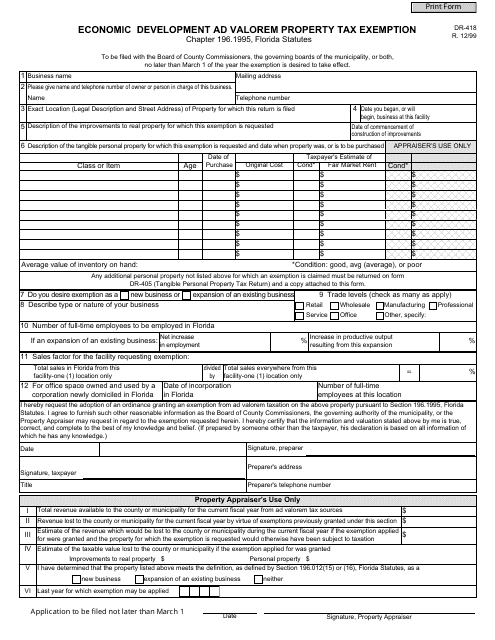

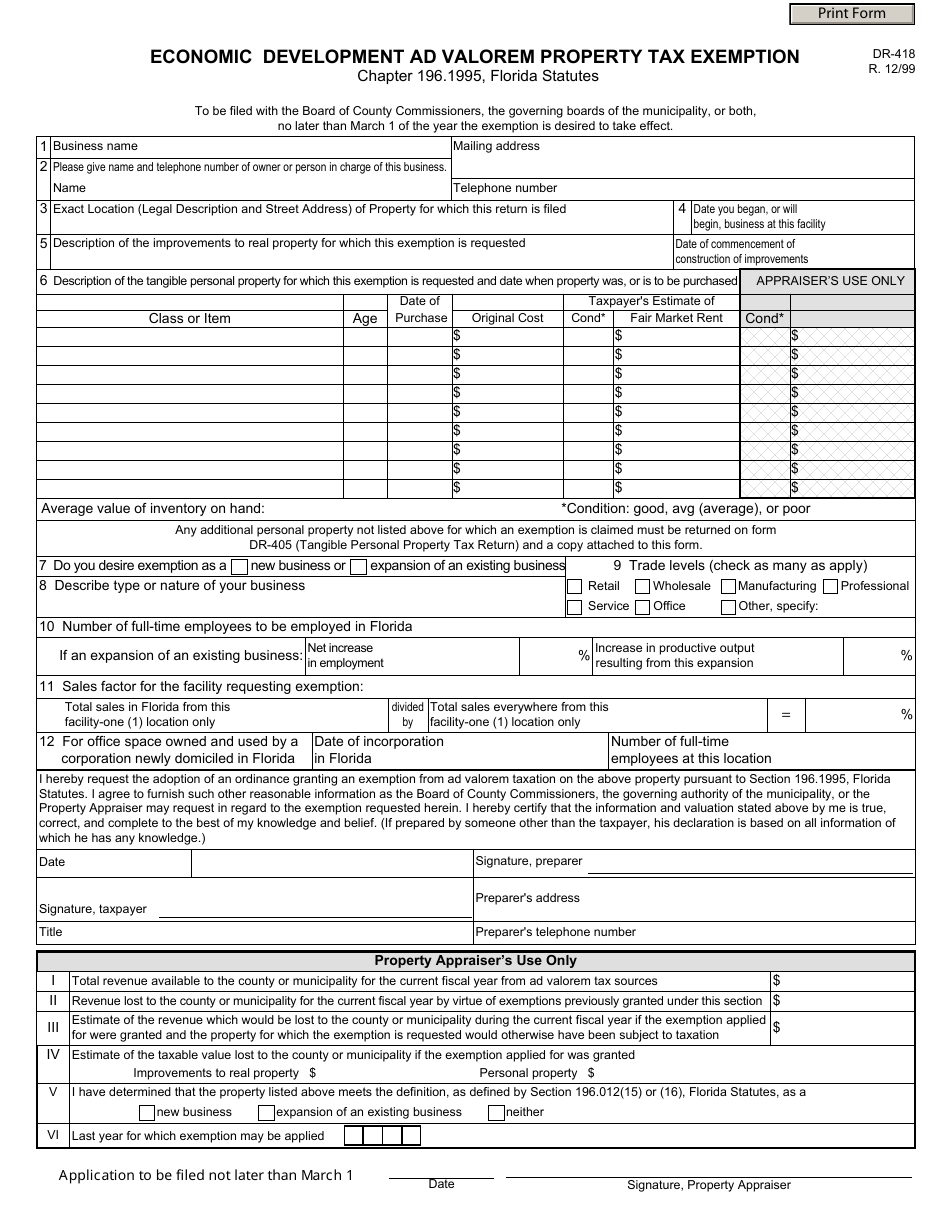

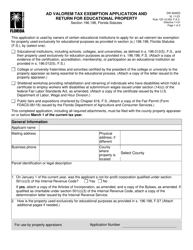

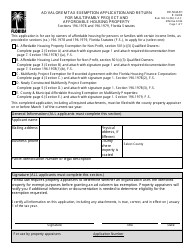

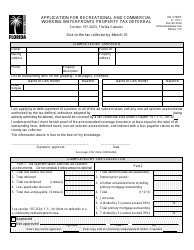

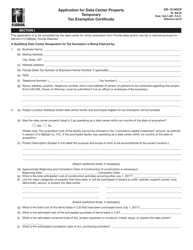

Form DR-418 Economic Development Ad Valorem Property Tax Exemption - Florida

What Is Form DR-418?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-418?

A: Form DR-418 is the Economic Development Ad Valorem Property Tax Exemption application form in Florida.

Q: What is the purpose of Form DR-418?

A: The purpose of Form DR-418 is to apply for an economic development ad valorem property tax exemption in Florida.

Q: Who can use Form DR-418?

A: Form DR-418 can be used by businesses and organizations seeking an economic development ad valorem property tax exemption in Florida.

Q: How do I fill out Form DR-418?

A: To fill out Form DR-418, you need to provide information about your business or organization, the property, and other required details as stated in the form.

Q: Is there a deadline for submitting Form DR-418?

A: Yes, Form DR-418 must be submitted to the property appraiser's office by March 1st of the year for which you are seeking the exemption.

Q: What happens after I submit Form DR-418?

A: After submitting Form DR-418, the property appraiser's office will review your application and determine if you are eligible for the economic development ad valorem property tax exemption.

Form Details:

- Released on December 1, 1999;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-418 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.