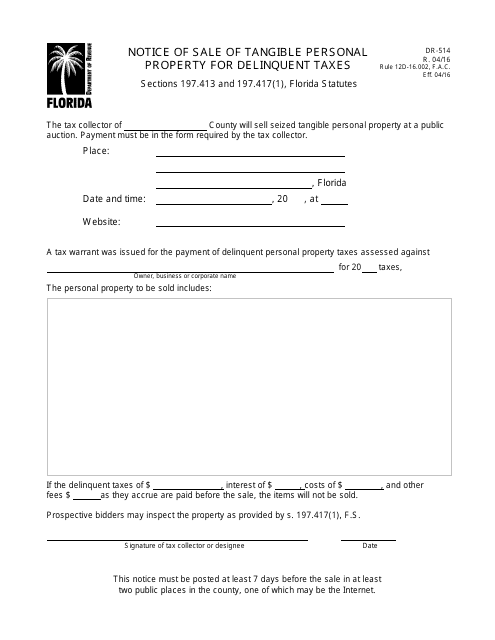

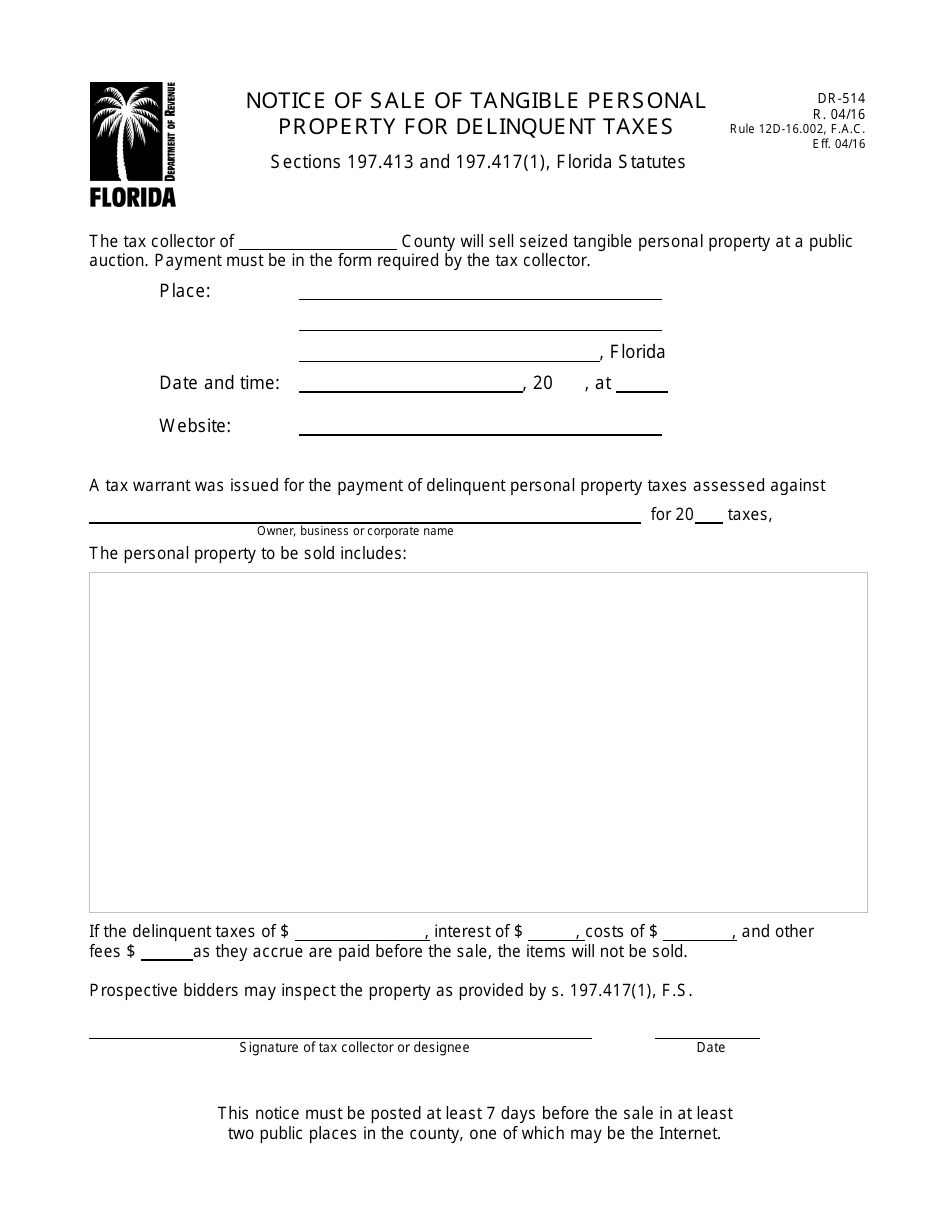

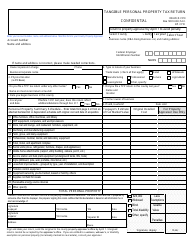

Form DR-514 Notice of Sale of Tangible Personal Property for Delinquent Taxes - Florida

What Is Form DR-514?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-514?

A: Form DR-514 is the Notice of Sale of Tangible Personal Property for Delinquent Taxes in Florida.

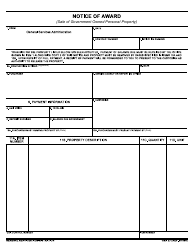

Q: Who is required to use Form DR-514?

A: This form is used by the tax collector or other authorized government agency when conducting a sale of tangible personal property for unpaid taxes.

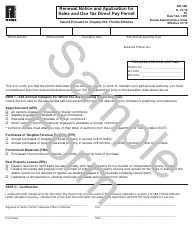

Q: What is the purpose of Form DR-514?

A: The purpose of Form DR-514 is to provide notice to the property owner and the public about the upcoming sale of their tangible personal property for unpaid taxes.

Q: When should Form DR-514 be filed?

A: Form DR-514 should be filed at least 30 days before the date of the sale.

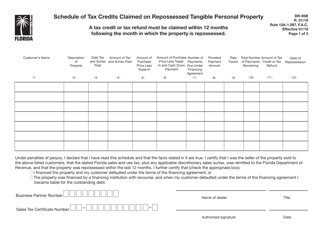

Q: What information is required on Form DR-514?

A: Form DR-514 requires information such as property owner's name, property description, amount of taxes owed, date and location of the sale, and contact information for the tax collector.

Q: Are there any penalties for failing to file Form DR-514?

A: Yes, failure to file Form DR-514 may result in the cancellation of the sale or other legal consequences.

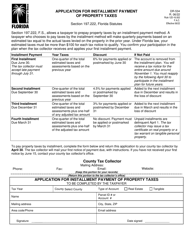

Q: Can I submit Form DR-514 electronically?

A: It depends on the tax collector or government agency's procedures. Some may allow electronic submission, while others may require a paper form to be filed.

Q: Is there a fee for filing Form DR-514?

A: There may be a fee associated with filing Form DR-514. Details about any required fees can be obtained from the tax collector or government agency.

Q: Can a property owner dispute the sale after Form DR-514 is filed?

A: Yes, a property owner has the right to dispute the sale by filing a petition with the appropriate court within a specified timeframe.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-514 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.