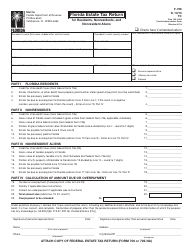

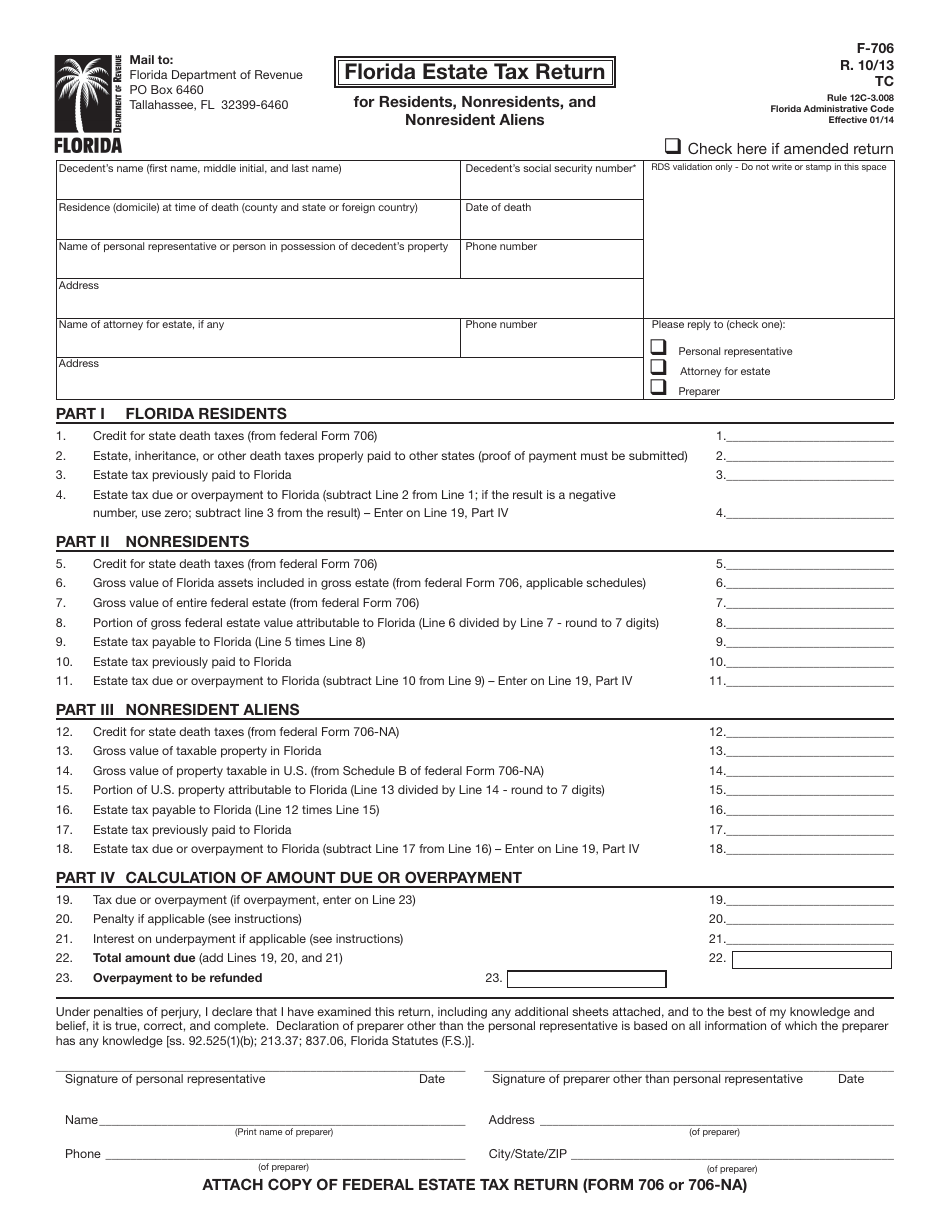

Form F-706 Florida Estate Tax Return for Residents, Nonresidents, and Nonresident Aliens - Florida

What Is Form F-706?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-706?

A: Form F-706 is the Florida Estate Tax Return for Residents, Nonresidents, and Nonresident Aliens.

