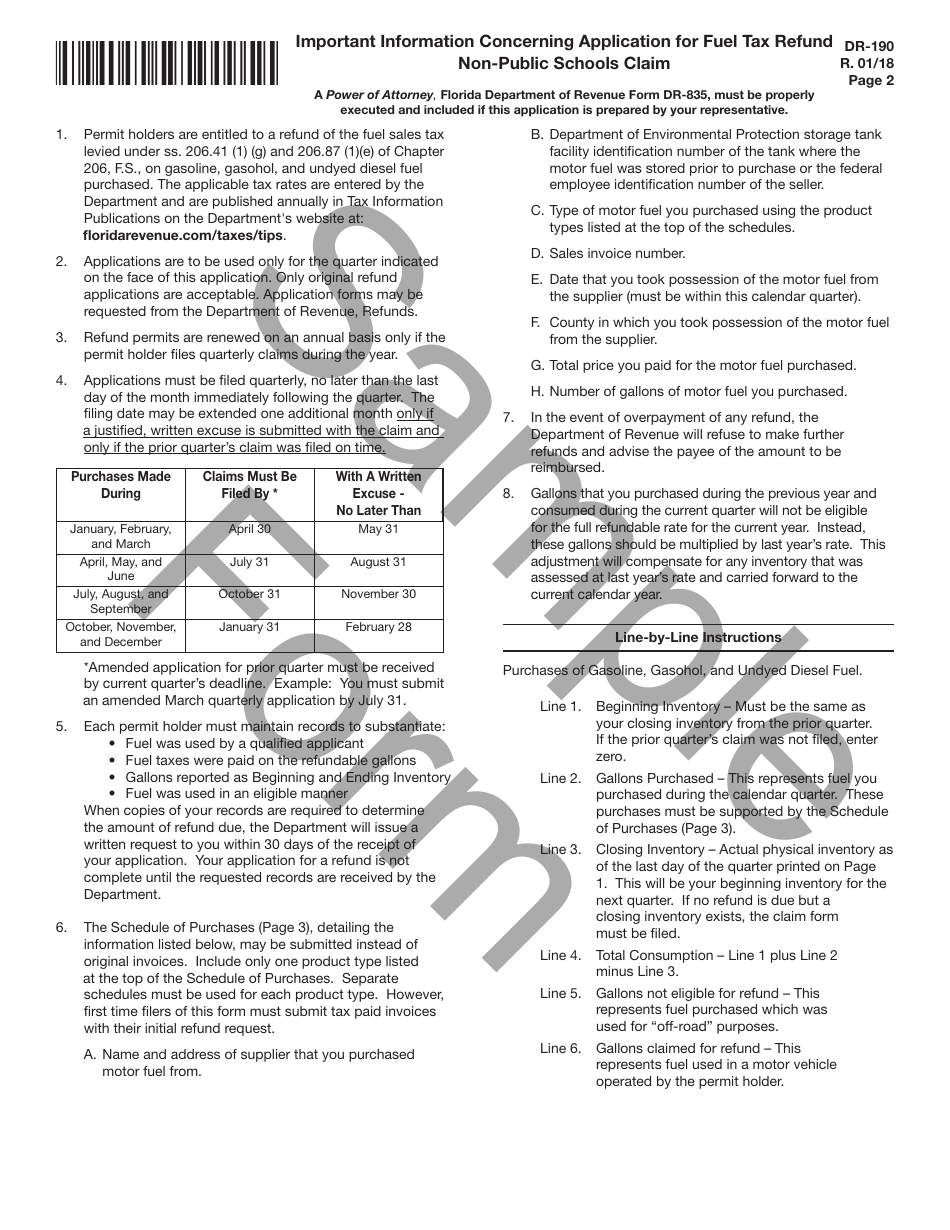

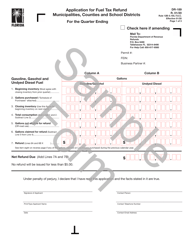

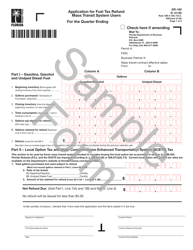

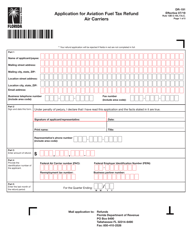

This version of the form is not currently in use and is provided for reference only. Download this version of

Form DR-190

for the current year.

