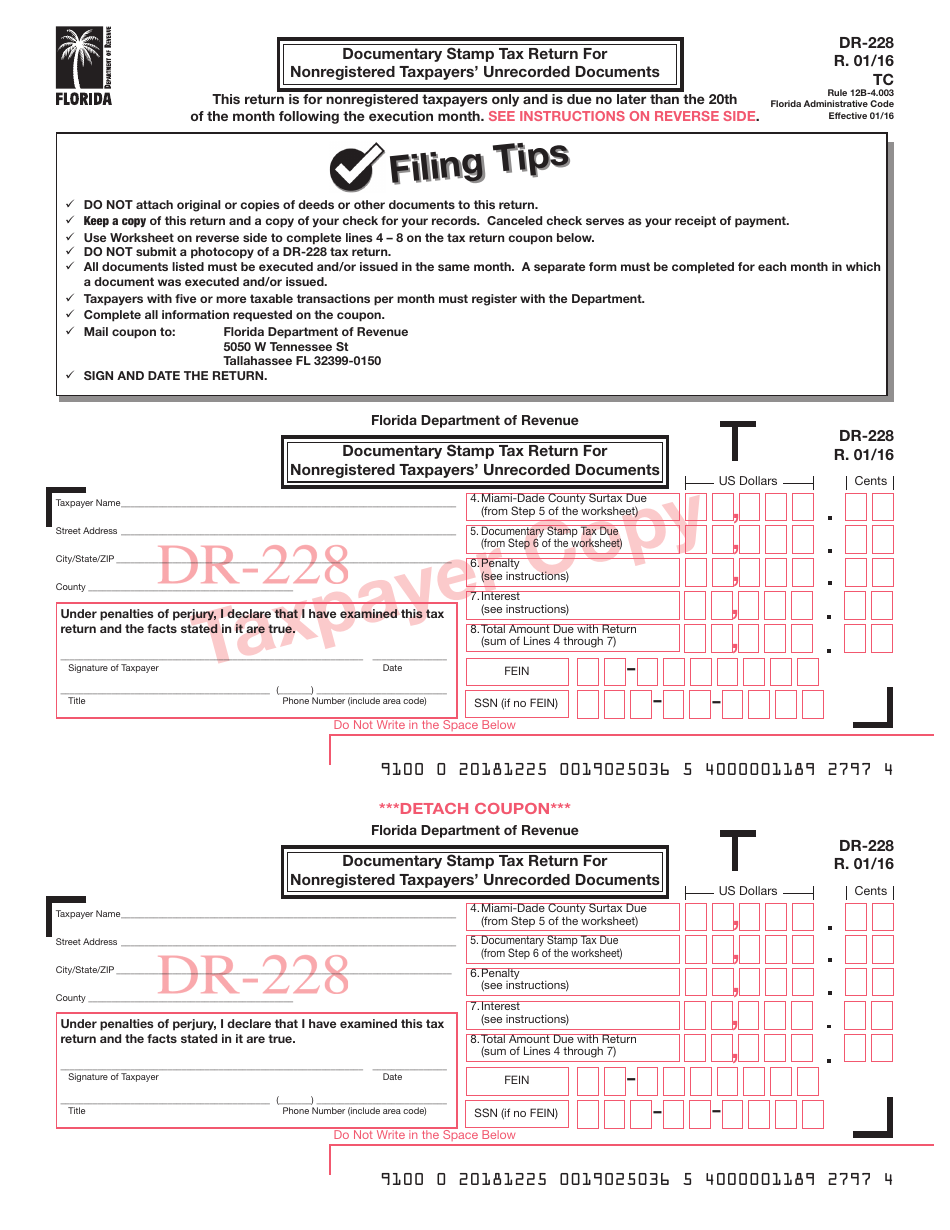

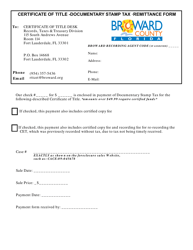

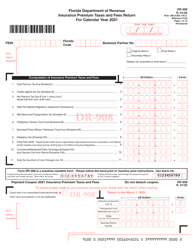

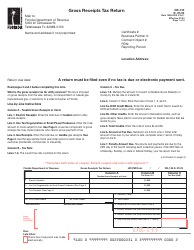

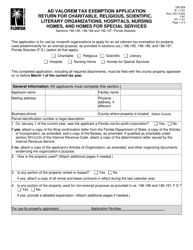

Form DR-228 Documentary Stamp Tax Return for Nonregistered Taxpayers' Unrecorded Documents - Florida

What Is Form DR-228?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-228?

