This version of the form is not currently in use and is provided for reference only. Download this version of

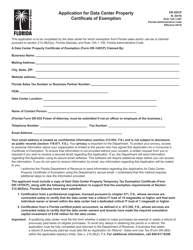

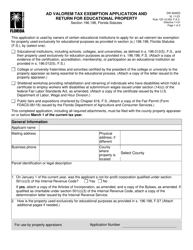

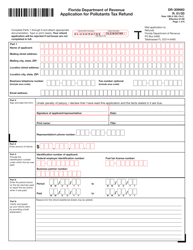

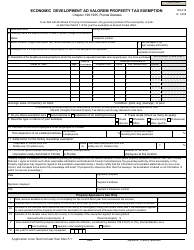

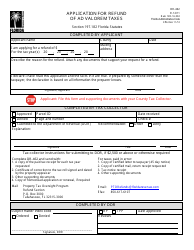

Form DR-1214DCP

for the current year.

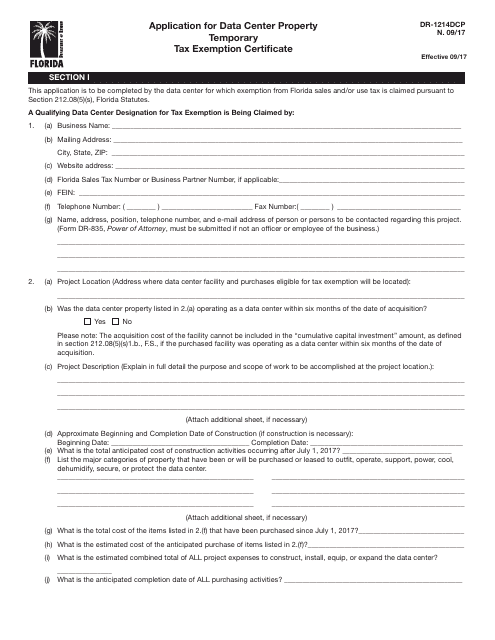

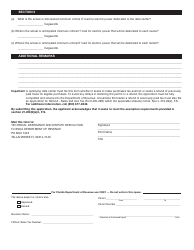

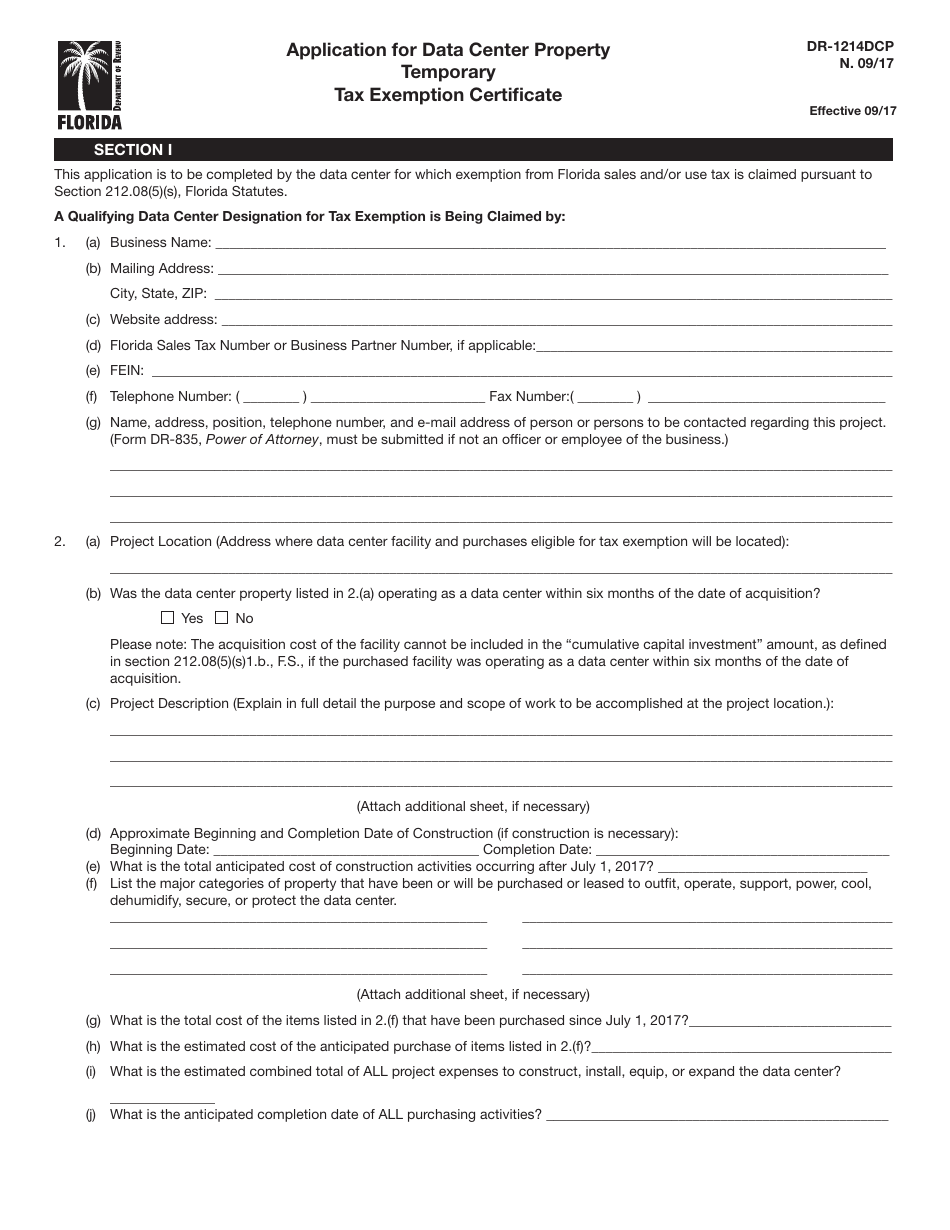

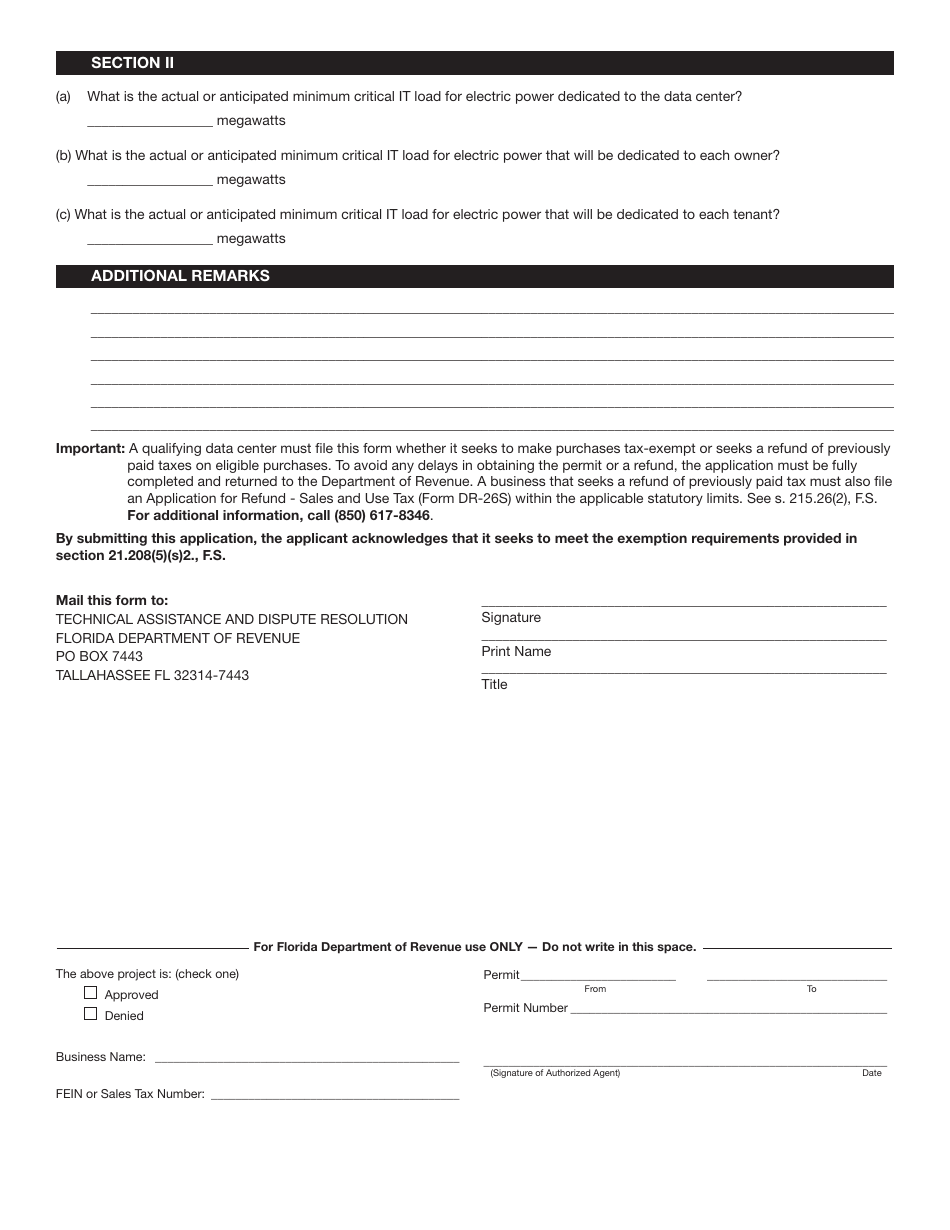

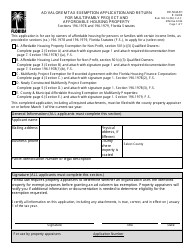

Form DR-1214DCP Application for Data Center Property Temporary Tax Exemption Certificate - Florida

What Is Form DR-1214DCP?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-1214DCP?

