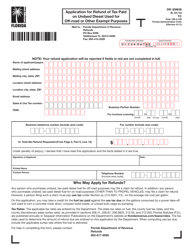

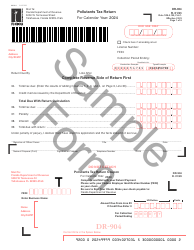

This version of the form is not currently in use and is provided for reference only. Download this version of

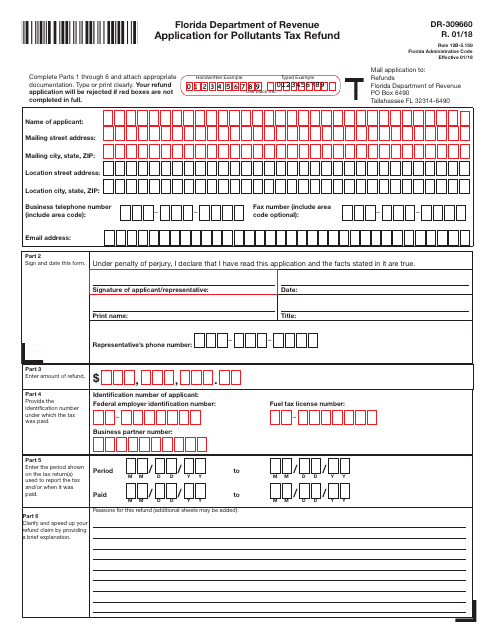

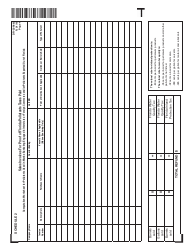

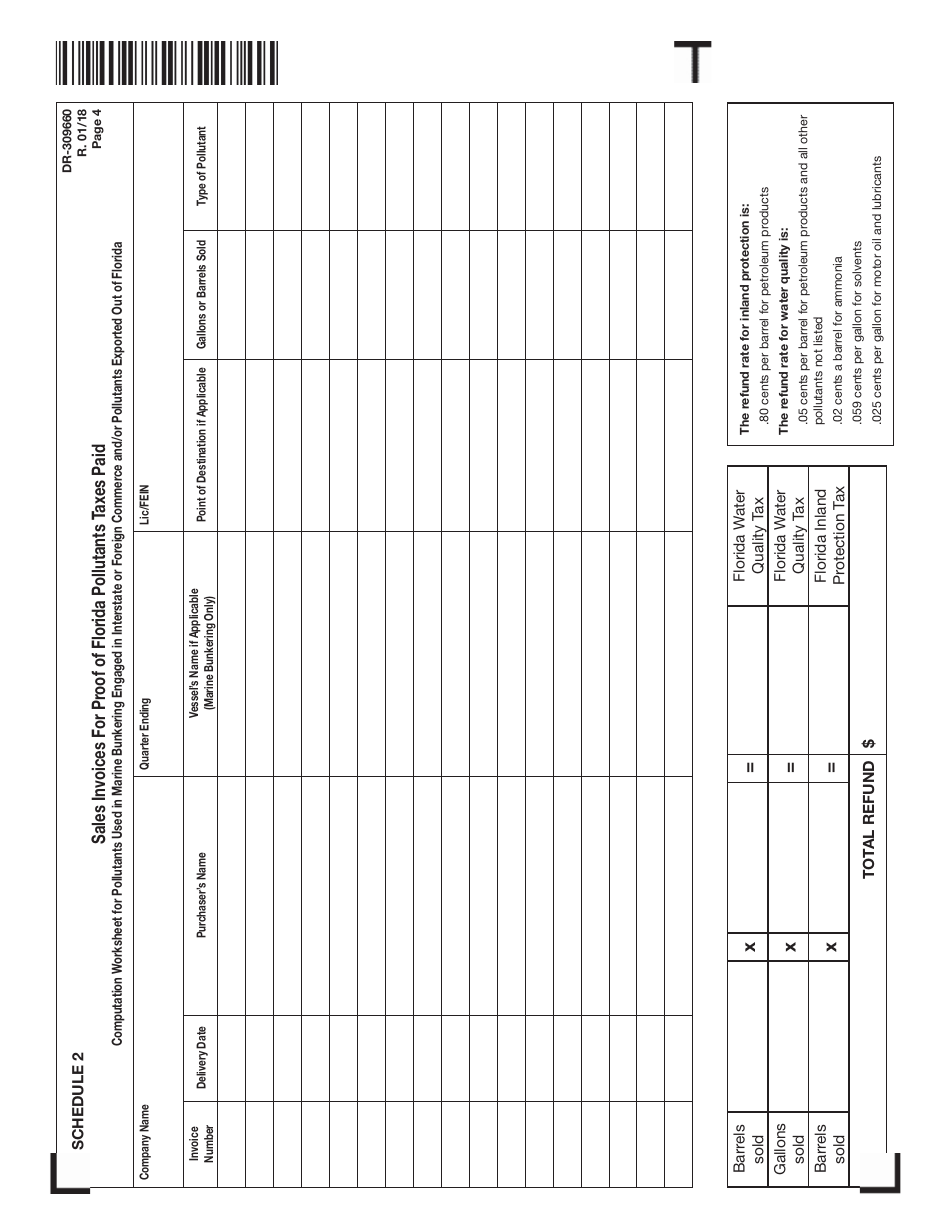

Form DR-309660

for the current year.

