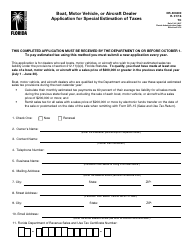

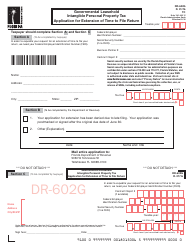

This version of the form is not currently in use and is provided for reference only. Download this version of

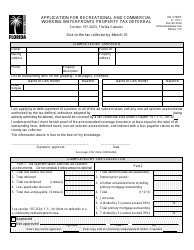

Form DR-534

for the current year.

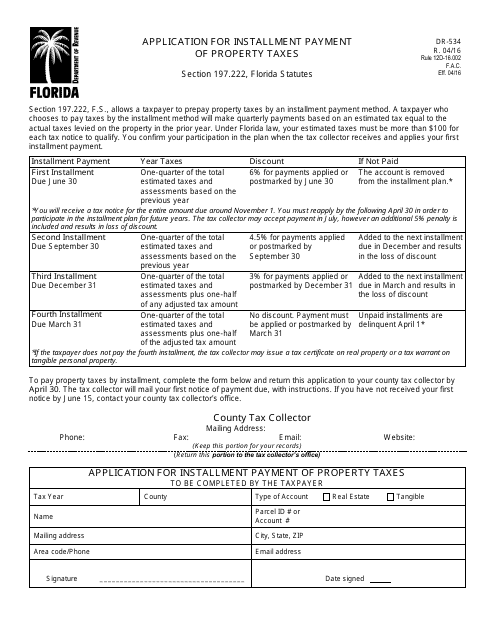

Form DR-534 Application for Installment Payment of Property Taxes - Florida

What Is Form DR-534?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-534?

A: Form DR-534 is an application for installment payment of property taxes in Florida.

Q: Who can file Form DR-534?

A: Any property owner in Florida who wants to pay their property taxes in installments can file Form DR-534.

Q: What is the purpose of Form DR-534?

A: The purpose of Form DR-534 is to allow property owners in Florida to spread out their property tax payments over multiple installments.

Q: How many installments can be requested using Form DR-534?

A: Property owners can request up to four installments using Form DR-534.

Q: What is the deadline for filing Form DR-534?

A: Form DR-534 must be filed by April 30th of each tax year.

Q: Is there a fee for requesting installment payments using Form DR-534?

A: Yes, there is a $10 fee for each installment option requested on Form DR-534.

Q: Can property owners still file Form DR-534 after the April 30th deadline?

A: No, Form DR-534 must be filed by the April 30th deadline to be eligible for installment payments.

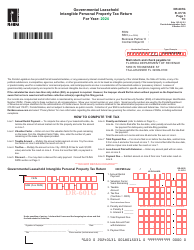

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-534 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.