This version of the form is not currently in use and is provided for reference only. Download this version of

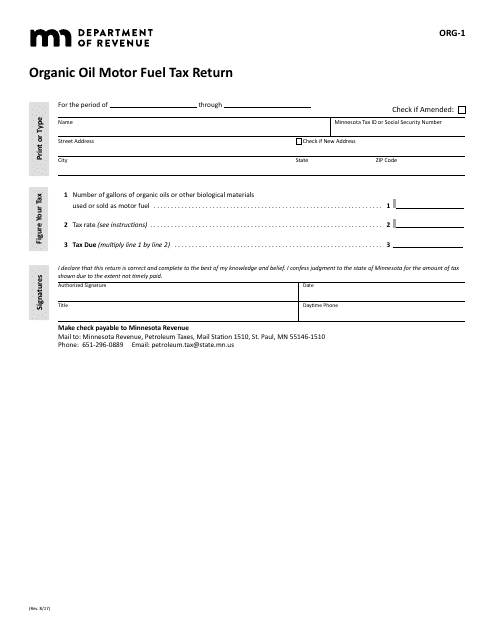

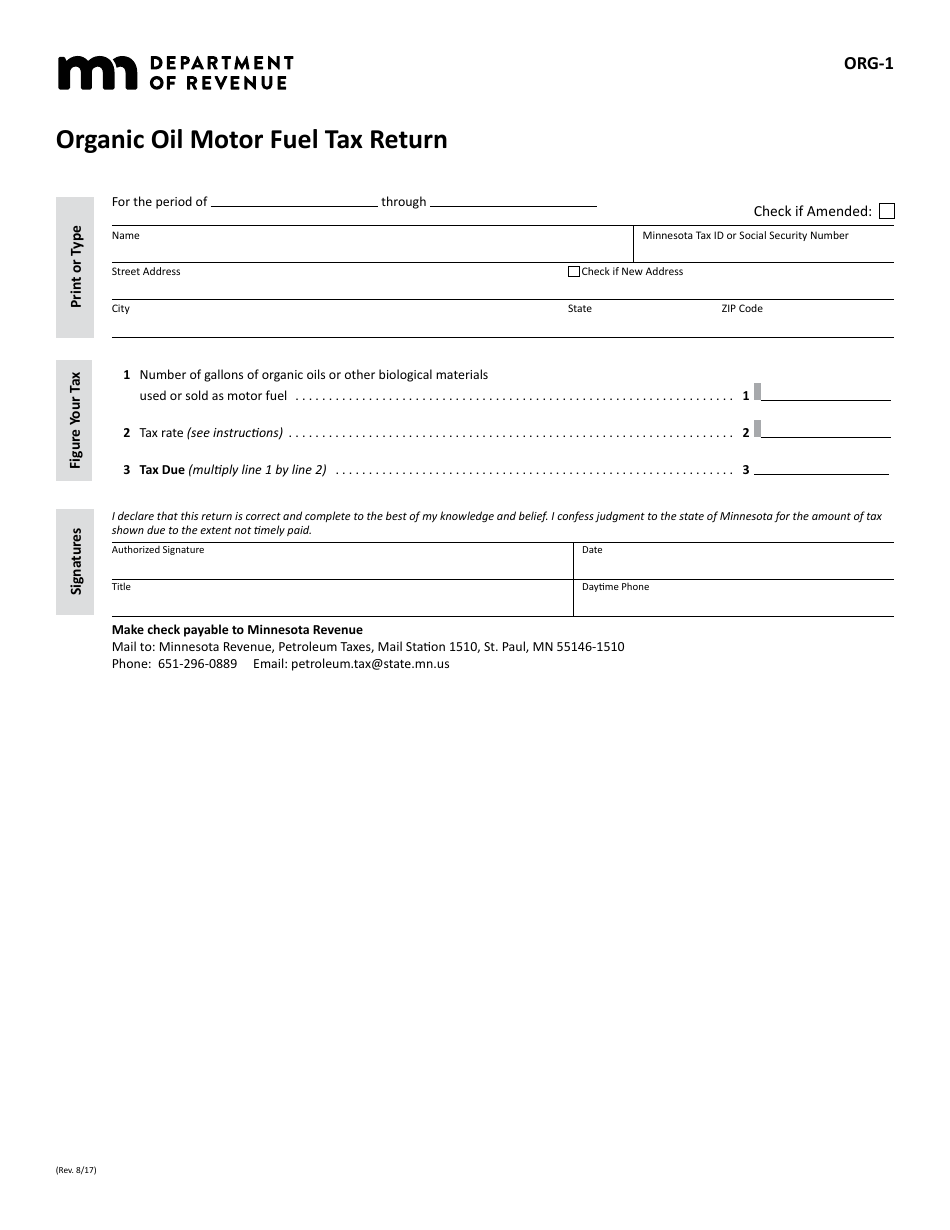

Form ORG-1

for the current year.

