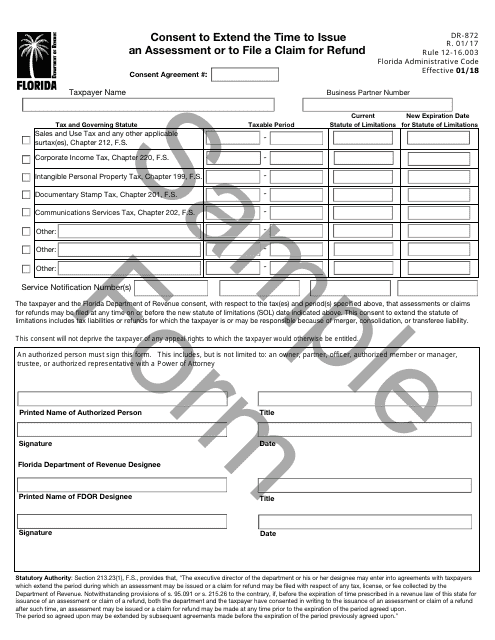

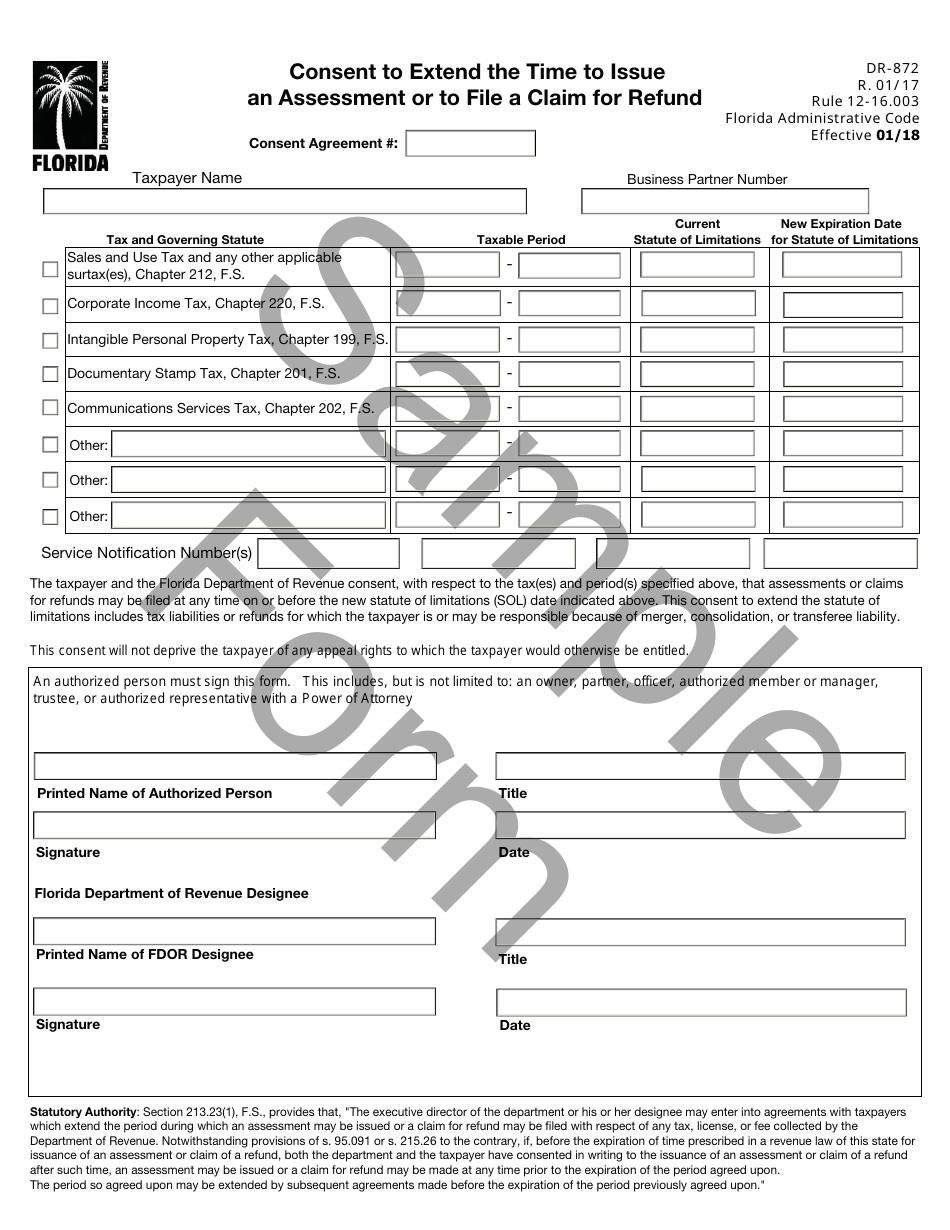

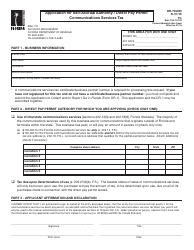

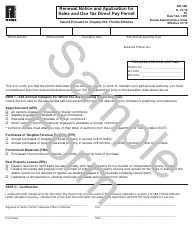

Sample Form DR-872 Consent to Extend the Time to Issue an Assessment or to File a Claim for Refund - Florida

What Is Form DR-872?

