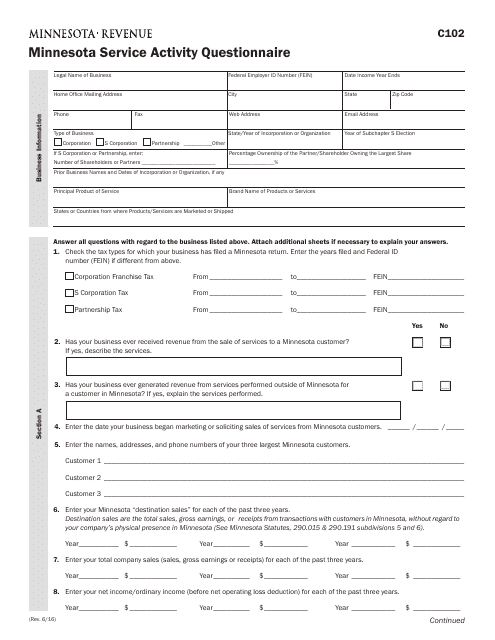

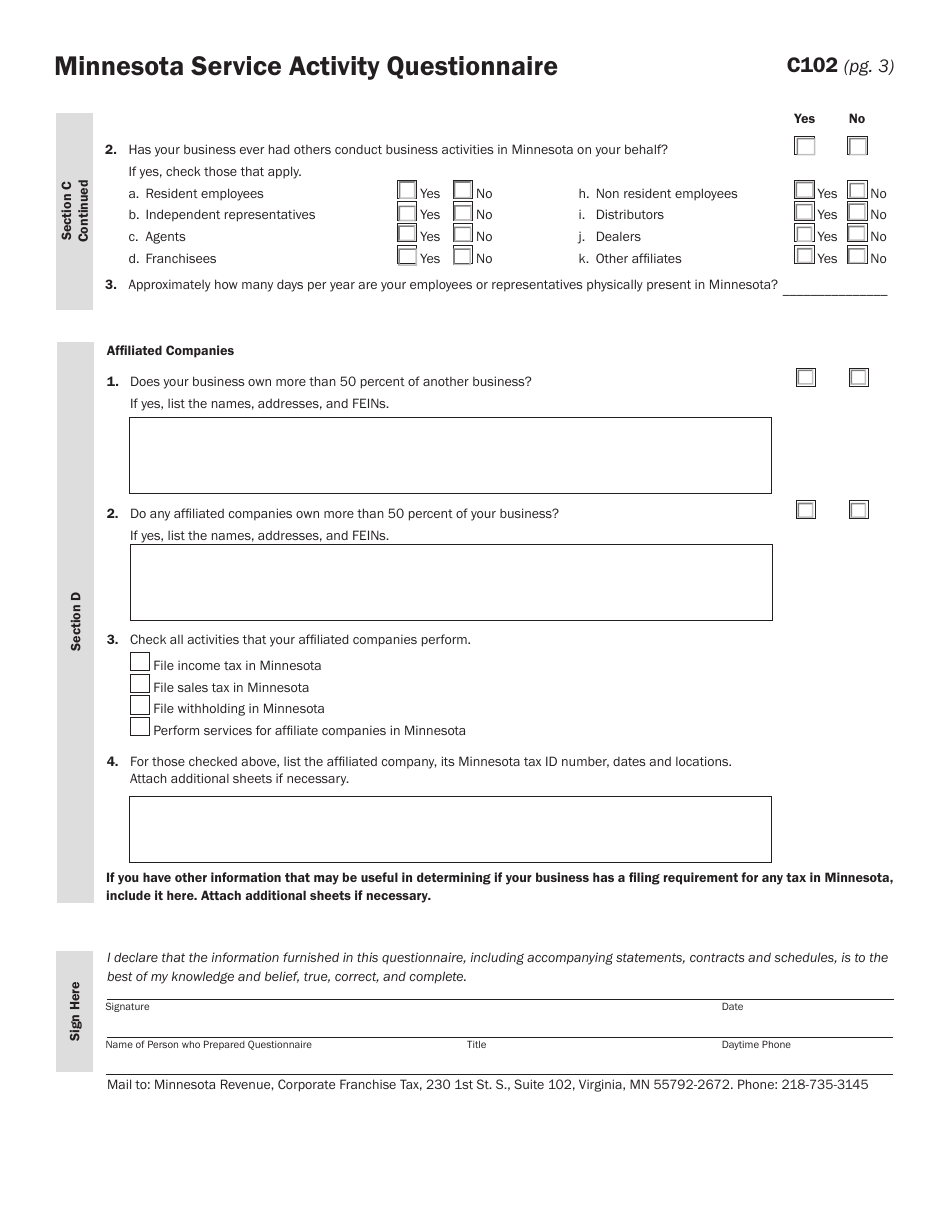

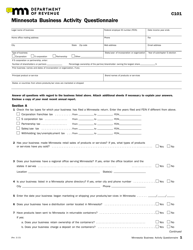

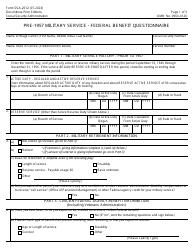

Form C102 Minnesota Service Activity Questionnaire - Minnesota

What Is Form C102?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C102?

A: Form C102 is the Minnesota Service Activity Questionnaire.

Q: Who needs to complete Form C102?

A: Individuals or organizations engaged in service activities in Minnesota may need to complete Form C102.

Q: What is the purpose of Form C102?

A: Form C102 is used to gather information about service activities performed in Minnesota.