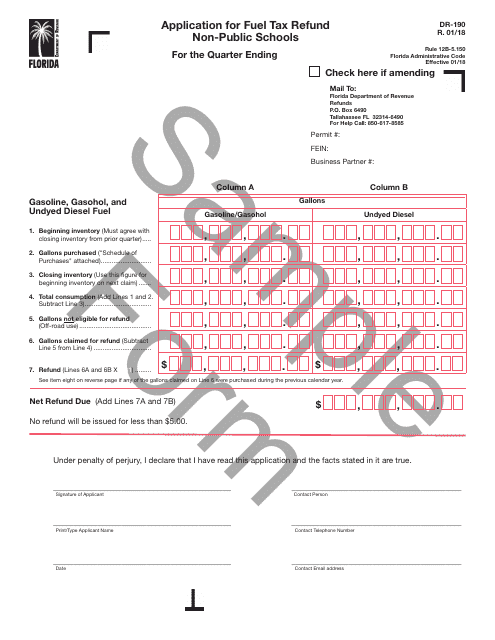

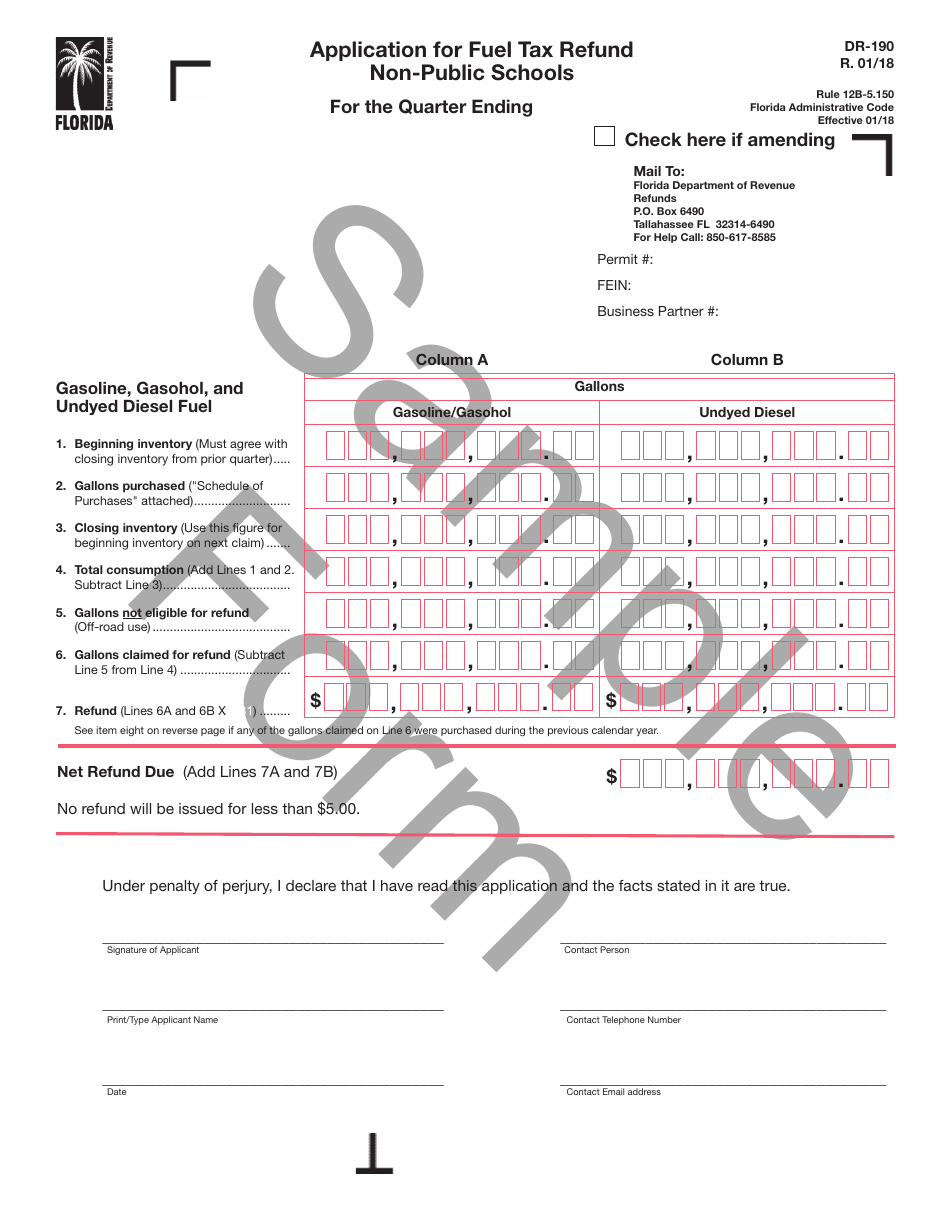

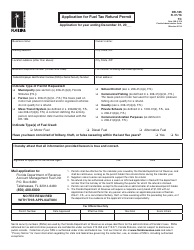

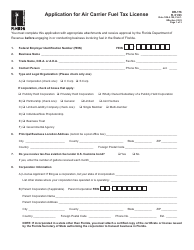

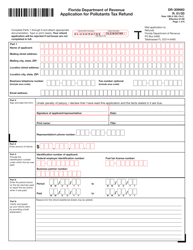

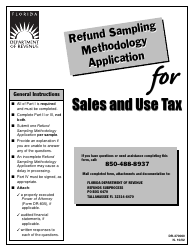

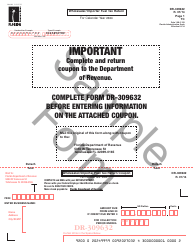

Sample Form DR-190 Application for Fuel Tax Refund Non-public Schools - Florida

What Is Form DR-190?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-190?

A: Form DR-190 is an application for fuel tax refund for non-public schools in Florida.

Q: Who can use Form DR-190?

A: Non-public schools in Florida can use Form DR-190 to apply for fuel tax refund.

Q: What is the purpose of Form DR-190?

A: The purpose of Form DR-190 is to claim a refund of fuel taxes paid by non-public schools in Florida.

Q: Are there any eligibility requirements to use Form DR-190?

A: Yes, non-public schools must meet specific eligibility criteria to be eligible for a fuel tax refund.

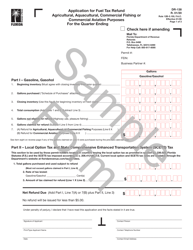

Q: What expenses can be claimed on Form DR-190?

A: Non-public schools can claim the cost of gasoline or diesel fuel purchased or used in school buses or other school vehicles.

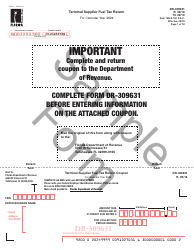

Q: Is there a deadline to submit Form DR-190?

A: Yes, Form DR-190 must be submitted on or before June 30th of the year following the year in which the taxes were paid.

