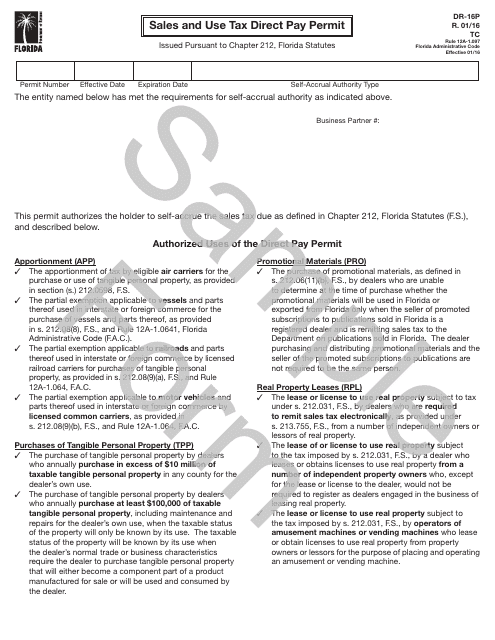

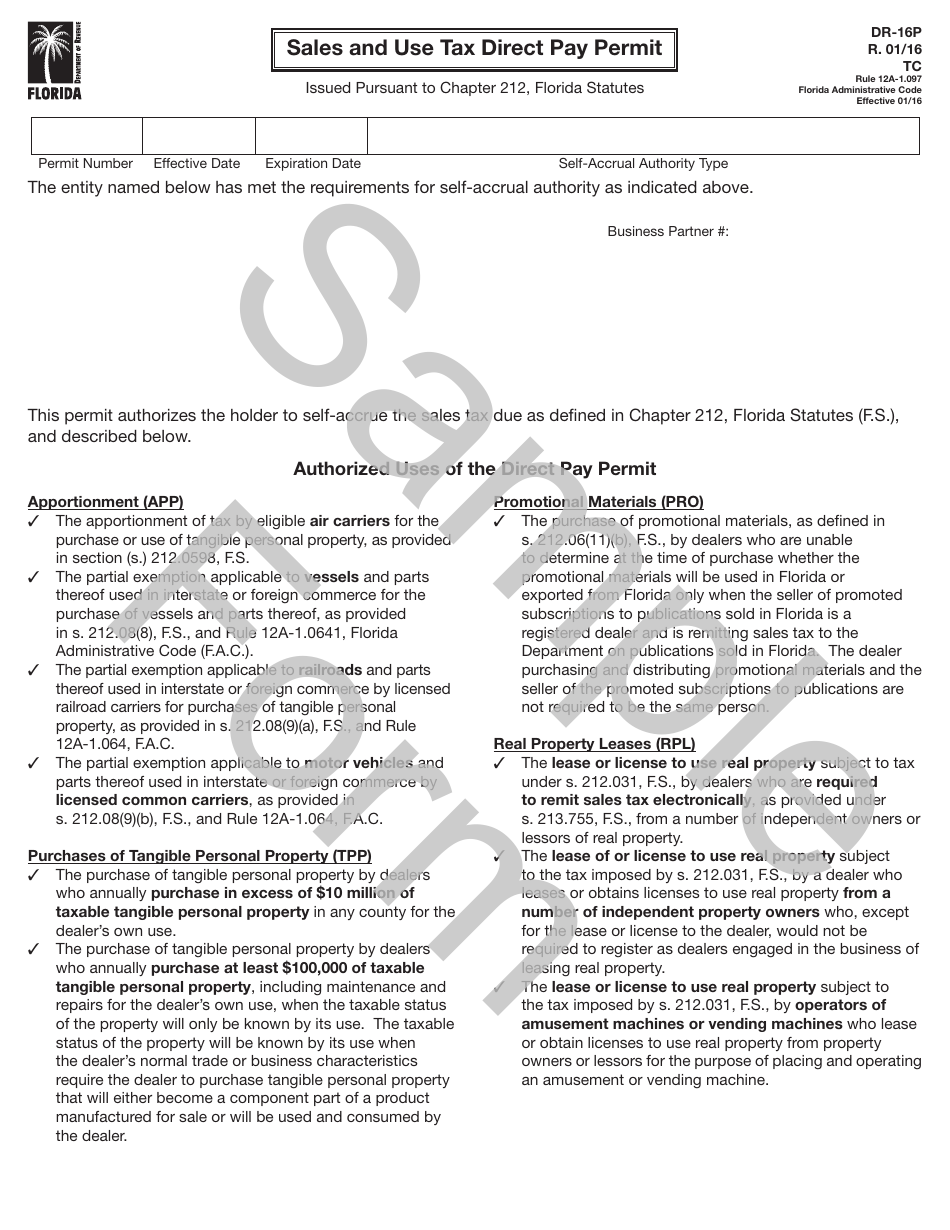

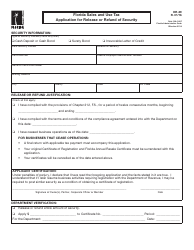

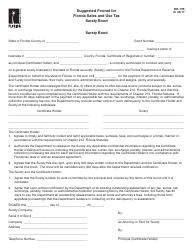

Sample Form DR-16P Sales and Use Tax Direct Pay Permit - Florida

What Is Form DR-16P?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-16P?