A: Form DR-228 is the Documentary Stamp Tax Return for Nonregistered Taxpayers' Unrecorded Documents in Florida.

Q: Who should use Form DR-228?

A: Form DR-228 should be used by nonregistered taxpayers in Florida for reporting and paying documentary stamp taxes on unrecorded documents.

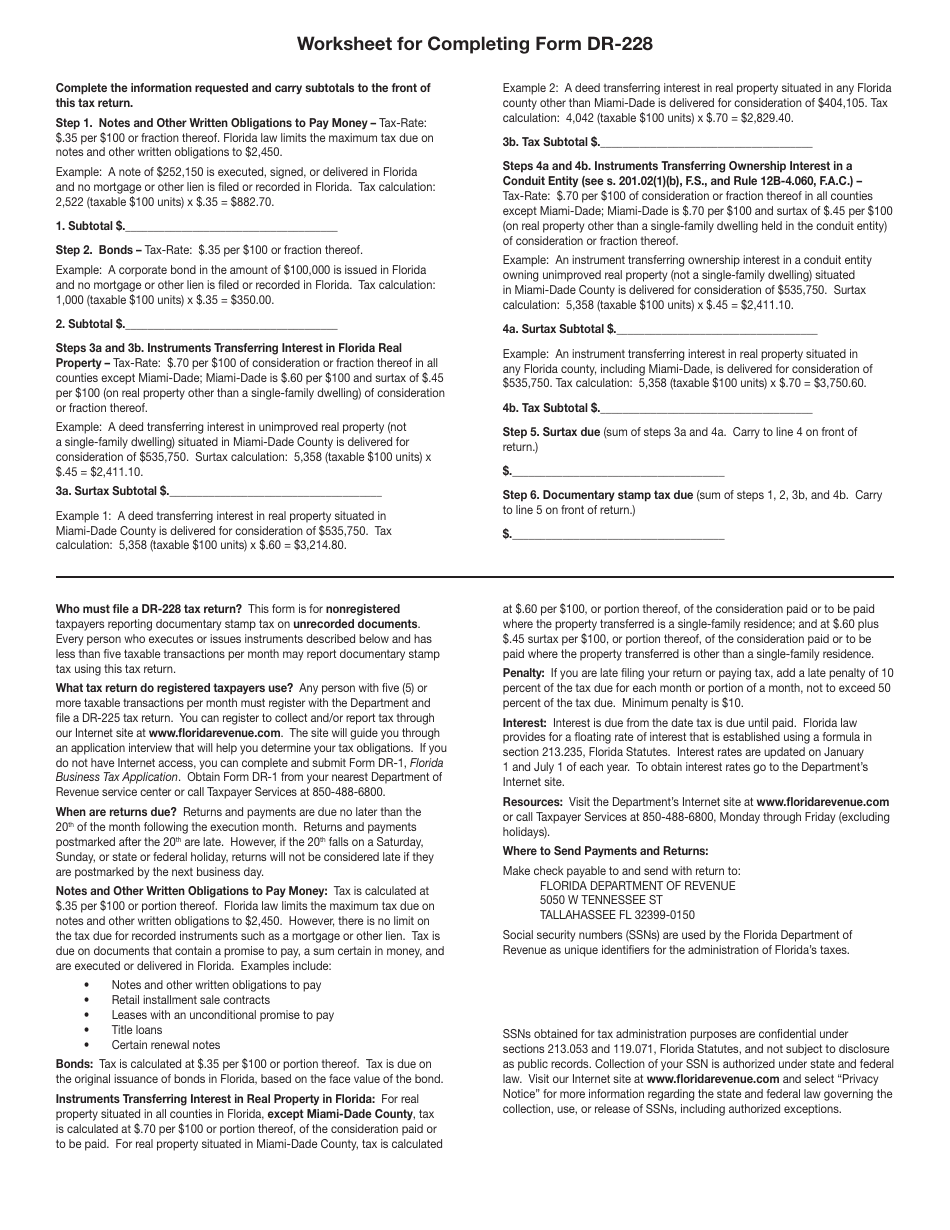

Q: What are documentary stamp taxes?

A: Documentary stamp taxes are taxes imposed on certain documents, such as deeds, mortgages, and promissory notes, that are recorded or executed in Florida.

Form Details:

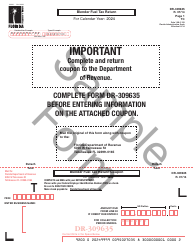

- Released on January 1, 2016;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

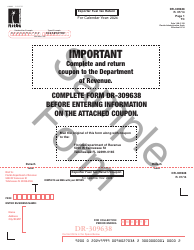

- Fill out the form in our online filing application.

Download a printable version of Form DR-228 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.