This version of the form is not currently in use and is provided for reference only. Download this version of

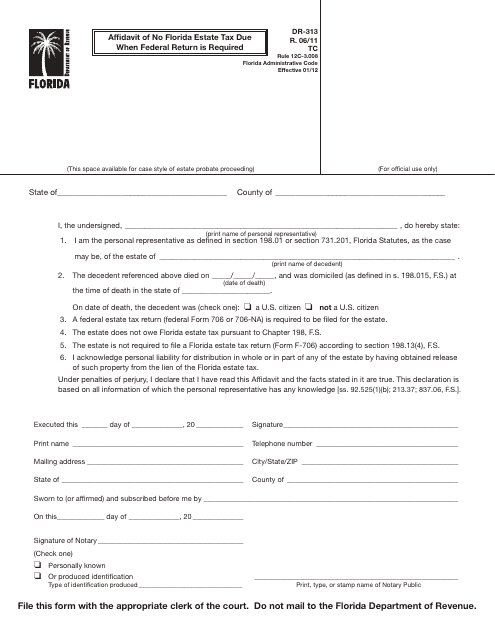

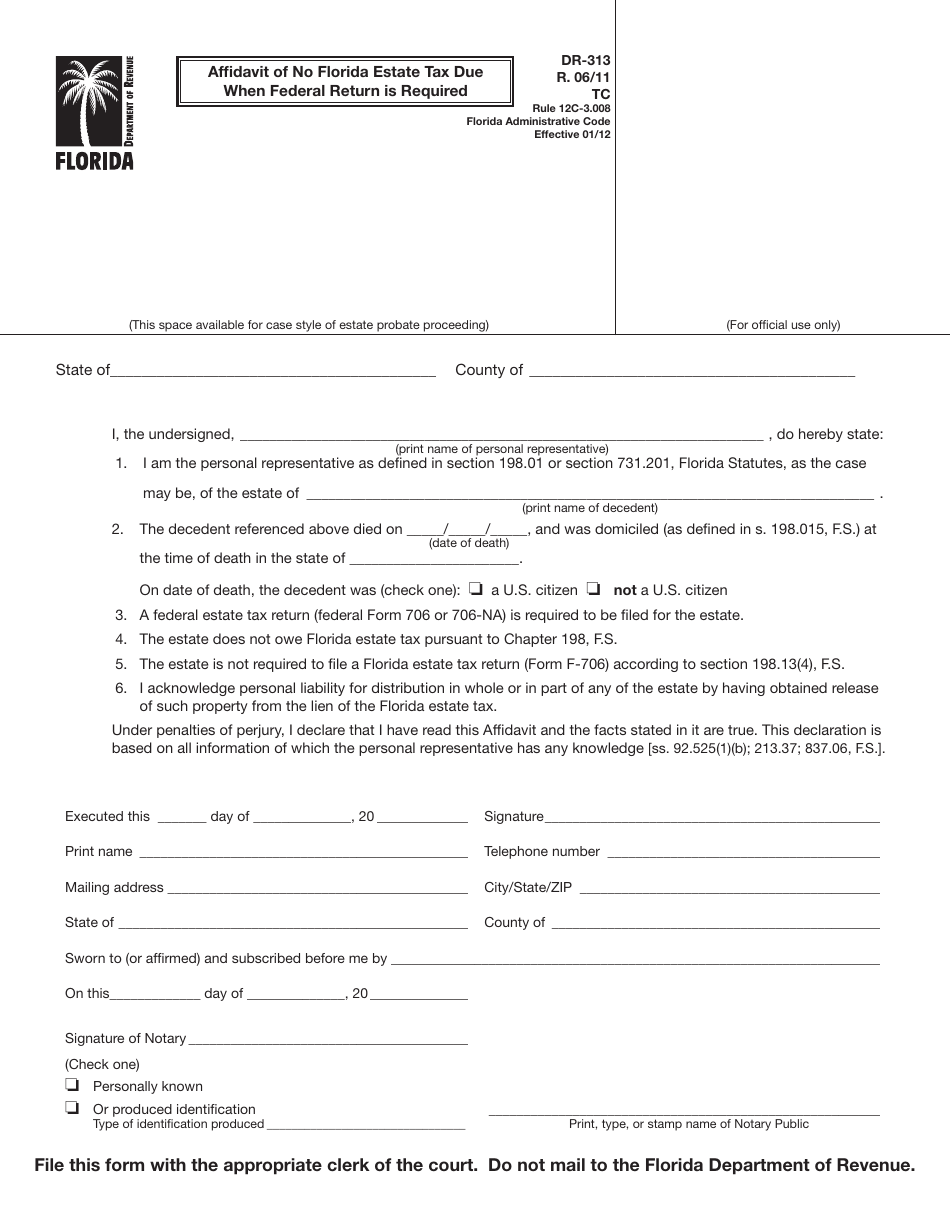

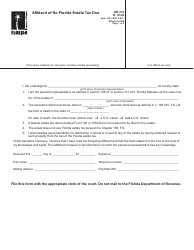

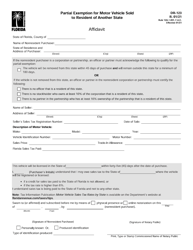

Form DR-313

for the current year.

Form DR-313 Affidavit of No Florida Estate Tax Due When Federal Return Is Required - Florida

What Is Form DR-313?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

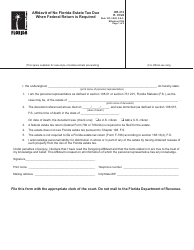

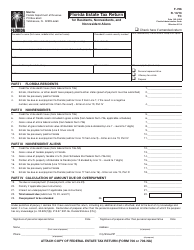

Q: What is Form DR-313?

