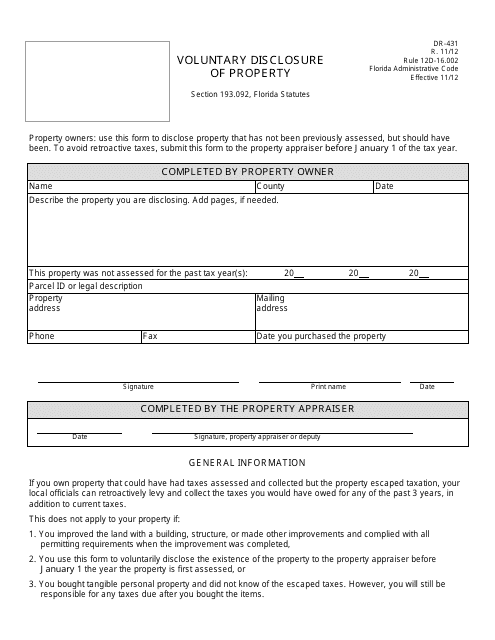

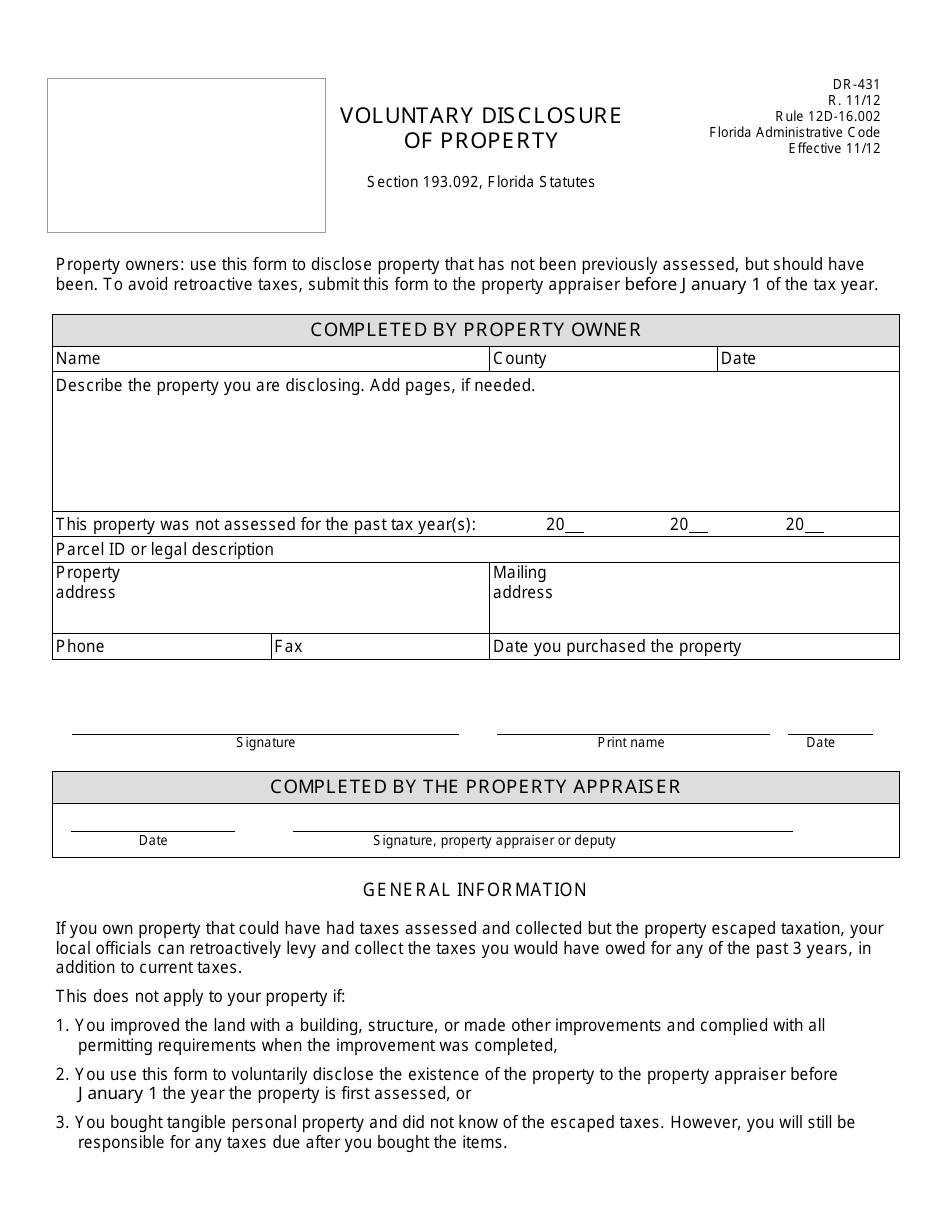

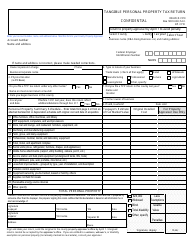

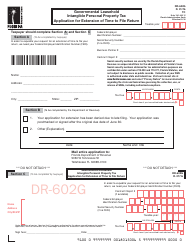

Form DR-431 Voluntary Disclosure of Property - Florida

What Is Form DR-431?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-431?

A: Form DR-431 is the Voluntary Disclosure of Property form used in Florida.

Q: What is the purpose of Form DR-431?

A: The purpose of Form DR-431 is to disclose any previously unreported property to avoid certain penalties and interest.

Q: Who needs to use Form DR-431?

A: Anyone who has unreported property in Florida and wants to voluntarily disclose it should use Form DR-431.

Q: What information is required on Form DR-431?

A: Form DR-431 requires information about the property being disclosed, such as description, location, and value.

Q: Are there any penalties for not using Form DR-431?

A: If unreported property is discovered by the Florida Department of Revenue without voluntary disclosure, penalties and interest may apply.

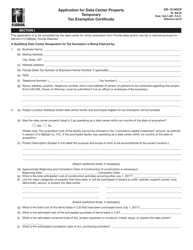

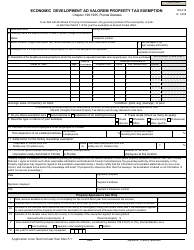

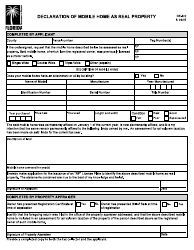

Q: Can Form DR-431 be used for all types of property?

A: Form DR-431 can be used to disclose all types of property, including real estate, tangible personal property, and intangible personal property.

Q: What should I do after submitting Form DR-431?

A: After submitting Form DR-431, you should keep a copy of the form for your records and follow any instructions provided by the Florida Department of Revenue.

Form Details:

- Released on November 1, 2012;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-431 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.