This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR-138

for the current year.

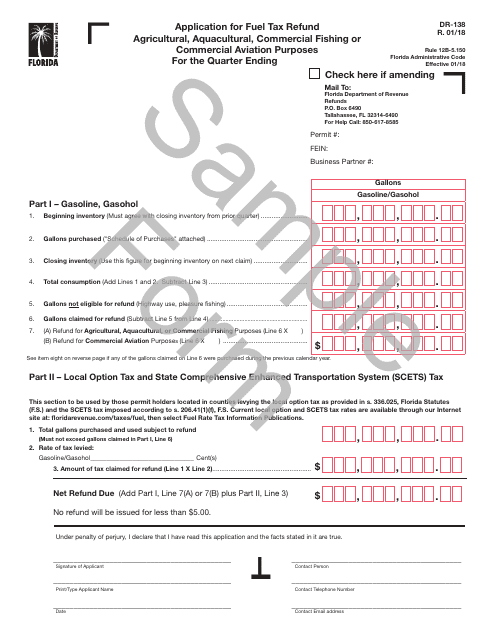

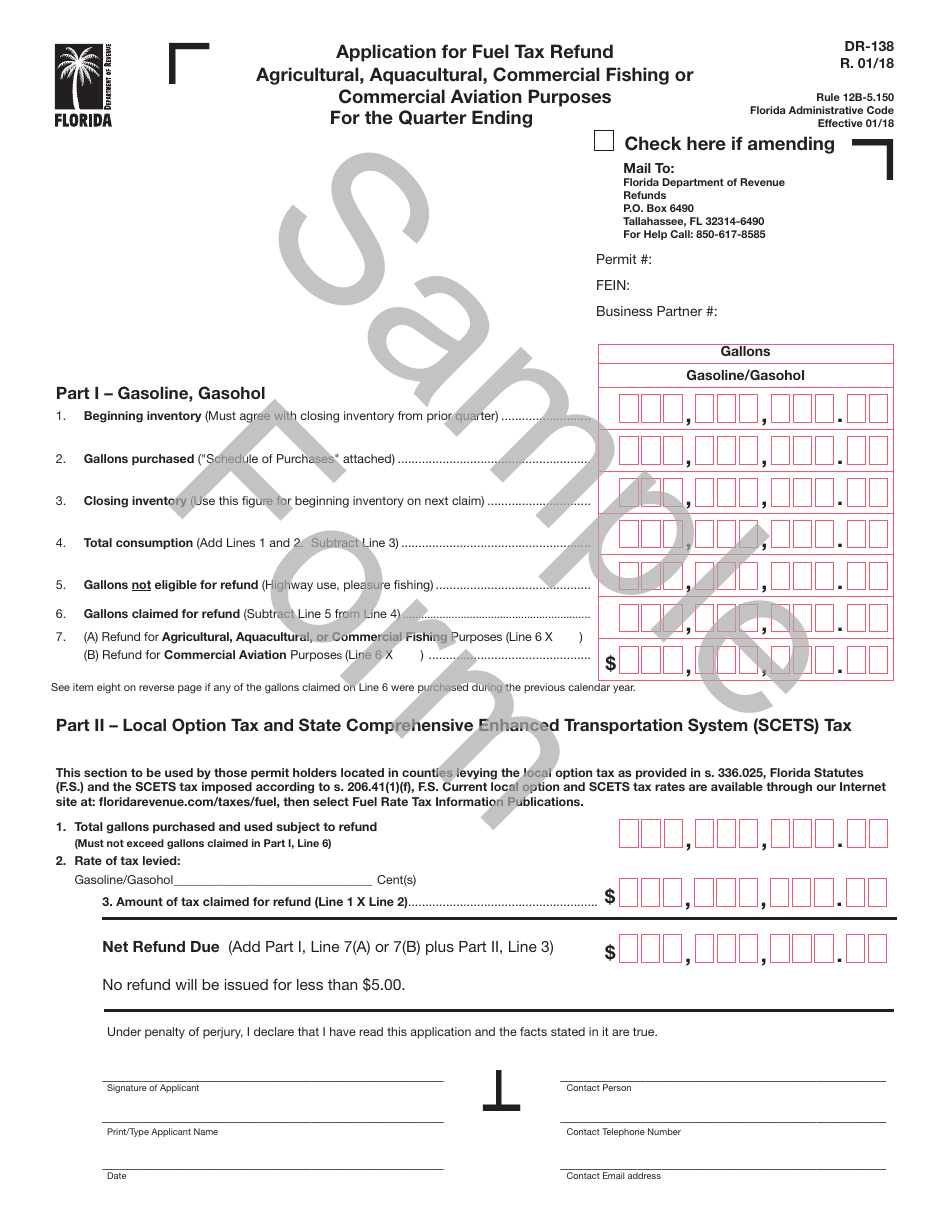

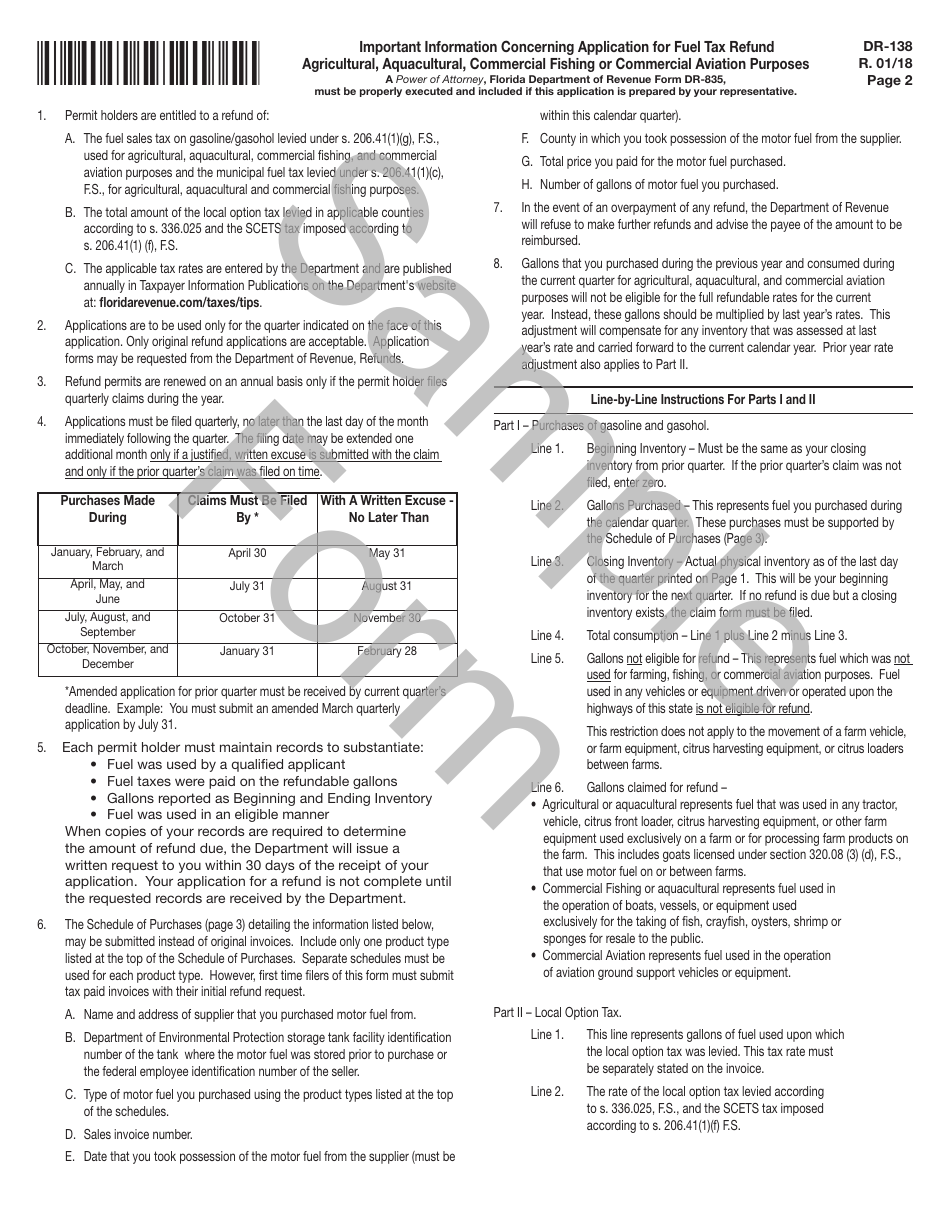

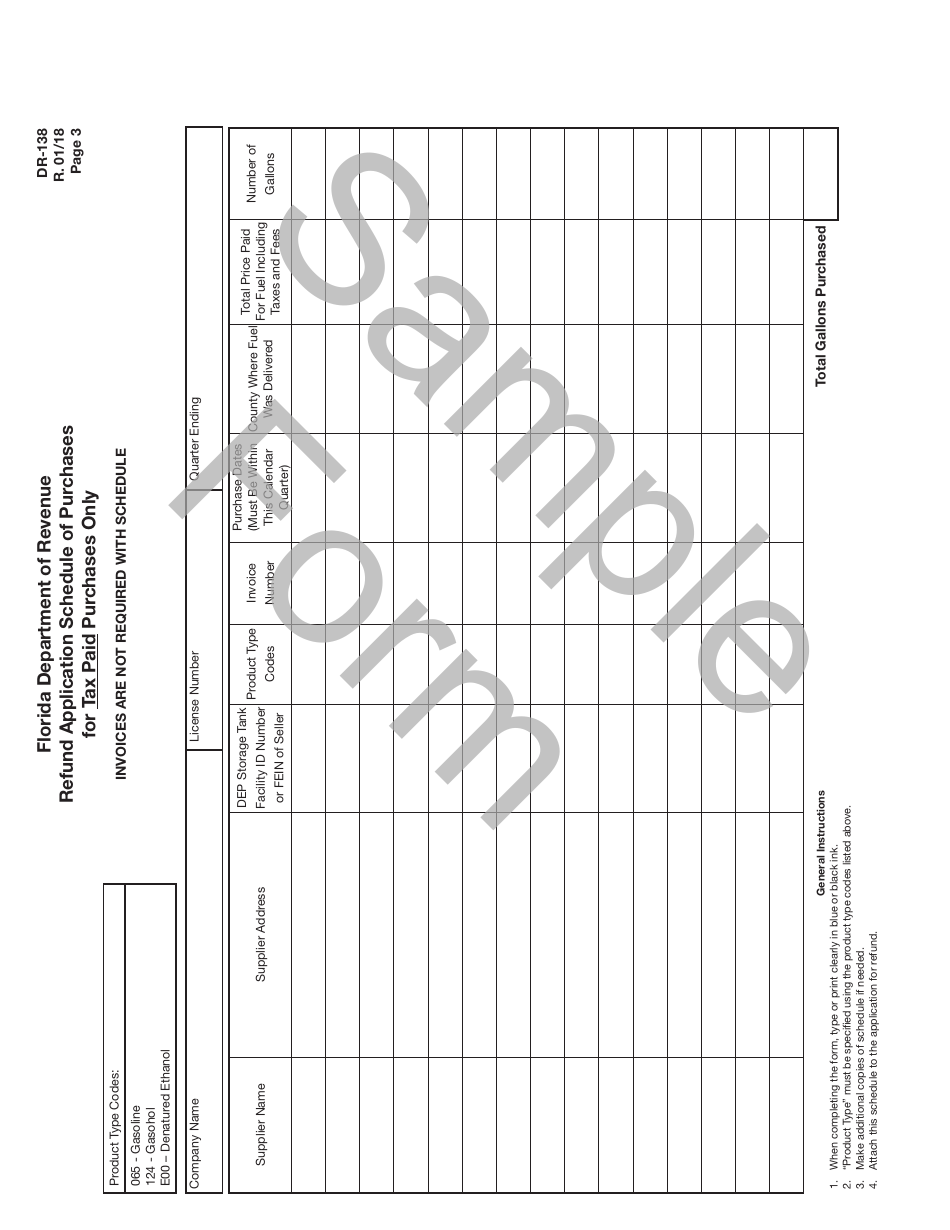

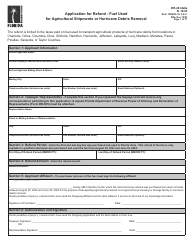

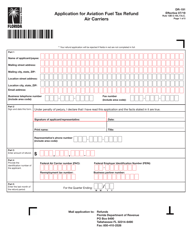

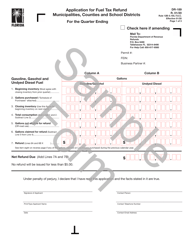

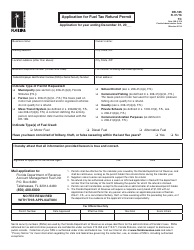

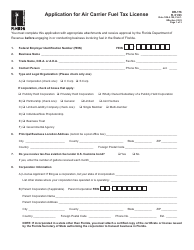

Sample Form DR-138 Application for Fuel Tax Refund Agricultural, Aquacultural, Commercial Fishing or Commercial Aviation Purposes - Florida

