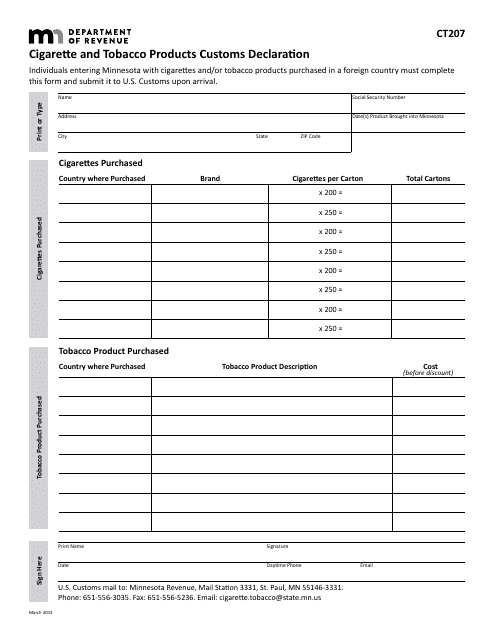

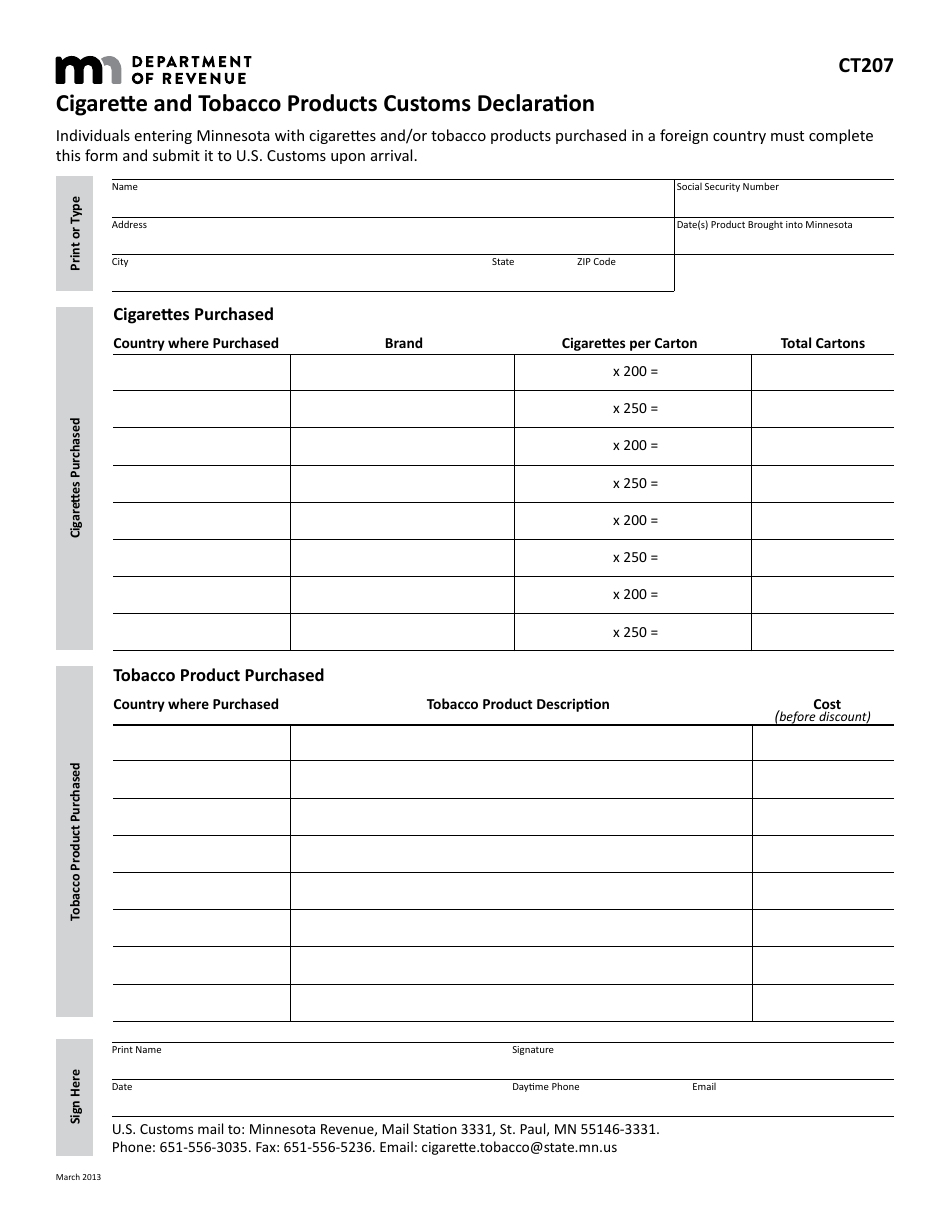

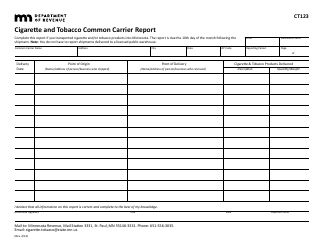

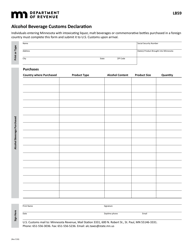

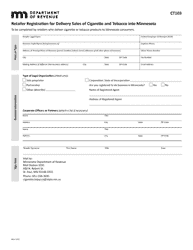

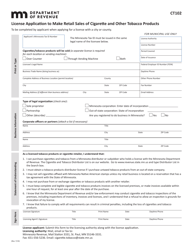

Form CT207 Cigarette and Tobacco Products Customs Declaration - Minnesota

What Is Form CT207?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT207?

