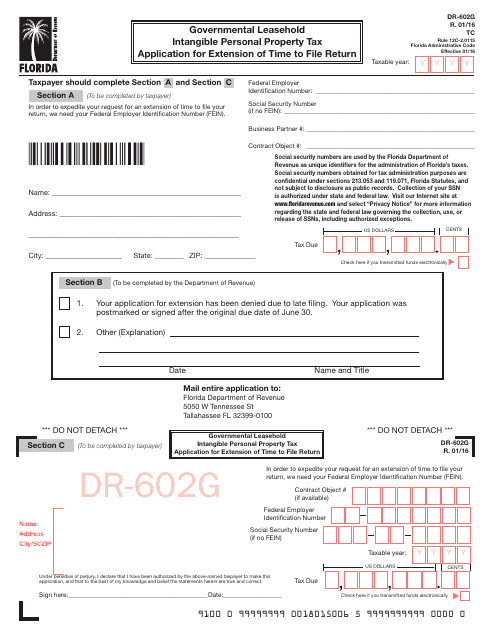

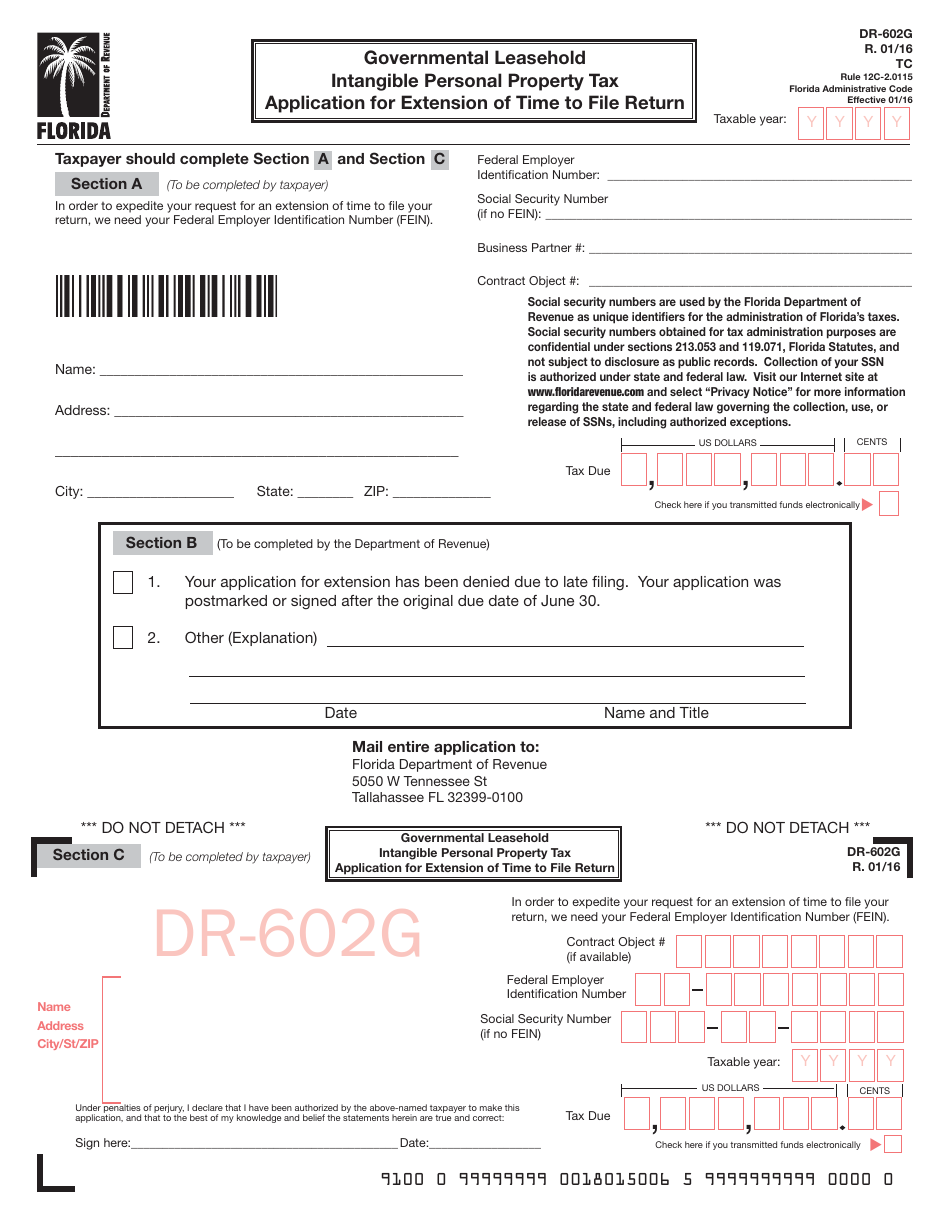

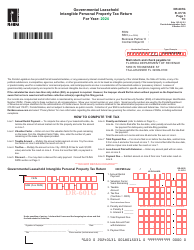

Form DR-602G Governmental Leasehold Intangible Personal Property Tax Application for Extension of Time to File Return - Florida

What Is Form DR-602G?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-602G?