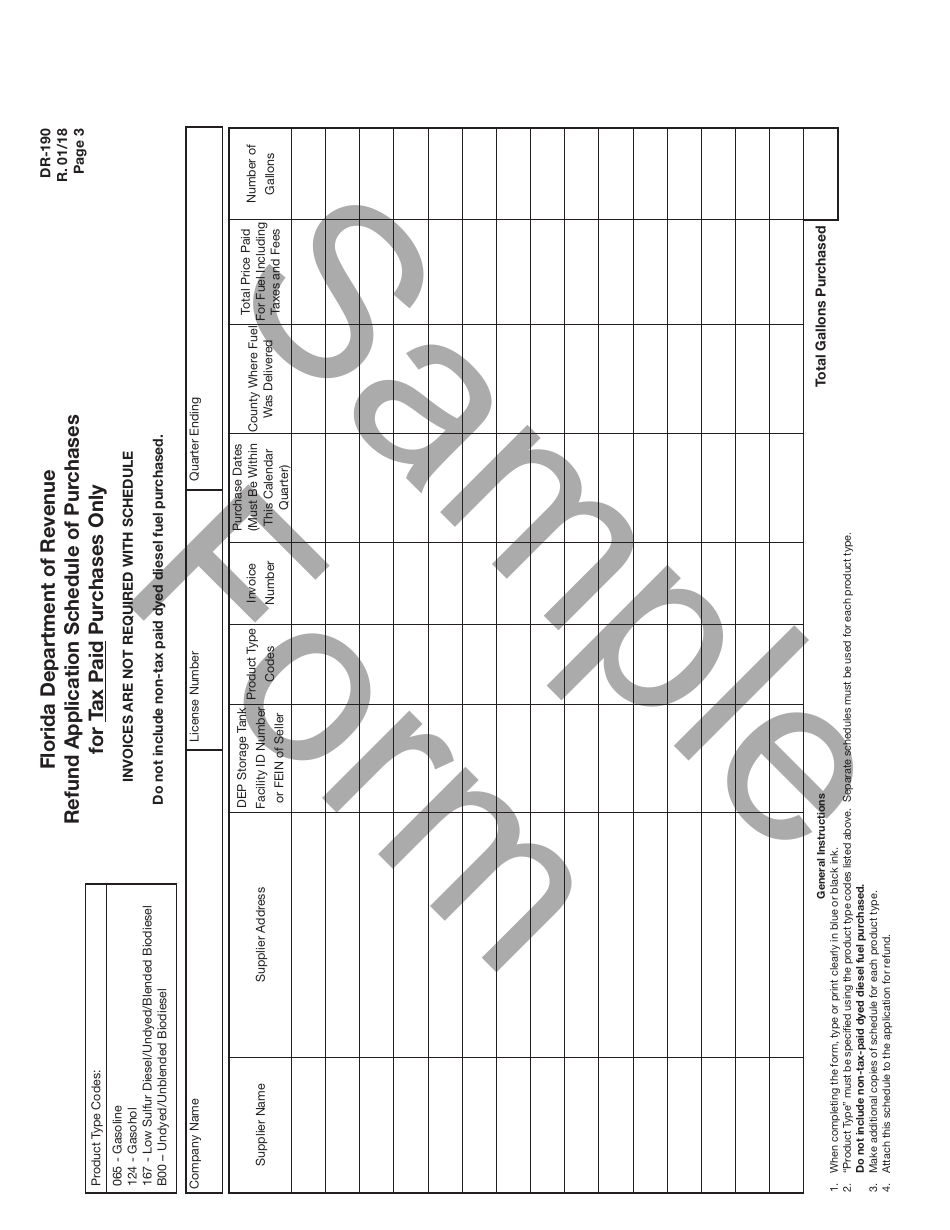

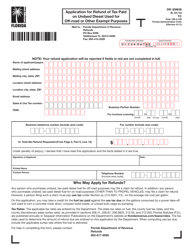

Q: What supporting documentation is required with Form DR-190?

A: Non-public schools must provide copies of fuel receipts or invoices as supporting documentation for the fuel tax refund claim.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Florida Department of Revenue;

- A printable and free sample of Form DR-190;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-190 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.