This version of the form is not currently in use and is provided for reference only. Download this version of

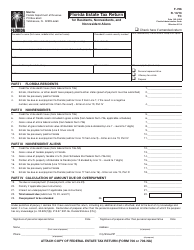

Form DR-312

for the current year.

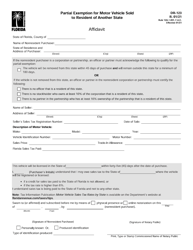

Form DR-312 Affidavit of No Florida Estate Tax Due - Florida

What Is DR-312 (Florida)?

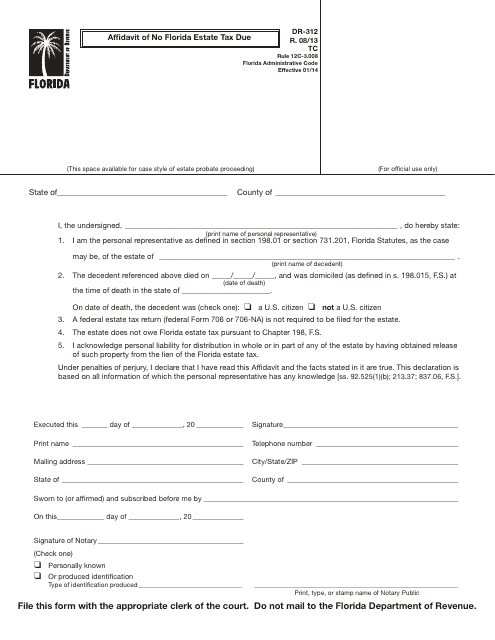

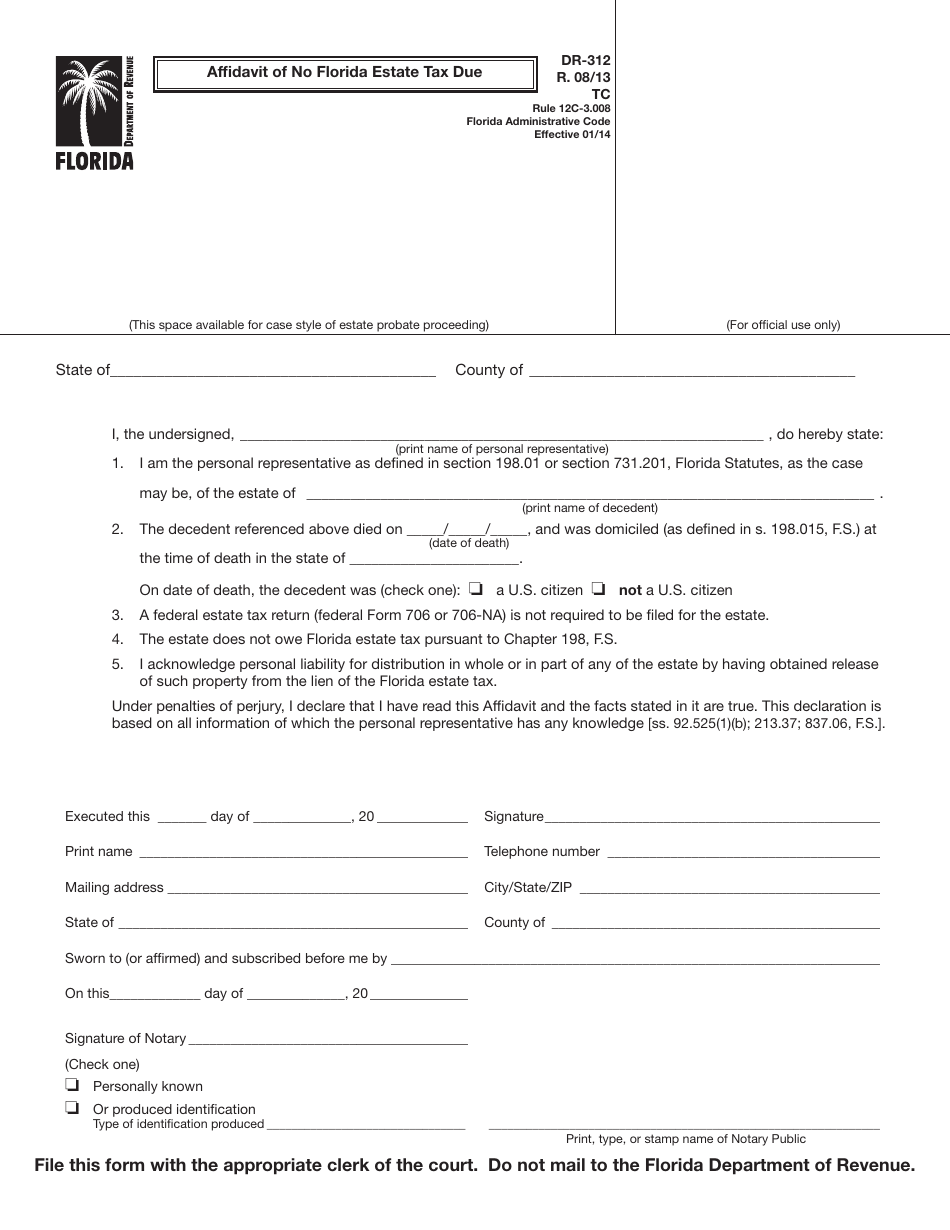

Form DR-312, Affidavit of No Florida Estate Tax Due , is a legal document completed for the estates of decedents who died on or after January 1, 2005, if the estate does not require the filing of a federal estate tax return.