A: Form DR-313 is the Affidavit of No Florida Estate Tax Due When Federal Return Is Required - Florida.

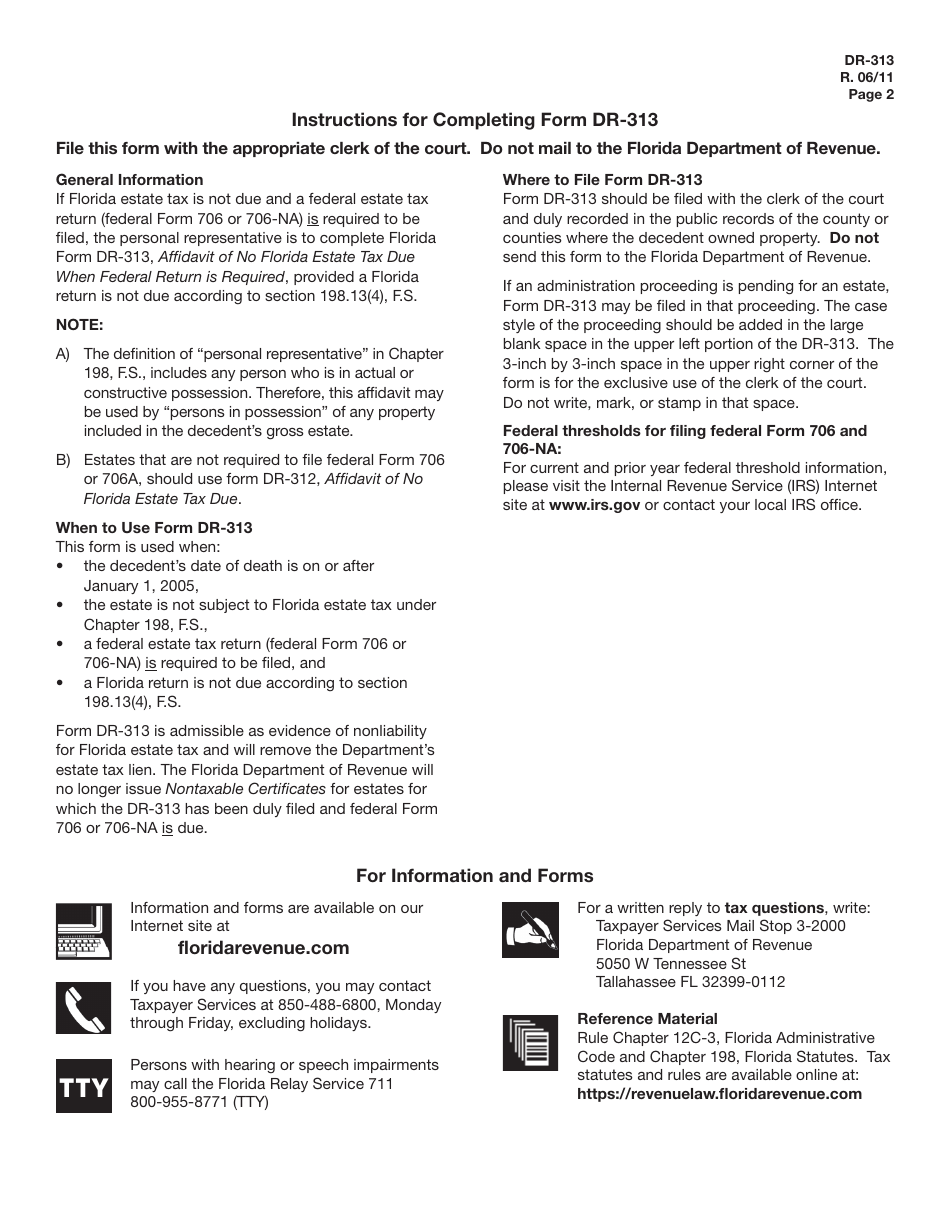

Q: When is Form DR-313 used?

A: This form is used when there is no Florida estate tax due, but a federal return is required.

Q: Who needs to fill out Form DR-313?

A: Any individual or estate that is required to file a federal estate tax return but has no Florida estate tax due.

Q: Is there a deadline for filing Form DR-313?

A: Yes, Form DR-313 must be filed within 9 months from the decedent's date of death.

Q: Are there any fees associated with filing Form DR-313?

A: No, there are no fees for filing Form DR-313.

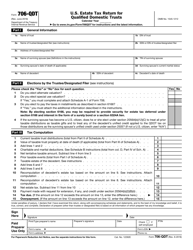

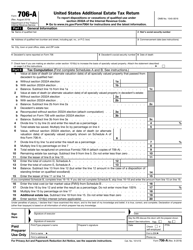

Q: What should I include when filing Form DR-313?

A: You should include a copy of the federal estate tax return (IRS Form 706) and any supporting documentation.

Q: What happens after I file Form DR-313?

A: The Florida Department of Revenue will review your form and supporting documents to verify that no Florida estate tax is due.

Q: Is there any penalty for not filing Form DR-313?

A: Failure to file Form DR-313 may result in penalties and interest.

Q: Can I file Form DR-313 electronically?

A: No, Form DR-313 must be filed by mail or in person.

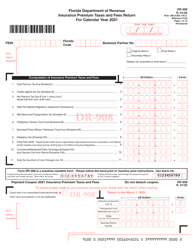

Form Details:

- Released on June 1, 2011;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-313 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.