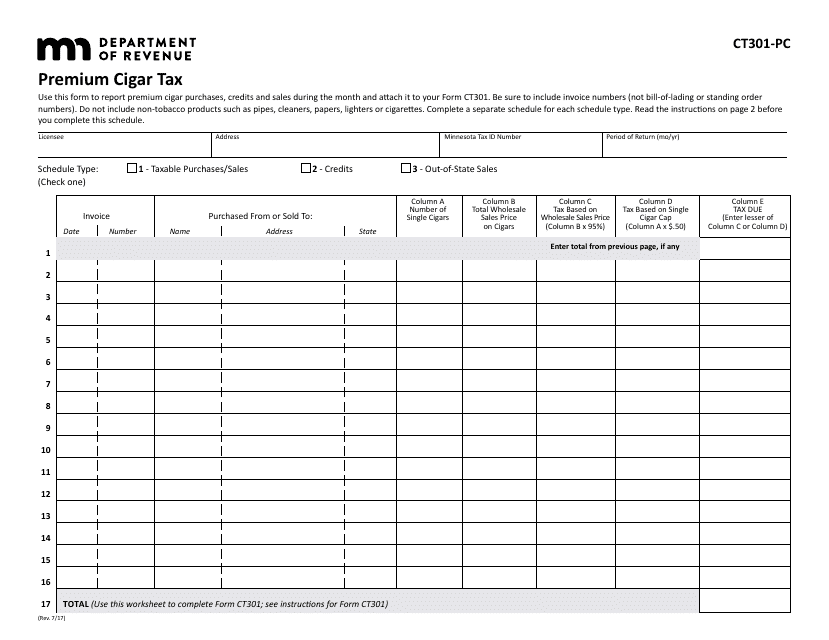

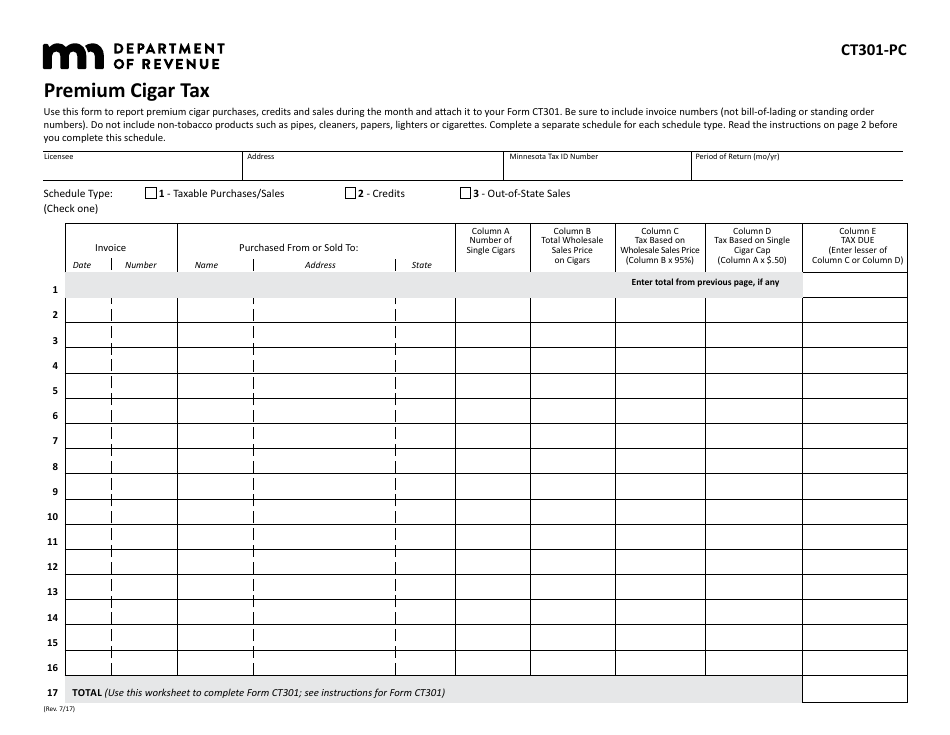

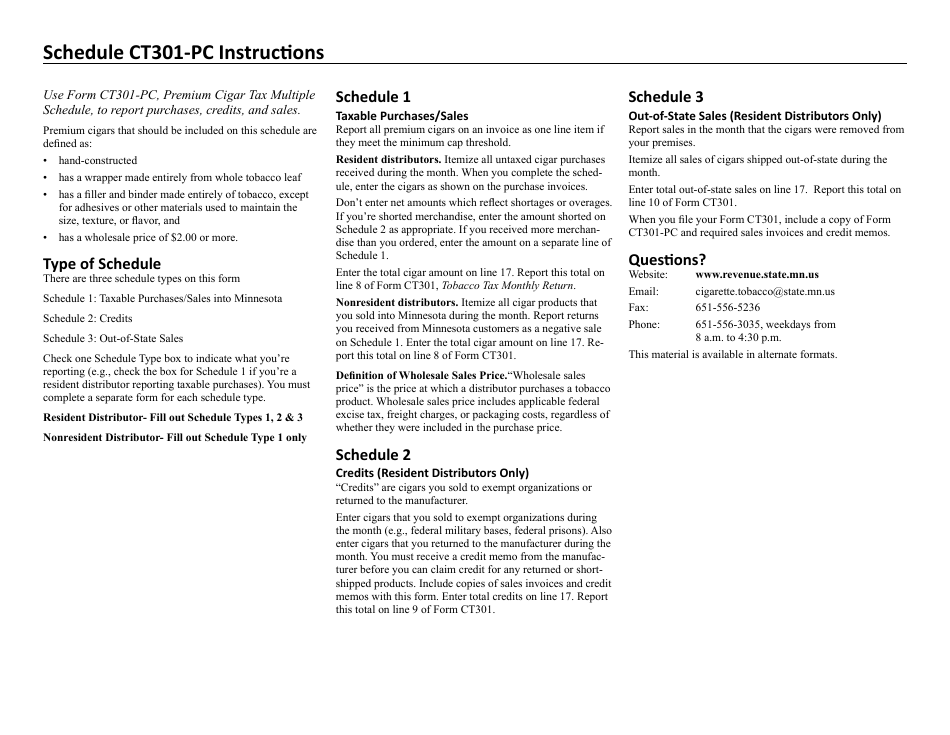

Schedule CT301-PC Premium Cigar Tax - Minnesota

What Is Schedule CT301-PC?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CT301-PC Premium Cigar Tax?

A: CT301-PC Premium Cigar Tax is a tax levied by the state of Minnesota on premium cigars.

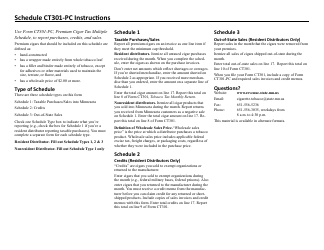

Q: Who is responsible for paying the CT301-PC Premium Cigar Tax?

A: The manufacturer or importer of premium cigars is generally responsible for paying the CT301-PC Premium Cigar Tax.

Q: How is the CT301-PC Premium Cigar Tax calculated?

A: The CT301-PC Premium Cigar Tax is calculated based on the wholesale price or the actual sale price of the premium cigars, whichever is greater.

Q: When is the CT301-PC Premium Cigar Tax due?

A: The CT301-PC Premium Cigar Tax is due on the 20th day of the month following the month of sale or distribution of the premium cigars.

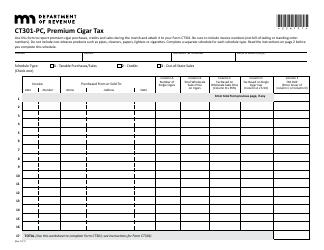

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule CT301-PC by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.