A: Form DR-16P is the Sales and Use TaxDirect Pay Permit form for the state of Florida.

Q: What is a Direct Pay Permit?

A: A Direct Pay Permit allows certain businesses to pay sales and use tax directly to the state, rather than paying it to the vendor at the time of purchase.

Q: Who is eligible for a Direct Pay Permit?

A: Businesses that meet certain criteria, such as having a minimum sales tax liability and demonstrating compliance with tax laws, may be eligible for a Direct Pay Permit.

Q: How do I apply for a Direct Pay Permit?

A: To apply for a Direct Pay Permit, you need to complete and submit Form DR-16P to the Florida Department of Revenue.

Q: Is there a fee for obtaining a Direct Pay Permit?

A: No, there is no fee for obtaining a Direct Pay Permit in Florida.

Q: What are the benefits of having a Direct Pay Permit?

A: Having a Direct Pay Permit allows businesses to have more control over their sales and use tax obligations, streamline their tax reporting and payment process, and potentially save money.

Q: How long does it take to get a Direct Pay Permit?

A: The processing time for a Direct Pay Permit application can vary, but it generally takes several weeks to be approved.

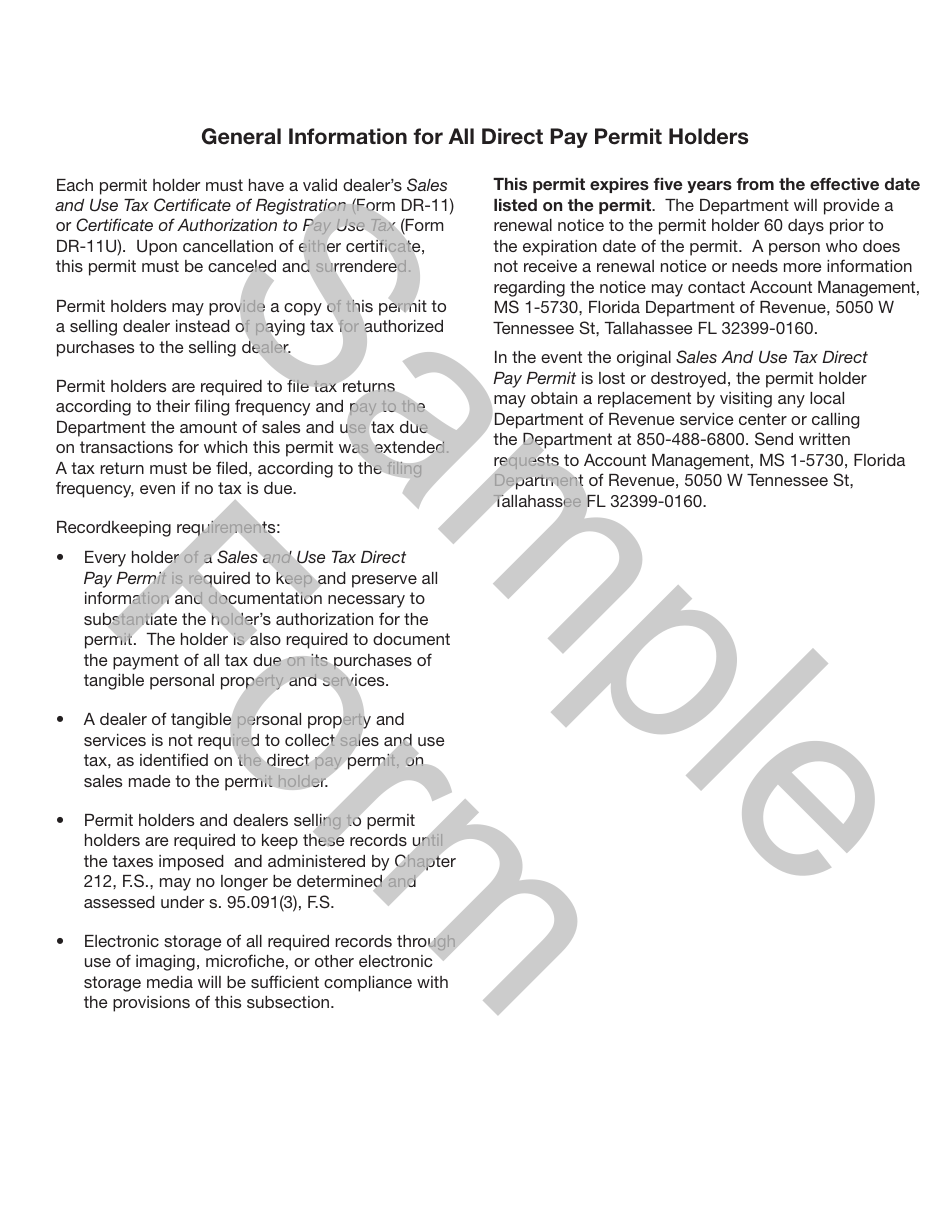

Q: Do I need to renew my Direct Pay Permit?

A: Yes, Direct Pay Permits in Florida need to be renewed every two years.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-16P by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.