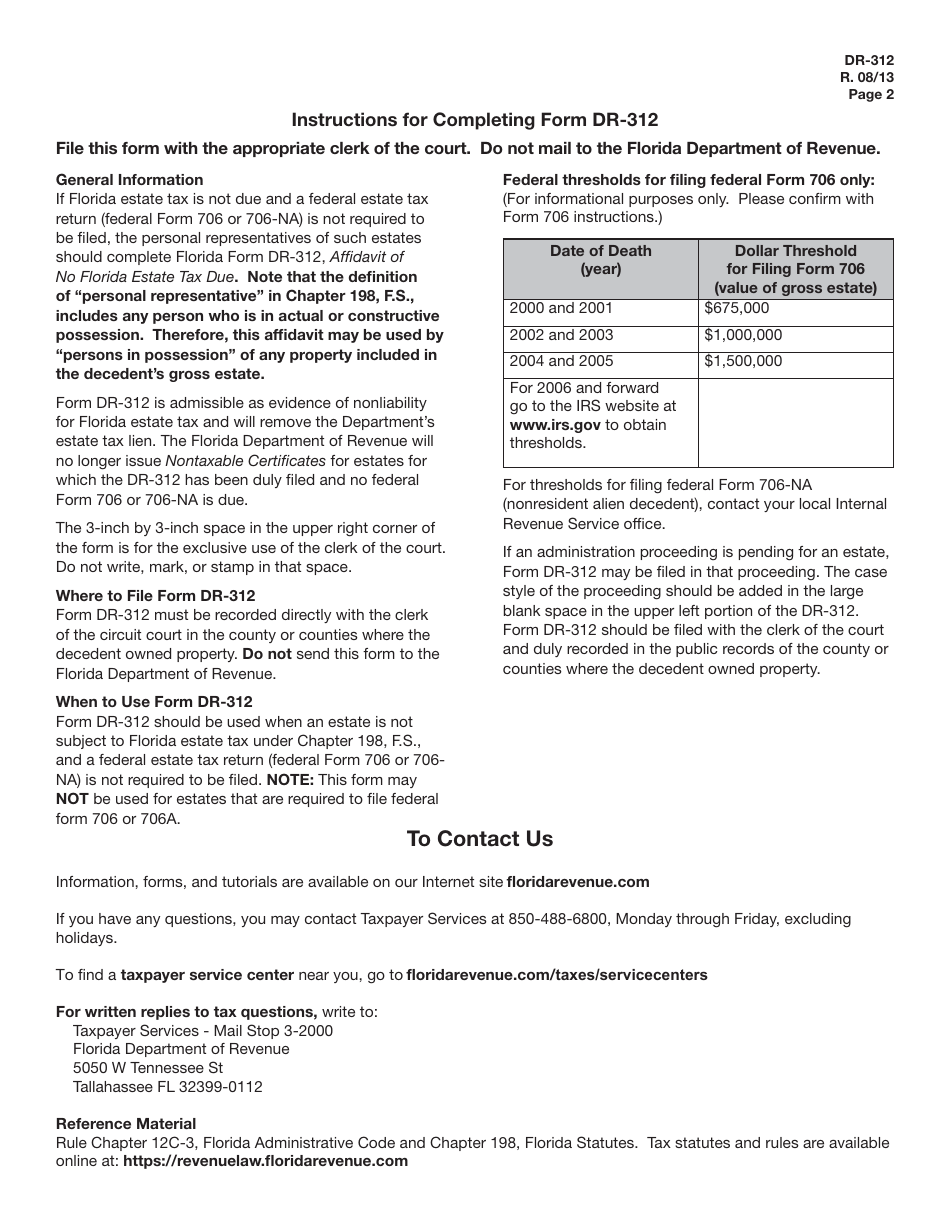

Use Florida Form DR-312 if an estate does not owe any taxes to the State of Florida and you do not need to file Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, or Form 706-NA, United States Estate (and Generation-Skipping Transfer) Tax Return - Regarding the estate of nonresident or citizens of the United States. It is filled out by a personal representative, also known as the executor or administrator of the estate, an individual placed in charge of settling the estate after a decedent's death.

This form was released by the Florida Department of Revenue . The latest version of the form was issued on August 1, 2013 , with all previous editions obsolete. A DR-312 fillable form can be downloaded through the link below.

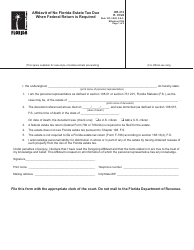

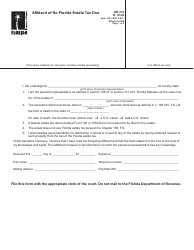

Form DR-313, Affidavit of No Florida Estate Tax Due When Federal Return is Required, is a related document filled out if an estate is required to complete a federal estate tax return.

Form DR-312 Instructions

Add the following details to Form DR-312:

- Name the state and county where the estate is situated;

- Enter the name of the personal representative;

- Write down the name, date of death, and domicile of the decedent at the time of death;

- State whether the decedent was a U.S. citizen or not a U.S. citizen;

- Confirm that the estate does not owe Florida estate tax;

- Acknowledge your personal liability for distribution of the estate;

- State your name, address, and telephone number. Sign and date the form in the presence of a notary who signs and stamps the document.

Once you have completed the form, record the affidavit with the clerk of the circuit court in the county where the decedent owned property. Do not send the document to the Department of Revenue.