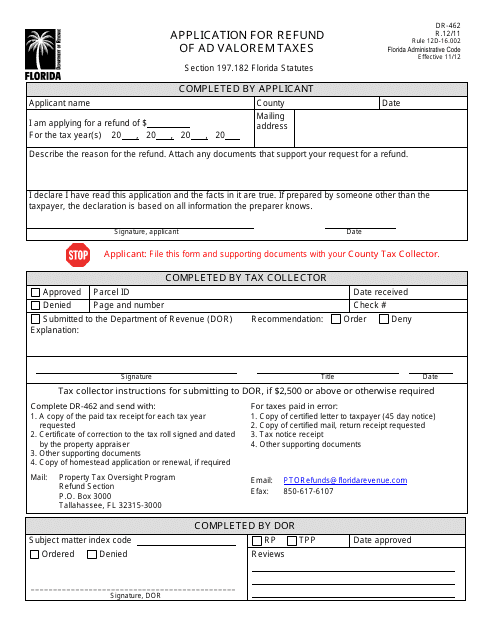

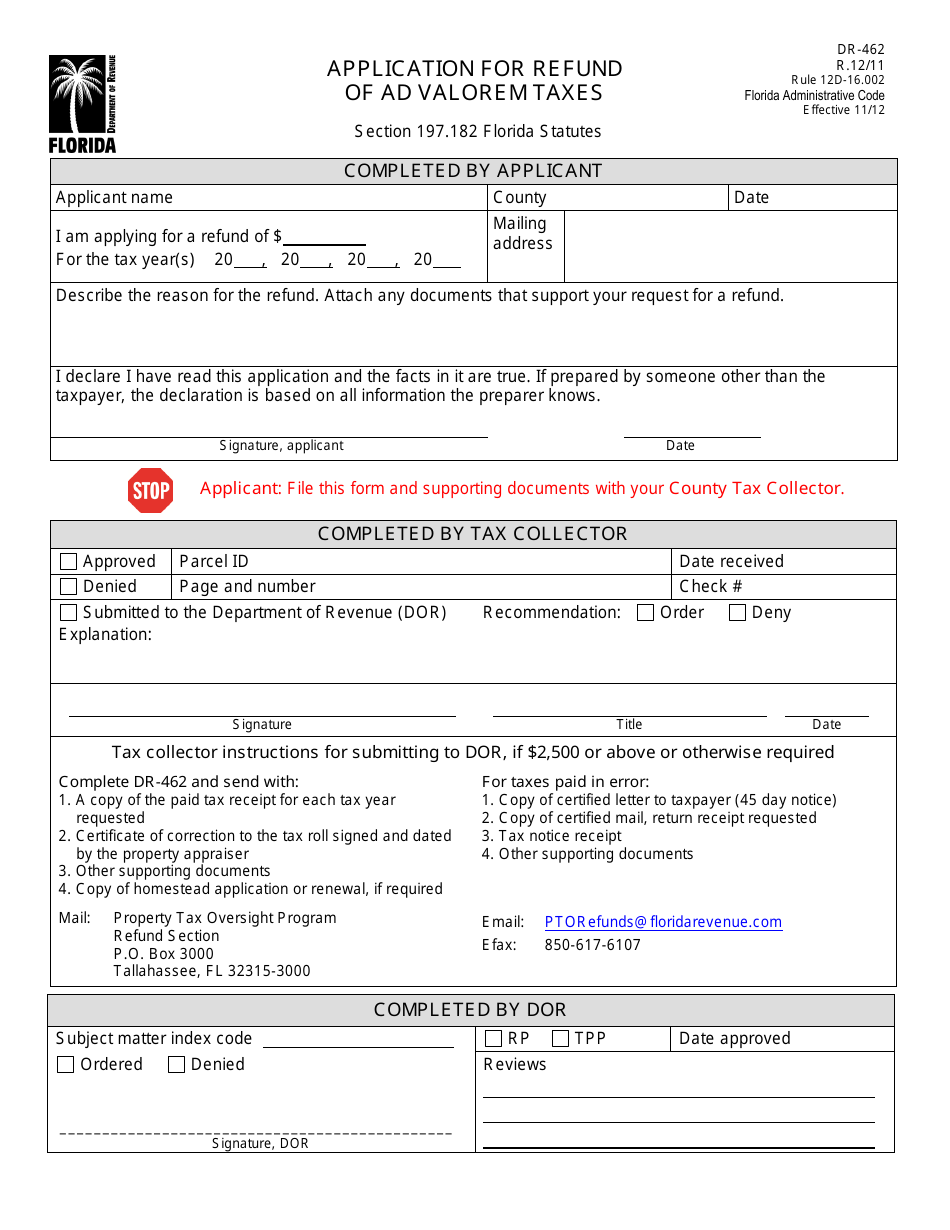

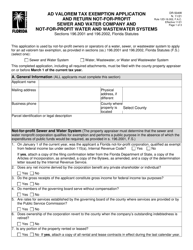

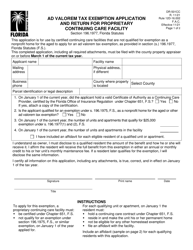

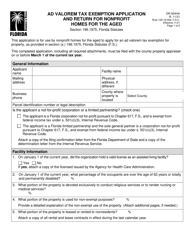

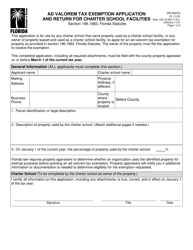

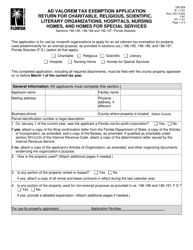

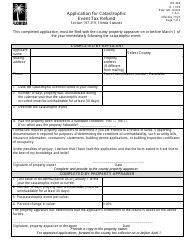

Form DR-462 Application for Refund of Ad Valorem Taxes - Florida

What Is Form DR-462?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-462?

A: Form DR-462 is the Application for Refund of Ad Valorem Taxes in Florida.

Q: What is the purpose of Form DR-462?

A: The purpose of Form DR-462 is to apply for a refund of ad valorem taxes in Florida.

Q: Who is eligible to use Form DR-462?

A: Any individual or business entity that believes they are eligible for a refund of ad valorem taxes in Florida may use Form DR-462.

Q: What information is required on Form DR-462?

A: Form DR-462 requires information such as the property description, the reason for the refund, and supporting documentation.

Q: How do I submit Form DR-462?

A: You can submit Form DR-462 by mail or in person to the Florida Department of Revenue.

Q: How long does it take to process Form DR-462?

A: The processing time for Form DR-462 varies, but it typically takes a few weeks to several months to receive a refund.

Q: Are there any fees associated with filing Form DR-462?

A: No, there are no fees associated with filing Form DR-462.

Q: What should I do if my Form DR-462 is denied?

A: If your Form DR-462 is denied, you can appeal the decision with the Florida Department of Revenue.

Form Details:

- Released on December 1, 2011;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-462 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.