What Is Form DR-138?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-138?

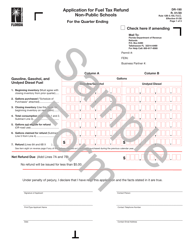

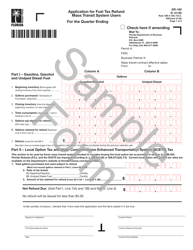

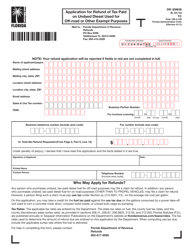

A: Form DR-138 is an application for fuel tax refund for agricultural, aquacultural, commercial fishing, or commercial aviation purposes in Florida.

Q: Who can use Form DR-138?

A: Form DR-138 can be used by individuals or businesses engaged in agricultural, aquacultural, commercial fishing, or commercial aviation activities in Florida.

Q: What is the purpose of Form DR-138?

A: The purpose of Form DR-138 is to apply for a refund of fuel taxes paid on fuel used for eligible purposes.

Q: What types of activities are eligible for a fuel tax refund using Form DR-138?

A: Activities involved in agricultural, aquacultural, commercial fishing, or commercial aviation are eligible for a fuel tax refund using Form DR-138.

Q: Are there any deadlines for submitting Form DR-138?

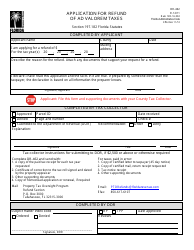

A: Yes, Form DR-138 must be filed within 12 months from the date of purchase of the fuel.

Q: What documentation do I need to include with Form DR-138?

A: You need to include copies of all fuel purchase invoices, receipts, and any other supporting documents that prove the eligible use of the fuel.

Q: How long does it take to process a fuel tax refund claim using Form DR-138?

A: The processing time for a fuel tax refund claim using Form DR-138 can vary, but it generally takes several weeks to months to receive a response from the Florida Department of Revenue.

Q: Can I submit Form DR-138 electronically?

A: No, Form DR-138 cannot be submitted electronically. It must be mailed to the Florida Department of Revenue.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-138 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.