This version of the form is not currently in use and is provided for reference only. Download this version of

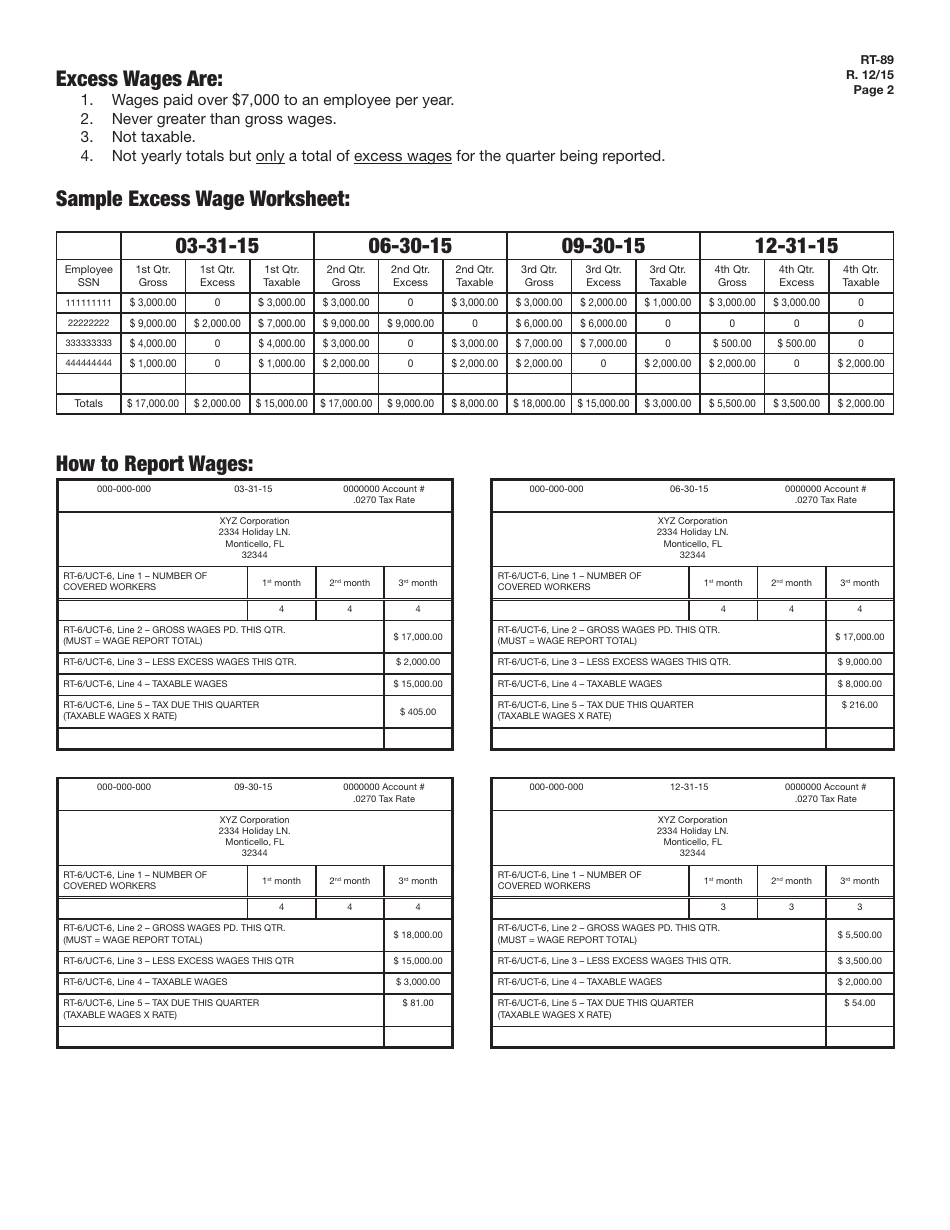

Form RT-89

for the current year.

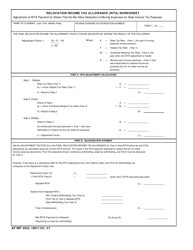

Form RT-89 Reemployment Tax Excess Audit Worksheet - Florida

What Is Form RT-89?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RT-89?

A: Form RT-89 is the Reemployment Tax Excess Audit Worksheet in Florida.

Q: What is Reemployment Tax?

A: Reemployment Tax is a tax imposed on employers in Florida to fund unemployment compensation benefits for former employees.

Q: Who is required to file Form RT-89?

A: Employers in Florida who have been notified by the Department of Revenue to complete this form are required to file Form RT-89.

Q: What is the purpose of Form RT-89?

A: The purpose of Form RT-89 is to calculate and report any excess reemployment tax paid by the employer during the audit period.

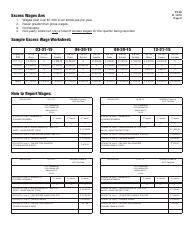

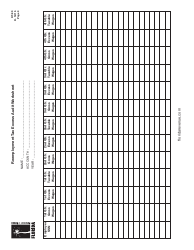

Q: How do I complete Form RT-89?

A: You need to fill in the information, including the employer's identification number, tax rate, taxable wages, total taxes paid, and any other required details for the audit period.

Q: When is the deadline to file Form RT-89?

A: The deadline to file Form RT-89 is typically stated in the notification received from the Department of Revenue.

Q: What happens if I don't file Form RT-89?

A: Failure to file Form RT-89 as required may result in penalties and fines imposed by the Department of Revenue.

Q: Are there any instructions provided with Form RT-89?

A: Yes, Form RT-89 includes detailed instructions on how to complete the worksheet. Make sure to read and follow them carefully.

Form Details:

- Released on December 1, 2015;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RT-89 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.