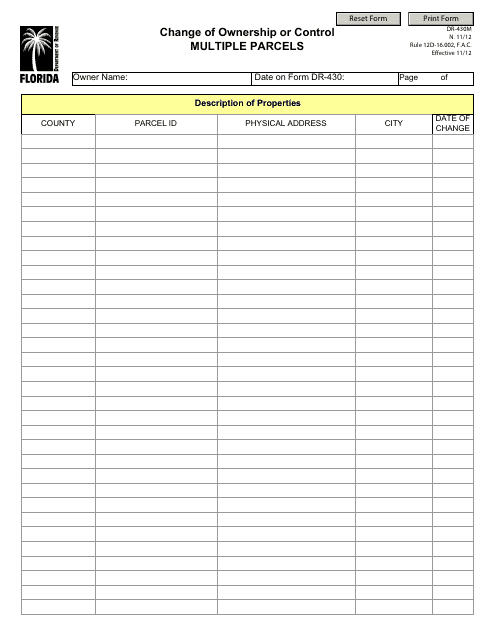

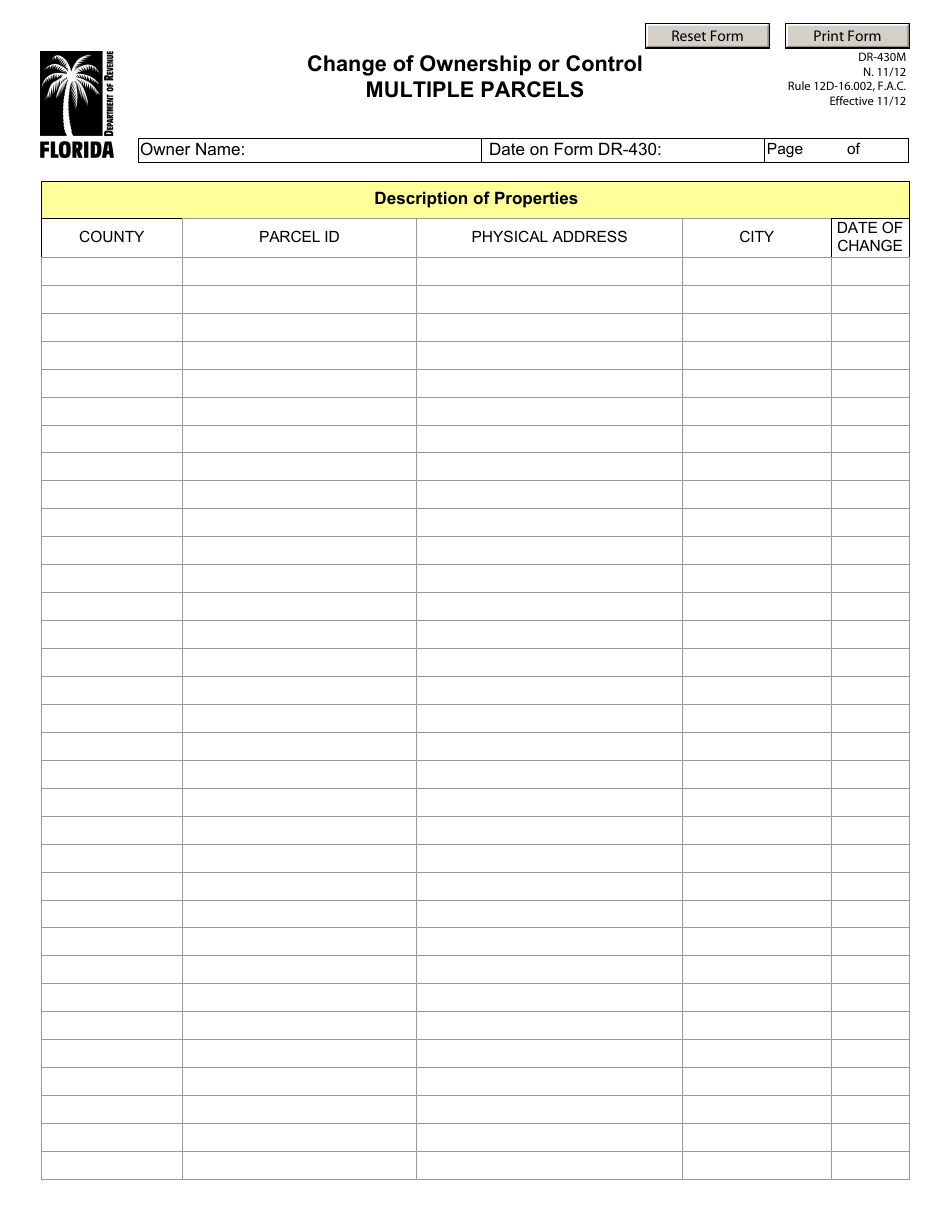

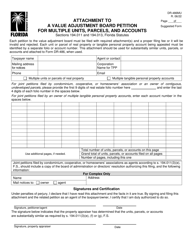

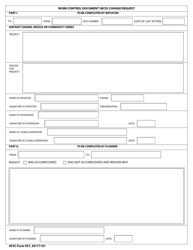

Form DR-430M Change of Ownership or Control Multiple Parcels - Florida

What Is Form DR-430M?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-430M?

A: Form DR-430M is a document used in Florida for reporting a change of ownership or control for multiple parcels.

Q: When should I use Form DR-430M?

A: You should use Form DR-430M when there is a change in ownership or control of multiple parcels in Florida.

Q: What is the purpose of Form DR-430M?

A: The purpose of Form DR-430M is to provide the necessary information to the local property appraiser regarding a change in ownership or control of multiple parcels.

Q: Who needs to fill out Form DR-430M?

A: The person or entity that has acquired or taken control of multiple parcels in Florida needs to fill out Form DR-430M.

Q: What information is required on Form DR-430M?

A: Form DR-430M requires information such as the names and addresses of the previous and current owners, the parcel identification numbers, and the effective date of the change in ownership or control.

Q: Are there any fees associated with filing Form DR-430M?

A: There may be fees associated with filing Form DR-430M. You should check with the local property appraiser's office for more information on the applicable fees.

Q: Is there a deadline for filing Form DR-430M?

A: Yes, there is a deadline for filing Form DR-430M. The form must be filed within 30 days from the date of the change in ownership or control.

Q: What happens after filing Form DR-430M?

A: After filing Form DR-430M, the local property appraiser will update their records to reflect the change in ownership or control of the multiple parcels.

Form Details:

- Released on November 1, 2012;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR-430M by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.