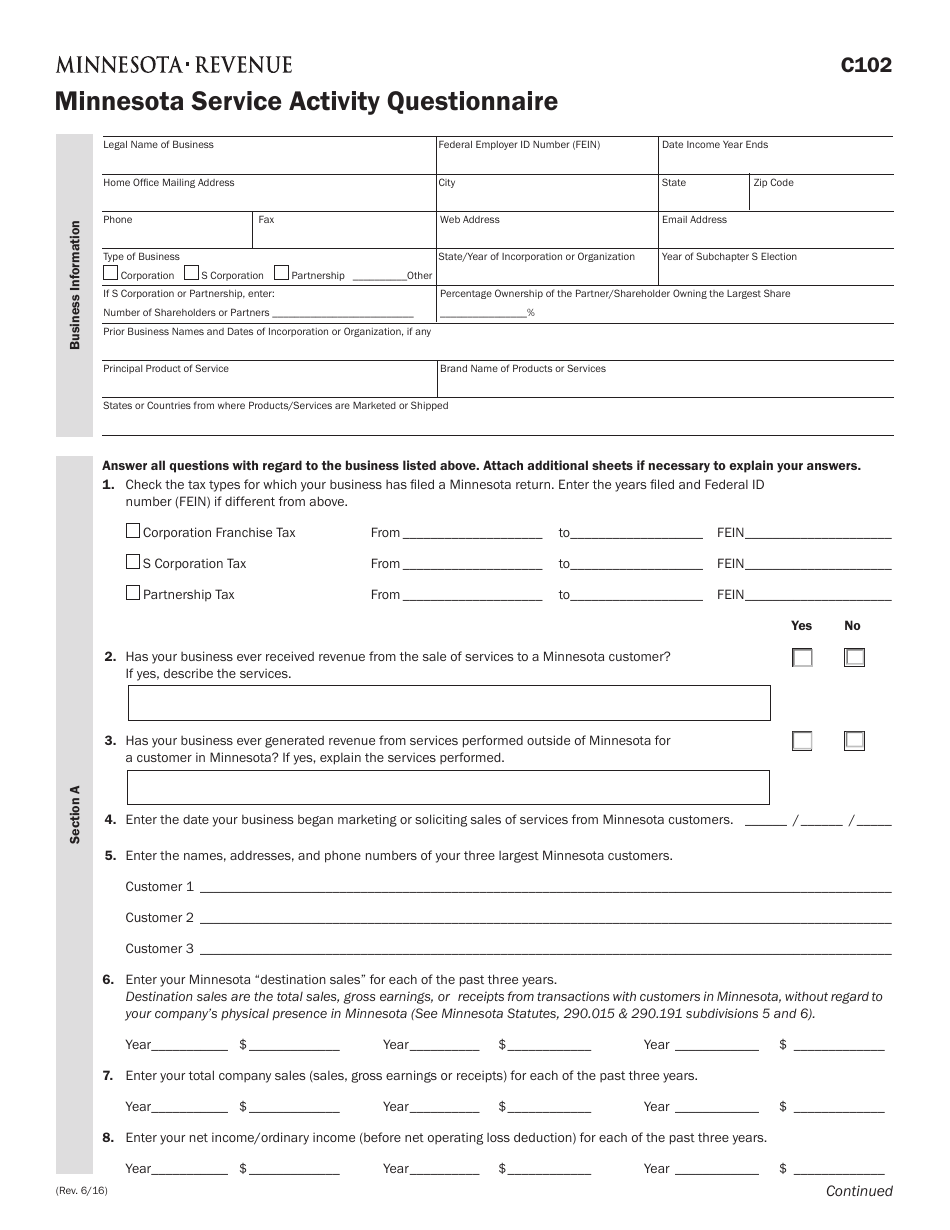

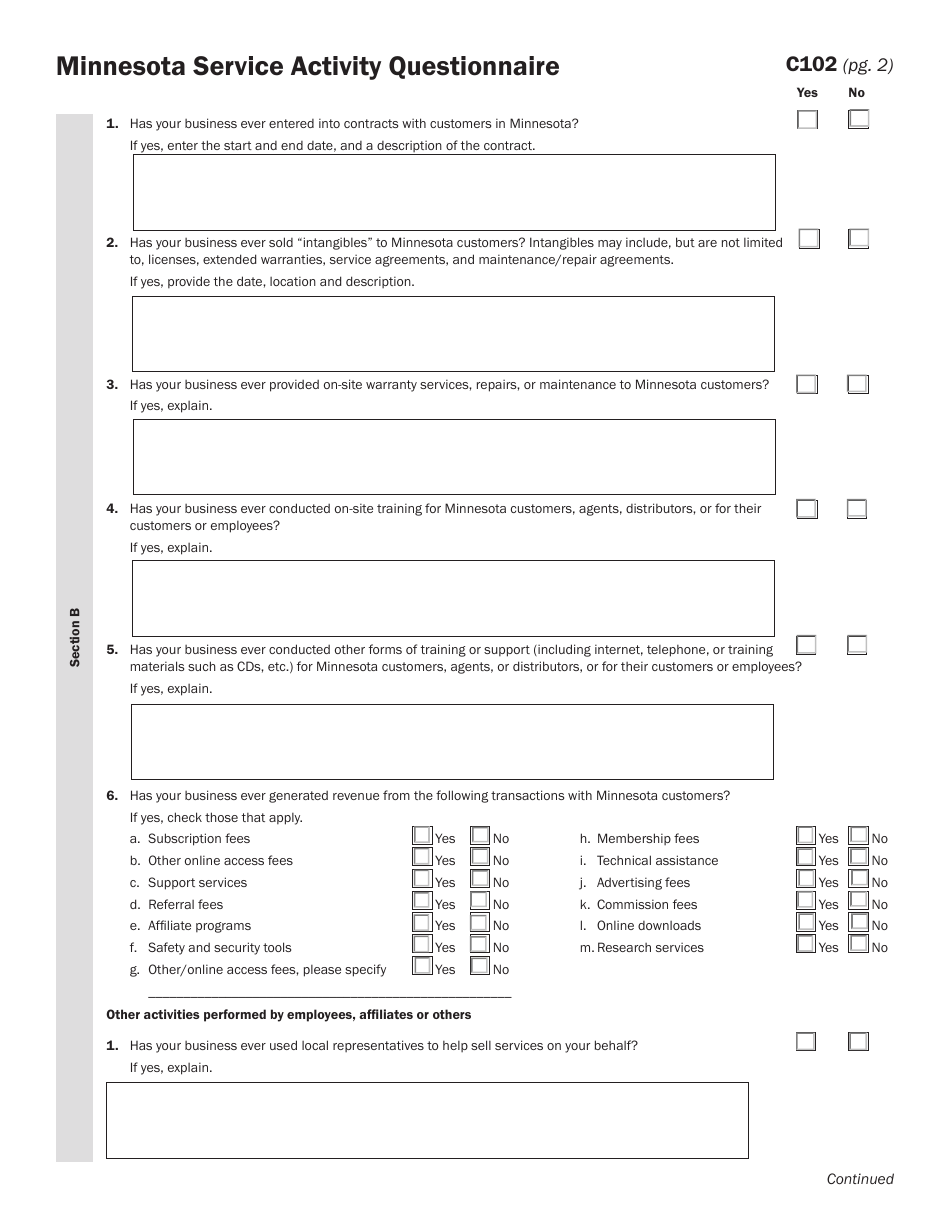

Q: What information is required on Form C102?

A: Form C102 requires information about the nature of the service activities, the location where they are performed, and the number of hours spent on each activity.

Q: When is Form C102 due?

A: Form C102 is due on or before the 15th day of the fourth month following the end of the tax year.

Q: Are there any penalties for late filing of Form C102?

A: Yes, there may be penalties for late or non-filing of Form C102. It is important to submit the form on time to avoid penalties.

Form Details:

- Released on June 1, 2016;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C102 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.