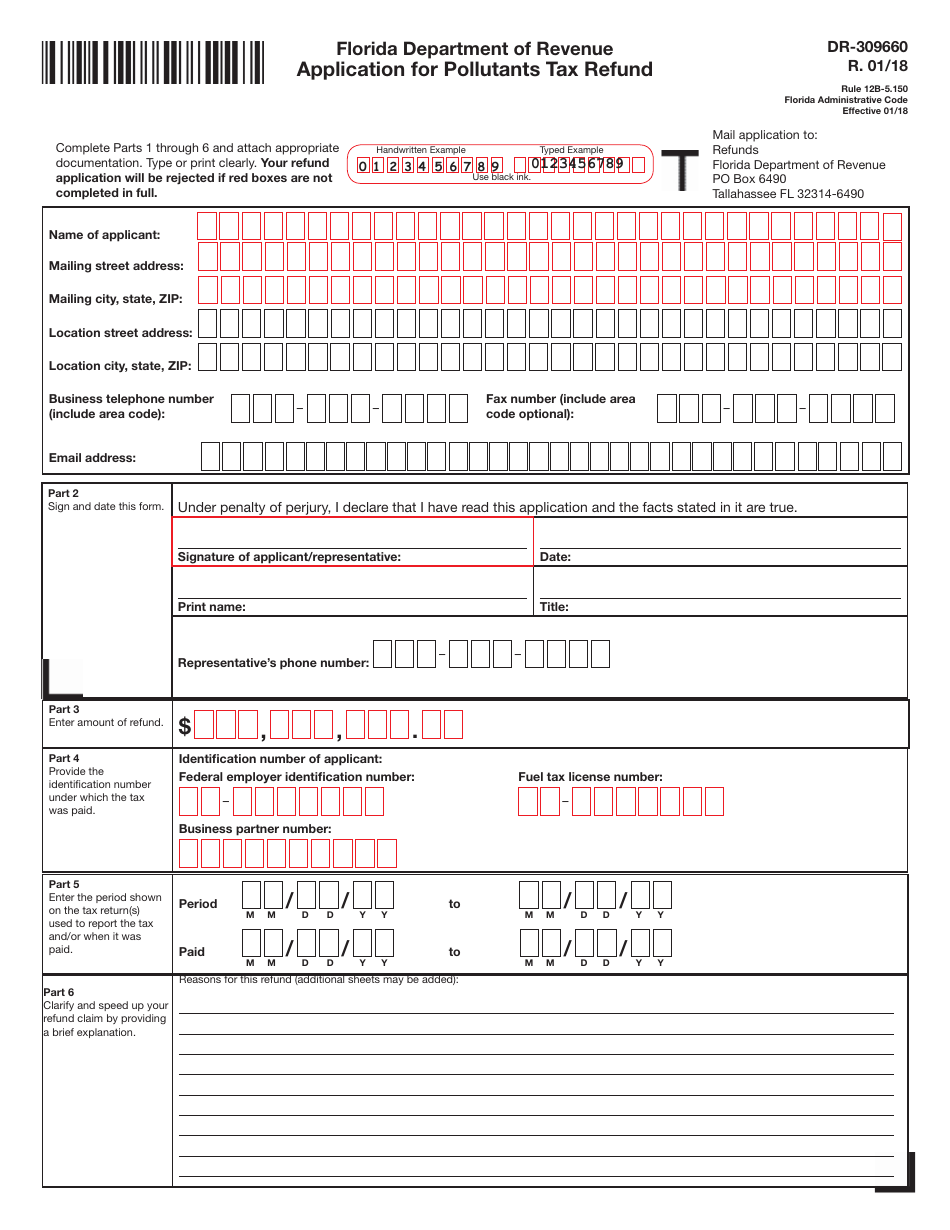

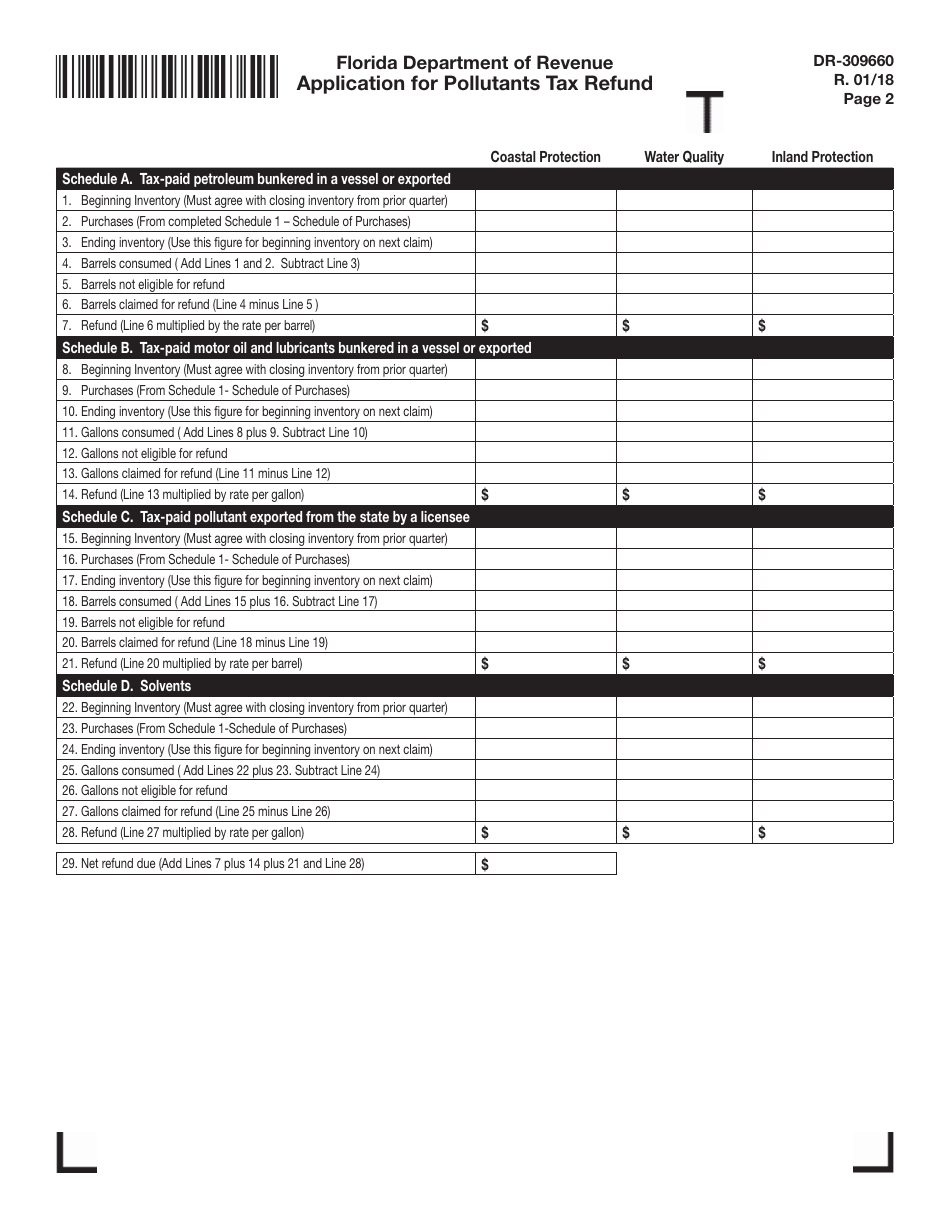

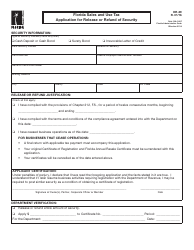

Form DR-309660 Application for Pollutants Tax Refund - Florida

What Is Form DR-309660?