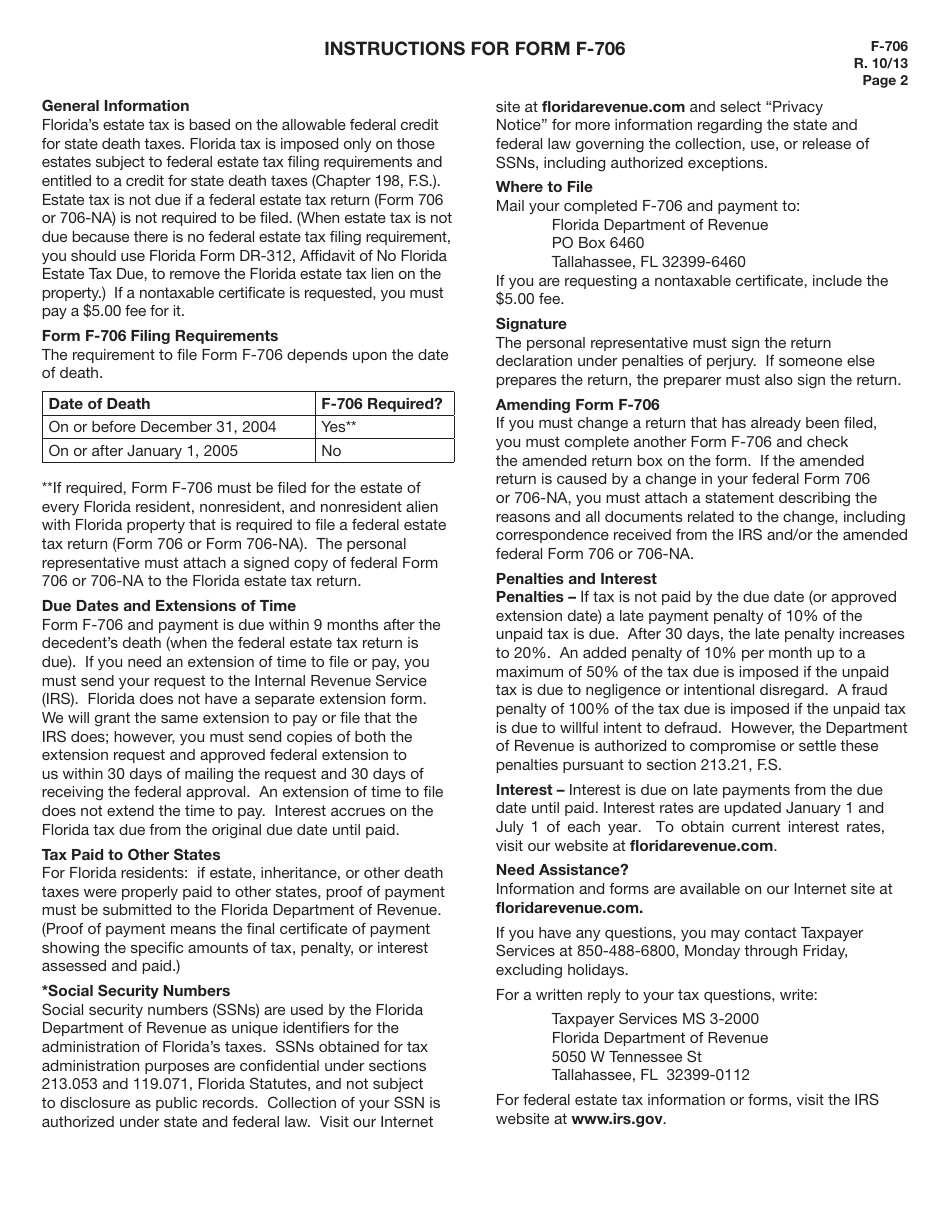

Q: Who is required to file Form F-706?

A: Form F-706 must be filed by the estate of any decedent who was a resident, nonresident, or nonresident alien of Florida at the time of their death.

Q: What is the purpose of Form F-706?

A: The purpose of Form F-706 is to report and pay the Florida estate tax.

Q: What information is required on Form F-706?

A: Form F-706 requires information about the decedent, the estate, and the estate assets and liabilities.

Q: When is Form F-706 due?

A: Form F-706 is due nine months after the decedent's date of death.

Q: Is there a penalty for late filing of Form F-706?

A: Yes, there is a penalty for late filing of Form F-706. The penalty is based on the amount of tax owed and increases over time.

Q: Can Form F-706 be filed electronically?

A: No, Form F-706 cannot be filed electronically. It must be filed by mail with the Florida Department of Revenue.

Q: Is there a filing fee for Form F-706?

A: No, there is no filing fee for Form F-706.

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form F-706 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.