A: Form CT207 is the Cigarette and Tobacco Products Customs Declaration for the state of Minnesota.

Q: What is the purpose of Form CT207?

A: The purpose of Form CT207 is to declare any cigarette and tobacco products being brought into Minnesota.

Q: Who needs to complete Form CT207?

A: Anyone bringing cigarette and tobacco products into Minnesota needs to complete Form CT207.

Q: What information is required on Form CT207?

A: Form CT207 requires information about the individual bringing the products, the type and quantity of products, and the invoice or purchase order number.

Q: When should I complete and submit Form CT207?

A: Form CT207 should be completed and submitted at the time of entry into Minnesota with the cigarette and tobacco products.

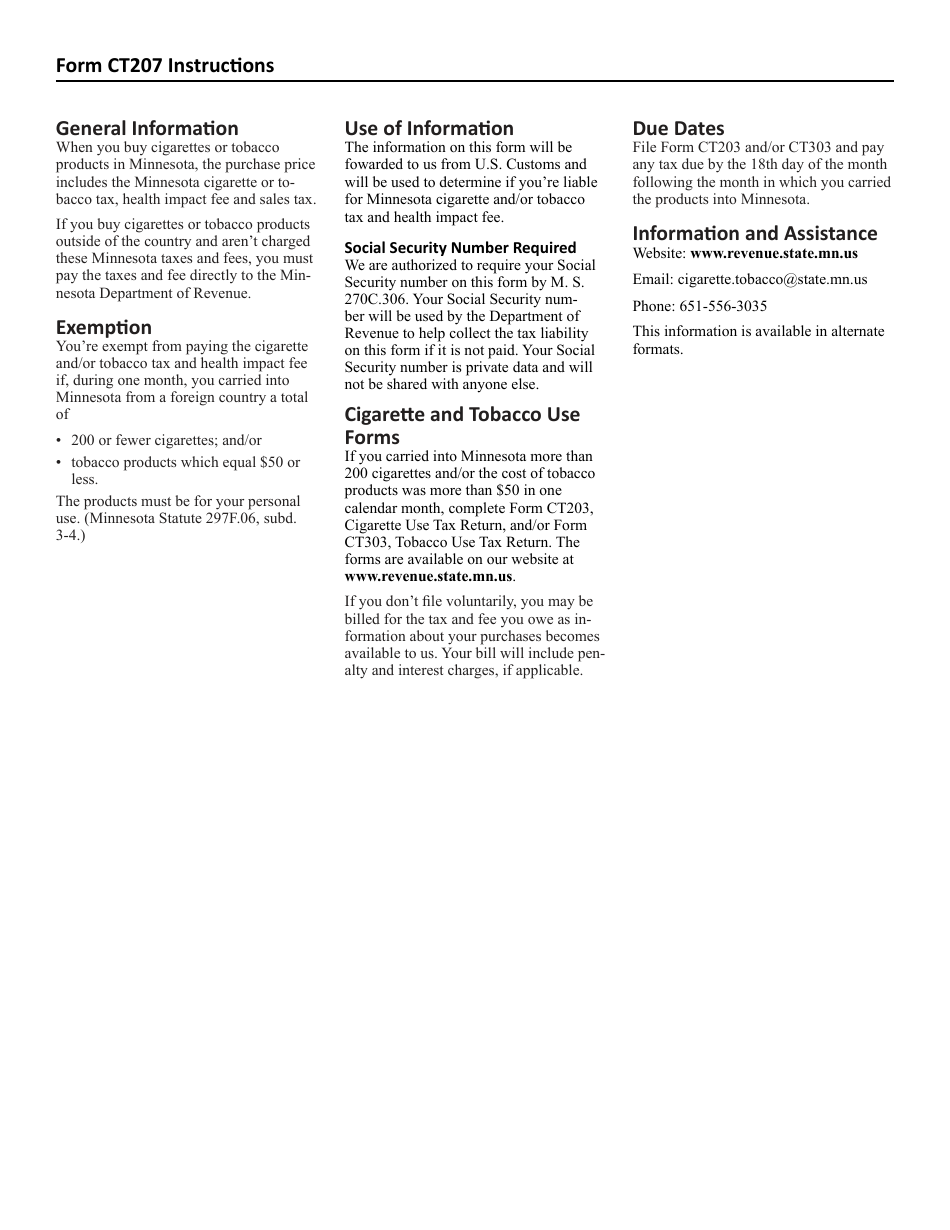

Q: Are there any fees or taxes associated with Form CT207?

A: Yes, there are fees and taxes associated with bringing cigarette and tobacco products into Minnesota. The specific amount depends on the type and quantity of products.

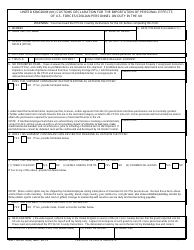

Q: What happens if I don't complete Form CT207?

A: Failure to complete Form CT207 or providing false information may result in penalties and legal consequences.

Q: Can I bring unlimited amounts of cigarette and tobacco products into Minnesota?

A: No, there are limits on the amount of cigarette and tobacco products that can be brought into Minnesota. The limits vary depending on the product.

Form Details:

- Released on March 1, 2013;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT207 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.