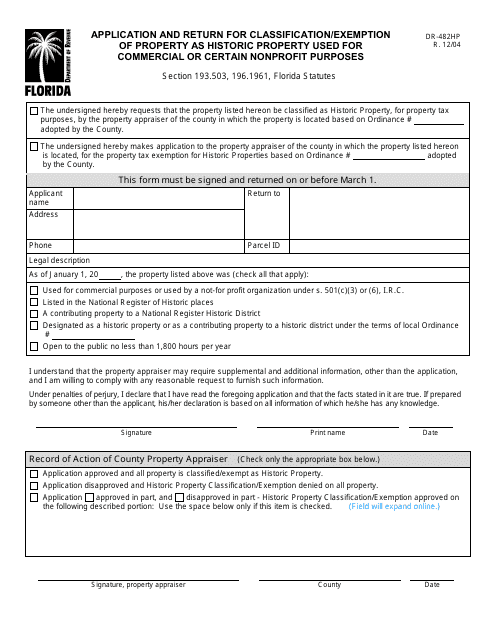

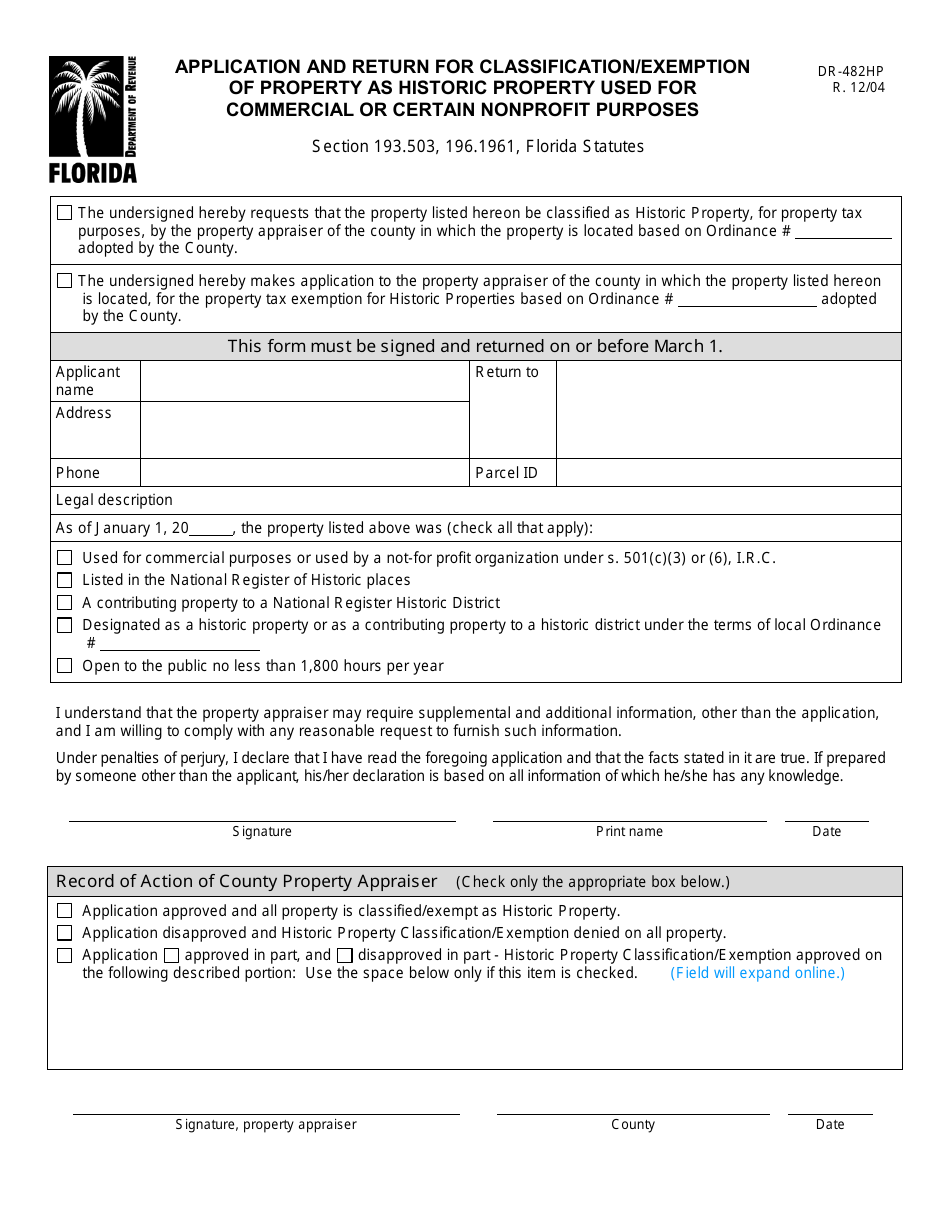

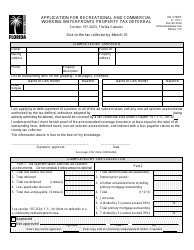

Form DR-482HP Application and Return for Classification / Exemption of Property as Historic Property Used for Commercial or Certain Nonprofit Purposes - Florida

What Is Form DR-482HP?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-482HP?

A: Form DR-482HP is an application and return for classification/exemption of property as historic property used for commercial or certain nonprofit purposes in Florida.

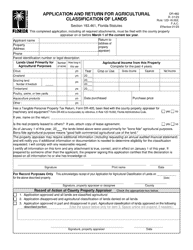

Q: What is the purpose of Form DR-482HP?

A: The purpose of Form DR-482HP is to apply for a classification or exemption for property that is considered historic and is used for commercial or certain nonprofit purposes.

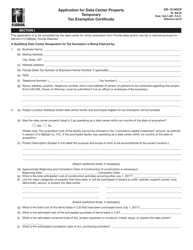

Q: Who should use Form DR-482HP?

A: Property owners in Florida who have a historic property and use it for commercial or certain nonprofit purposes should use Form DR-482HP to apply for classification or exemption.

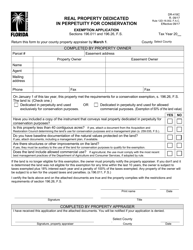

Q: What is the benefit of classifying a property as historic?

A: Classifying a property as historic can provide certain tax exemptions or special assessment levels that can help reduce property taxes.

Q: Are there any filing fees for Form DR-482HP?

A: Yes, there may be filing fees associated with submitting Form DR-482HP. The specific fees can vary by county, so it is recommended to check with the local county property appraiser's office for the exact fee amount.

Q: What documents are required to be submitted with Form DR-482HP?

A: The specific documents required can vary by county, but typically, the application must include proof of ownership, a detailed property description, and any supporting documentation related to its historic significance.

Q: When should Form DR-482HP be filed?

A: Form DR-482HP should be filed with the county property appraiser's office on or before March 1st of the assessment year for which the classification or exemption is sought.

Q: Can a property be denied classification or exemption under Form DR-482HP?

A: Yes, the property appraiser may deny the classification or exemption if the property does not meet the eligibility requirements or if the application is incomplete or submitted after the deadline.

Q: Is the classification or exemption under Form DR-482HP permanent?

A: No, the classification or exemption must be renewed annually by filing a new application each year.

Q: Can I appeal a denial of classification or exemption?

A: Yes, property owners have the right to appeal the denial of classification or exemption by following the procedures outlined by the county property appraiser's office.

Form Details:

- Released on December 1, 2004;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-482HP by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.