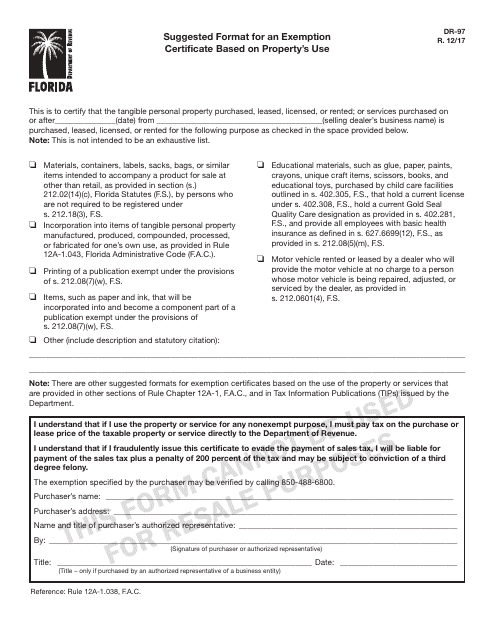

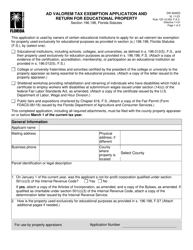

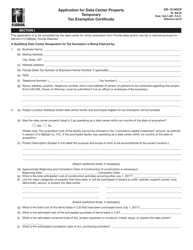

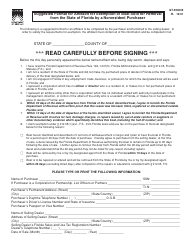

Form DR-97 Suggested Format for an Exemption Certificate Based on Property's Use - Florida

What Is Form DR-97?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-97?

A: Form DR-97 is a suggested format for an exemption certificate based on a property's use in Florida.

Q: What is the purpose of Form DR-97?

A: The purpose of Form DR-97 is to provide a standardized format for exemption certificates based on a property's use.

Q: Who should use Form DR-97?

A: Form DR-97 should be used by individuals or businesses in Florida who are claiming an exemption from certain taxes based on the property's use.

Q: What information is required on Form DR-97?

A: Form DR-97 requires information such as the property owner's name, address, and tax identification number, as well as a description of the property and the specific exemption being claimed.

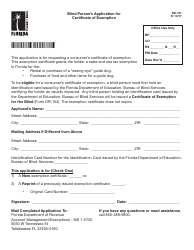

Q: Are there any specific instructions for completing Form DR-97?

A: Yes, the Florida Department of Revenue provides detailed instructions on how to complete Form DR-97, which should be carefully followed to ensure accurate and valid exemption claims.

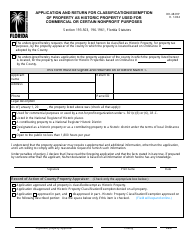

Q: Can Form DR-97 be used for all types of exemptions?

A: No, Form DR-97 is specifically designed for exemptions based on a property's use. Other types of exemptions may require different forms or documentation.

Q: Is Form DR-97 mandatory for claiming exemptions in Florida?

A: While Form DR-97 provides a suggested format for exemption certificates, it is not mandatory. However, using the suggested format can help ensure that the exemption claim is properly documented and understood by tax authorities.

Q: Are there any fees associated with filing Form DR-97?

A: No, there are no fees associated with filing Form DR-97. However, certain taxes or fees may still apply depending on the specific exemption being claimed.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-97 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.