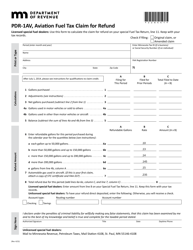

Form ORG-1 Organic Oil Motor Fuel Tax Return - Minnesota

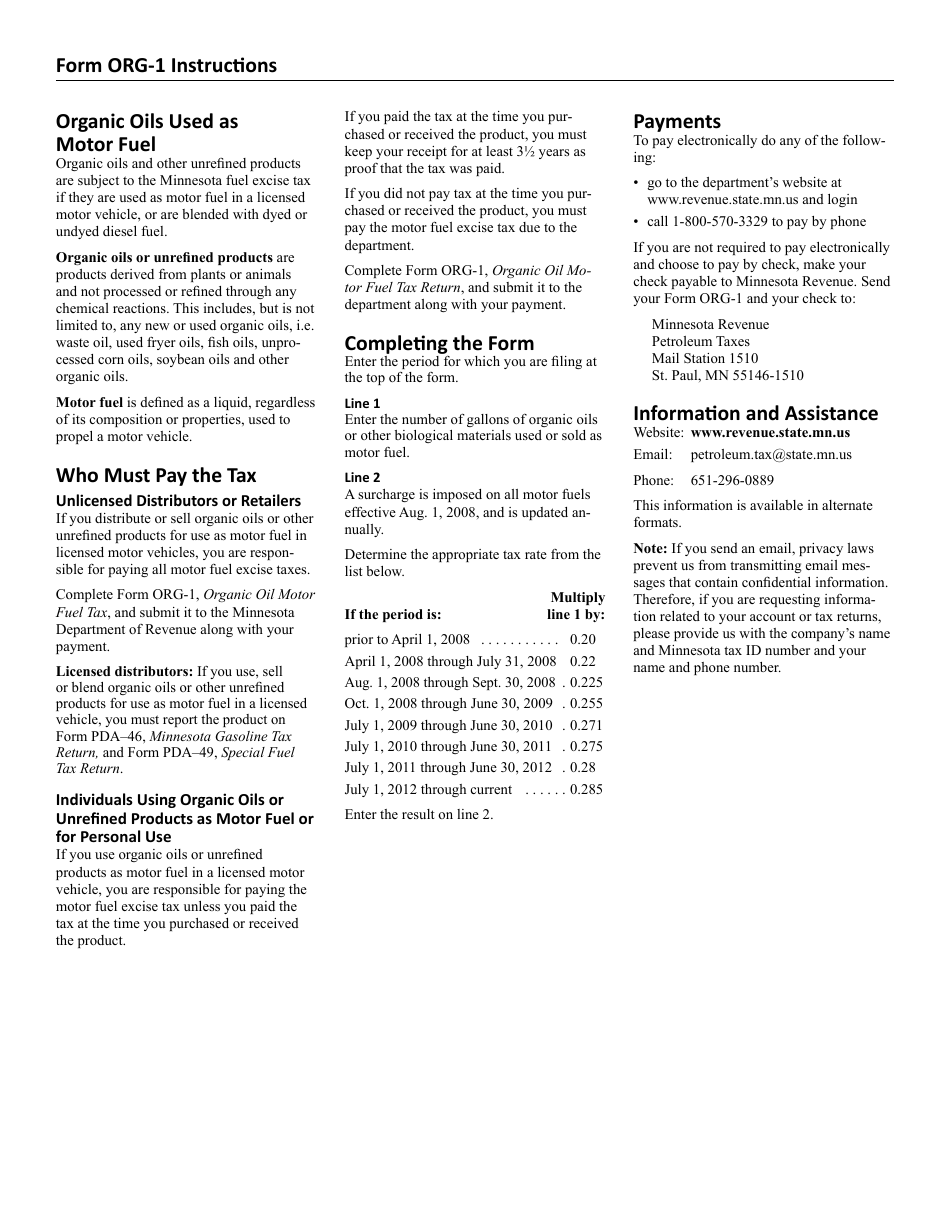

What Is Form ORG-1?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ORG-1?

A: Form ORG-1 is the Organic Oil Motor Fuel Tax Return.

Q: Who needs to file Form ORG-1?

A: Anyone who sells or uses organic oil motor fuel in Minnesota needs to file Form ORG-1.

Q: What is organic oil motor fuel?

A: Organic oil motor fuel includes certain oils or fats that are used as fuel in diesel engines.

Q: When is Form ORG-1 due?

A: Form ORG-1 is due on a monthly basis, with the due date being the 18th day of the month following the month being reported.

Q: What information needs to be included on Form ORG-1?

A: Form ORG-1 requires information such as the total number of gallons of organic oil motor fuel sold or used, the total tax due, and any credits or refunds being claimed.

Q: Are there any penalties for late filing of Form ORG-1?

A: Yes, there are penalties for late filing of Form ORG-1, including a late filing fee and interest on any unpaid tax.

Q: Can I file Form ORG-1 electronically?

A: Yes, you can file Form ORG-1 electronically through the Minnesota e-Services system.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ORG-1 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.