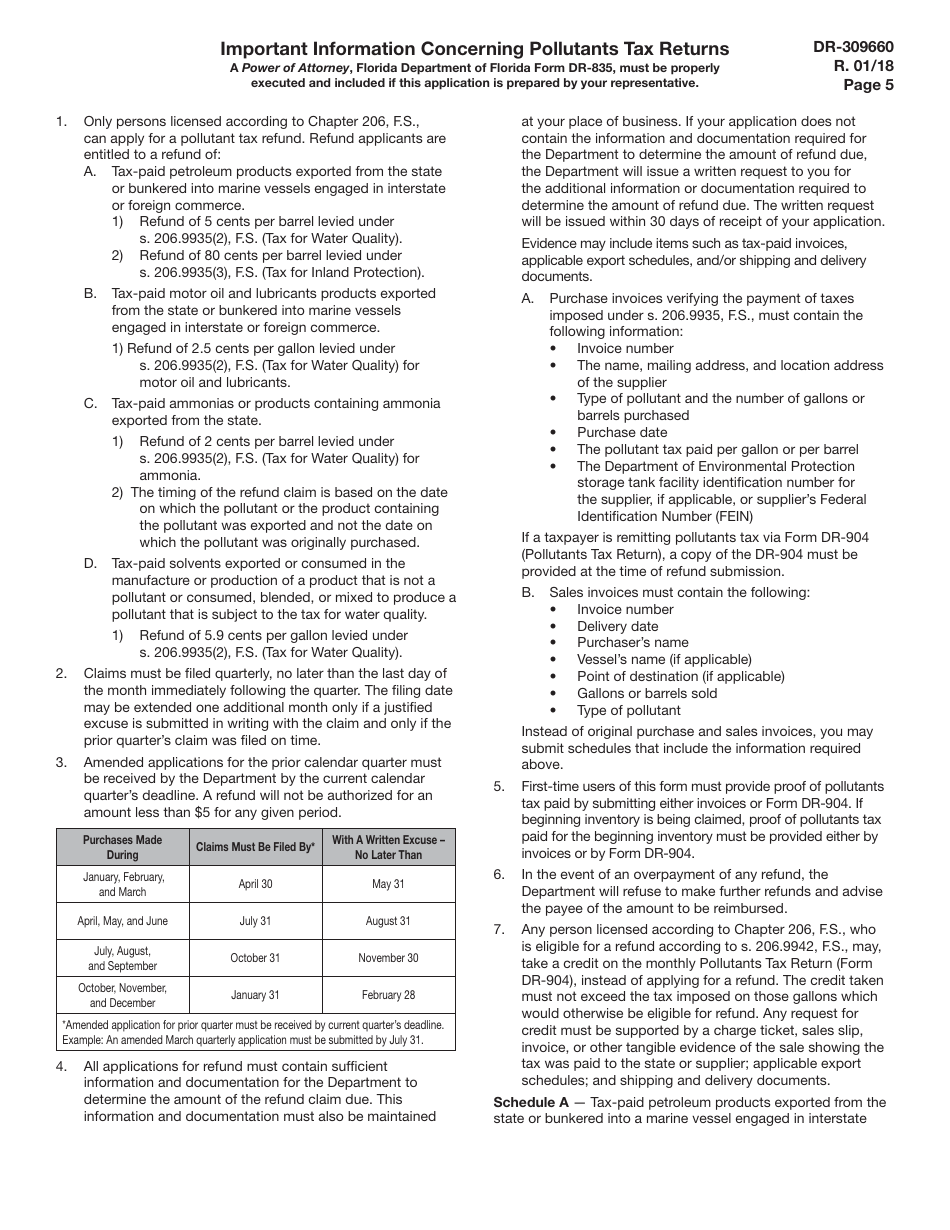

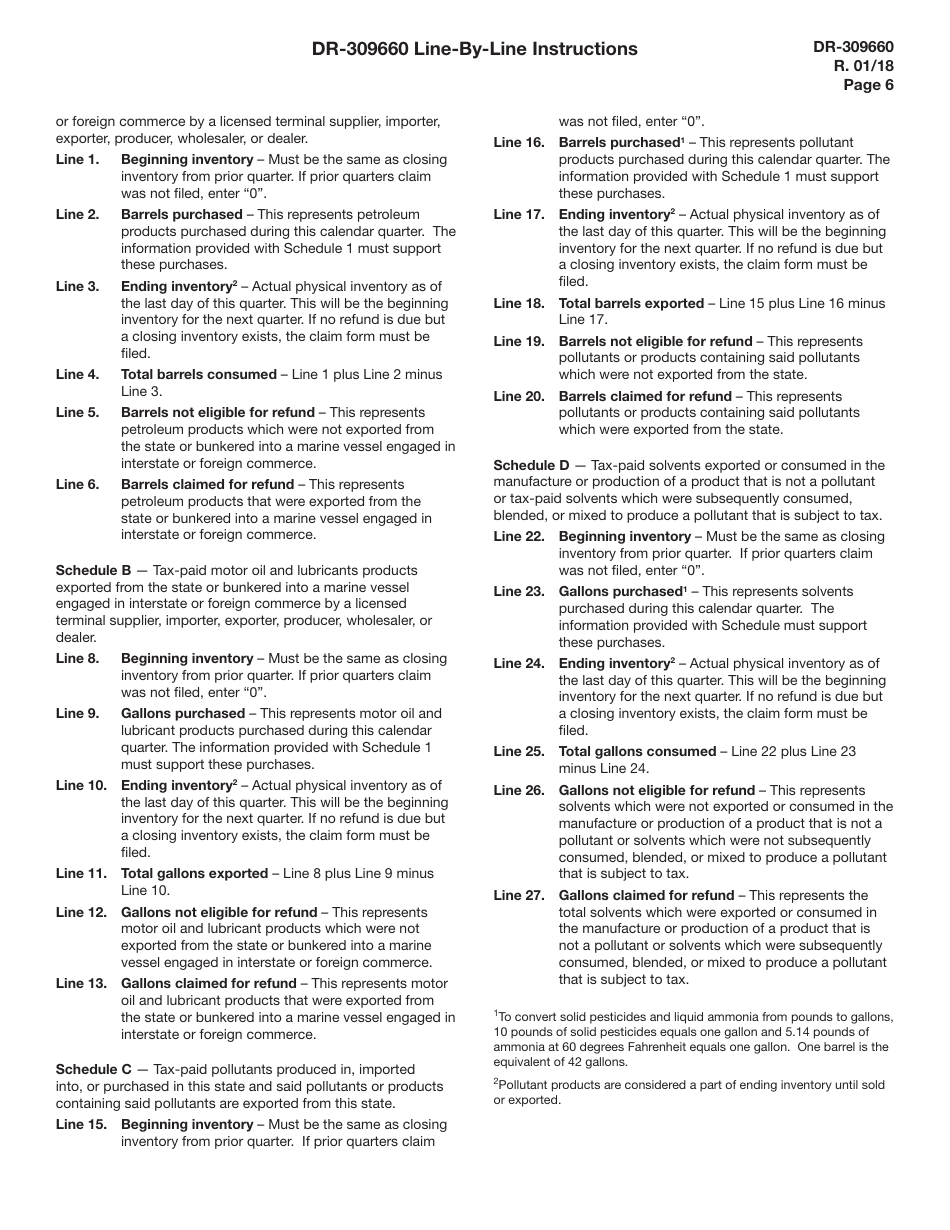

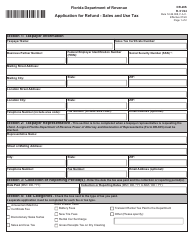

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

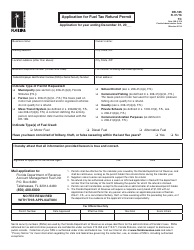

Q: What is Form DR-309660?

A: Form DR-309660 is an application for Pollutants Tax Refund in the state of Florida.

Q: Who needs to fill out Form DR-309660?

A: Anyone in Florida who wants to apply for a refund of pollutants tax needs to fill out this form.

Q: What is the purpose of the Pollutants Tax Refund?

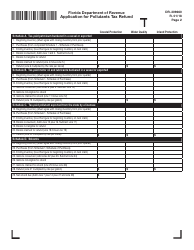

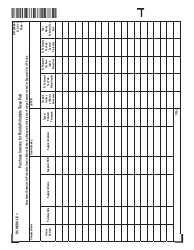

A: The purpose of the Pollutants Tax Refund is to provide a refund for taxes paid on fuels used for non-highway purposes, such as farming or industrial use.

Q: What are the eligibility criteria for the Pollutants Tax Refund?

A: Eligibility criteria for the Pollutants Tax Refund include being a registered Florida taxpayer, using fuel for non-highway purposes, and meeting other specific requirements.

Q: Is there a deadline for submitting Form DR-309660?

A: Yes, the deadline for submitting Form DR-309660 is within 12 months from the last day of the calendar month in which the fuel was purchased.

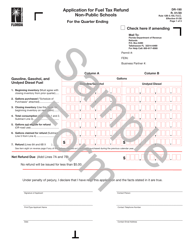

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-309660 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.