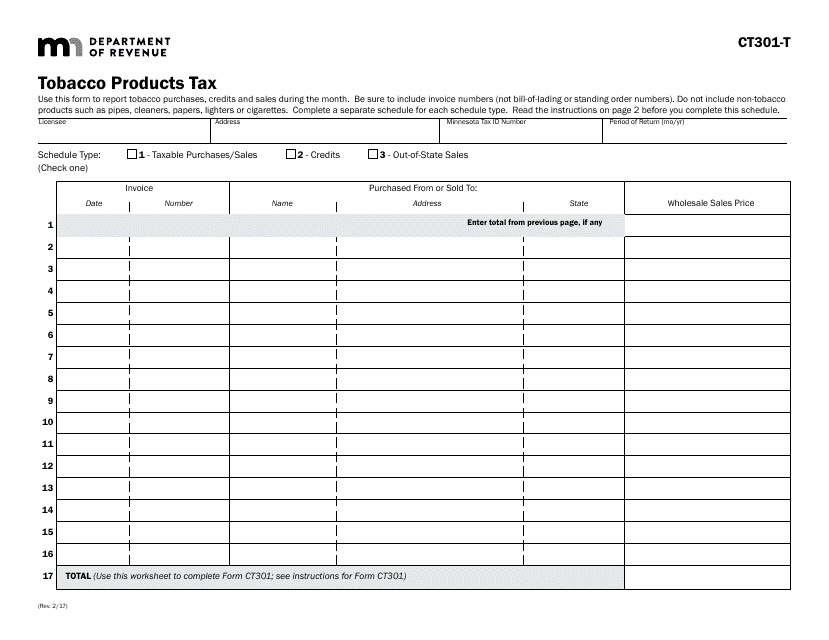

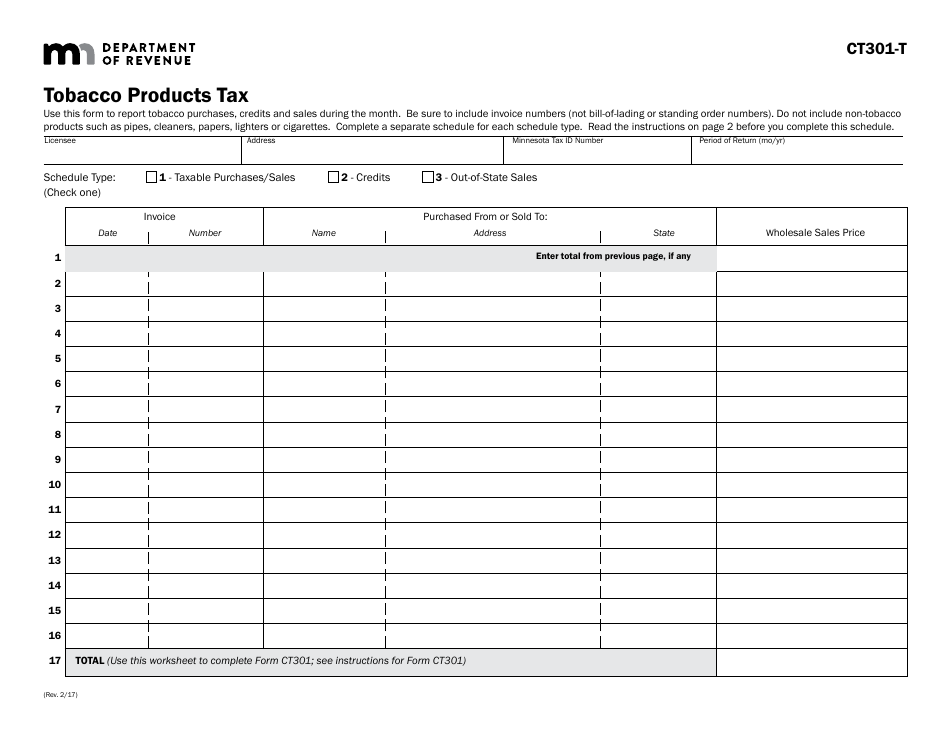

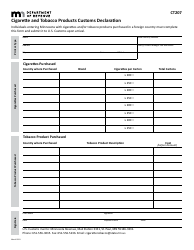

Form CT301-T Tobacco Products Tax - Minnesota

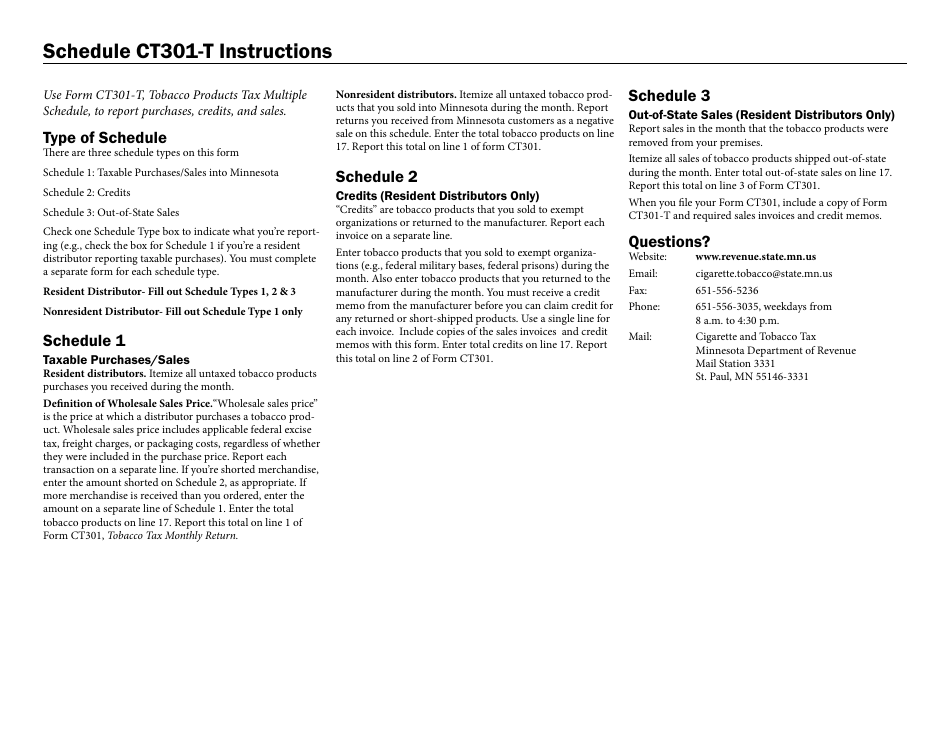

What Is Form CT301-T?

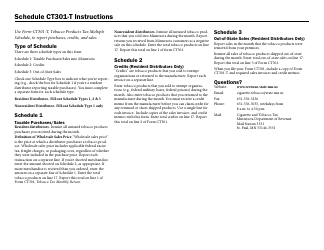

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

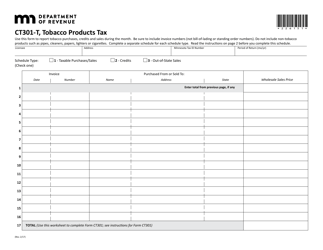

Q: What is Form CT301-T?

A: Form CT301-T is a form used to report and pay tobacco products tax in Minnesota.

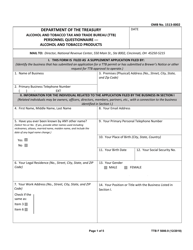

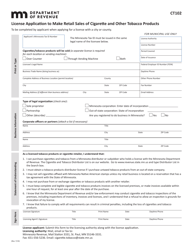

Q: Who needs to file Form CT301-T?

A: Any person or business engaged in the sale or distribution of tobacco products in Minnesota must file Form CT301-T.

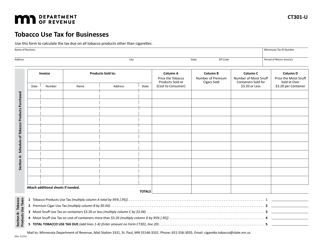

Q: What is tobacco products tax?

A: Tobacco products tax is a tax imposed on the sale or distribution of tobacco products, such as cigarettes, cigars, and smokeless tobacco.

Q: How often do I need to file Form CT301-T?

A: Form CT301-T must be filed on a monthly basis, with the tax payment due by the 18th day of the following month.

Q: Are there any penalties for not filing Form CT301-T?

A: Yes, failure to file Form CT301-T or pay the tax by the due date may result in penalties and interest.

Q: Is there a minimum amount of tax that I must pay?

A: Yes, there is a minimum tax liability of $250 per year for businesses that sell tobacco products in Minnesota.

Form Details:

- Released on February 1, 2017;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT301-T by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.