A: Form DR-602G is the Governmental Leasehold Intangible Personal Property Tax Application for Extension of Time to File Return in Florida.

Q: What is the purpose of Form DR-602G?

A: The purpose of Form DR-602G is to request an extension of time to file the Governmental Leasehold Intangible Personal Property Tax Return.

Q: Who needs to file Form DR-602G?

A: Businesses or individuals who have a leasehold interest in government-owned property and need more time to file the tax return.

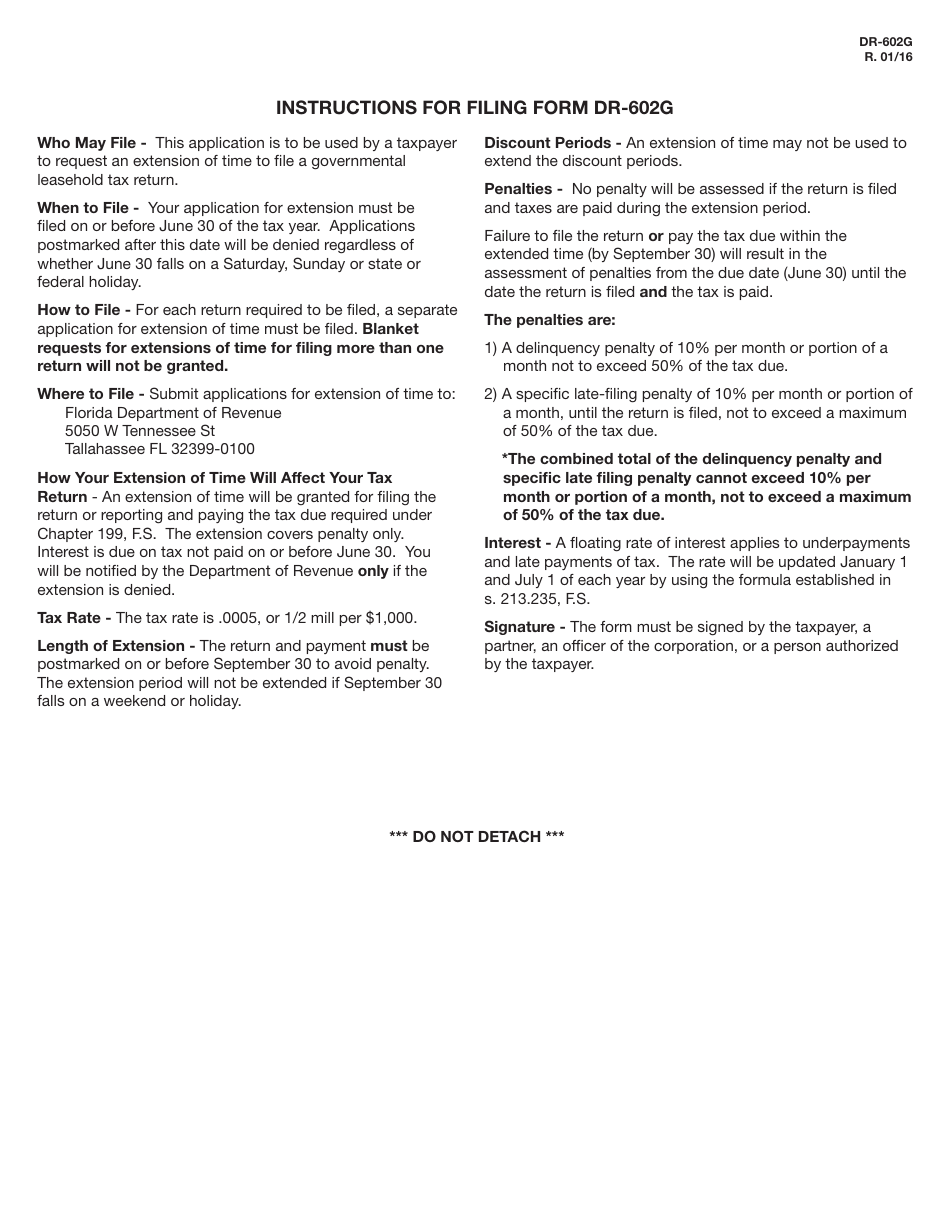

Q: When is the deadline to file Form DR-602G?

A: The deadline to file Form DR-602G is generally the same as the deadline for the Governmental Leasehold Intangible Personal Property Tax Return, but this form allows you to request an extension.

Q: Is there a fee for filing Form DR-602G?

A: No, there is no fee for filing Form DR-602G.

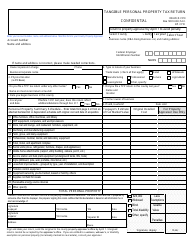

Q: What information is required on Form DR-602G?

A: On Form DR-602G, you will need to provide your contact information, the property details, the reason for the extension request, and a signature.

Q: How long of an extension can I request with Form DR-602G?

A: You can request an extension of up to 90 days with Form DR-602G.

Q: Can I e-file Form DR-602G?

A: No, Form DR-602G cannot be e-filed. It must be filed by mail or in person.

Q: What should I do if my extension request is denied?

A: If your extension request is denied, you must still file the Governmental Leasehold Intangible Personal Property Tax Return by the original due date.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-602G by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.