A: Form DR-1214DCP is the Application for Data Center Property Temporary Tax Exemption Certificate in Florida.

Q: What is the purpose of Form DR-1214DCP?

A: The purpose of Form DR-1214DCP is to apply for a temporary tax exemption for data center properties in Florida.

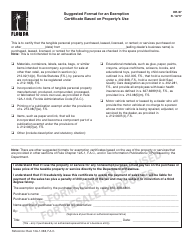

Q: Who needs to fill out Form DR-1214DCP?

A: Anyone who owns or operates a data center property in Florida and wants to apply for a temporary tax exemption needs to fill out Form DR-1214DCP.

Q: When should I fill out Form DR-1214DCP?

A: You should fill out Form DR-1214DCP before the start of the calendar year for which you are seeking the temporary tax exemption.

Q: Is there a fee for submitting Form DR-1214DCP?

A: No, there is no fee for submitting Form DR-1214DCP.

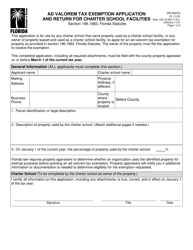

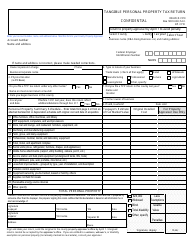

Q: What supporting documents do I need to submit with Form DR-1214DCP?

A: You will need to submit a copy of the property lease or ownership documentation, a description of the data center facilities, and any other relevant documentation requested on the form.

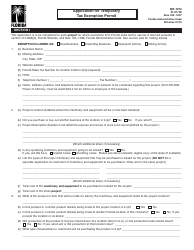

Q: How long does the temporary tax exemption last?

A: The temporary tax exemption for data center properties in Florida lasts for up to 20 years.

Q: Can I renew the temporary tax exemption?

A: No, the temporary tax exemption cannot be renewed. After 20 years, the property will be subject to regular taxation.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-1214DCP by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.