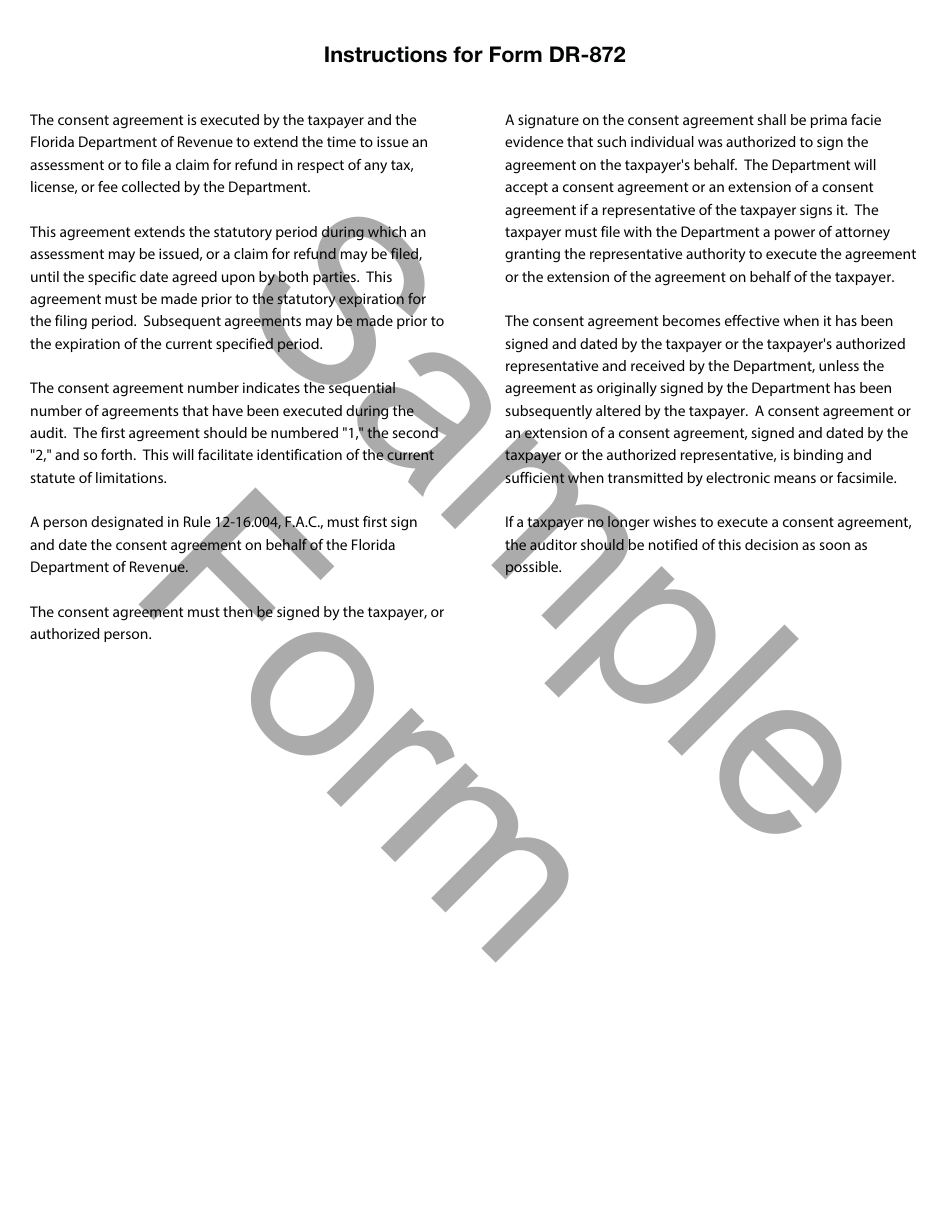

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form DR-872?

A: Form DR-872 is the Consent to Extend the Time to Issue an Assessment or to File a Claim for Refund in Florida.

Q: What does form DR-872 allow me to do?

A: Form DR-872 allows you to request an extension of time to issue an assessment or to file a claim for refund.

Q: When should I use form DR-872?

A: You should use form DR-872 when you need additional time to complete the assessment or claim for refund process in Florida.

Q: Is there a fee to submit form DR-872?

A: No, there is no fee to submit form DR-872.

Q: Are there any eligibility requirements to use form DR-872?

A: Yes, you must meet certain eligibility requirements, such as having a reasonable cause for needing an extension.

Q: What happens after I submit form DR-872?

A: After you submit form DR-872, the Florida Department of Revenue will review your request and notify you of their decision.

Q: How long does the extension granted by form DR-872 last?

A: The length of the extension granted by form DR-872 will depend on the specific circumstances of your request.

Q: What should I do if my request for an extension is denied?

A: If your request for an extension is denied, you may need to seek alternative options or consult with a tax professional for guidance.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-872 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.