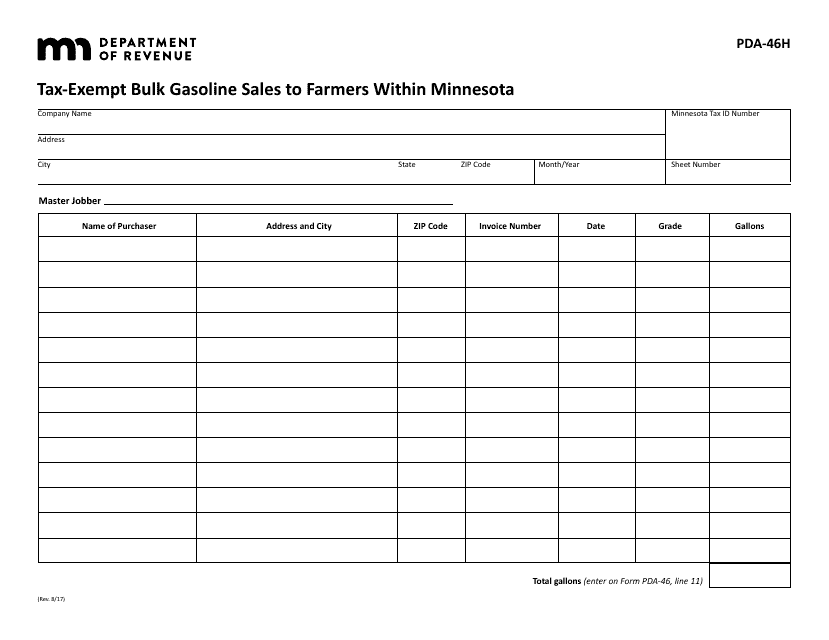

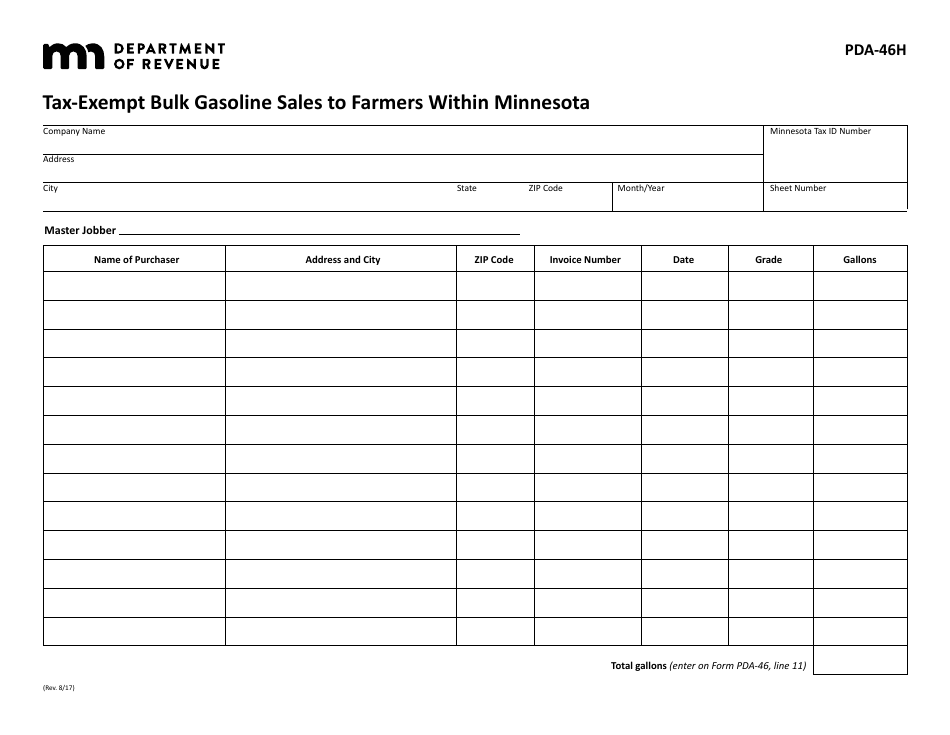

Form PDA-46H Tax-Exempt Bulk Gasoline Sales to Farmers Within Minnesota - Minnesota

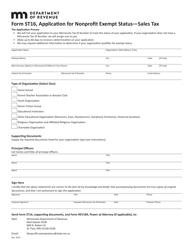

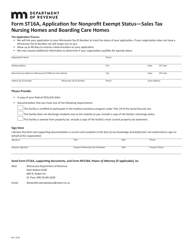

What Is Form PDA-46H?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PDA-46H?

A: Form PDA-46H is a tax-exempt bulk gasoline sales form for farmers in Minnesota.

Q: Who can use Form PDA-46H?

A: Form PDA-46H is specifically for farmers within Minnesota.

Q: What is the purpose of Form PDA-46H?

A: The purpose of Form PDA-46H is to claim tax exemption on bulk gasoline sales for farming purposes.

Q: What is the eligibility criteria for tax-exempt bulk gasoline sales?

A: To be eligible, the purchaser must be a farmer engaged in farming activities in Minnesota.

Q: What must be provided on Form PDA-46H?

A: Form PDA-46H requires the buyer's name, address, registration number, and a description of the purchased gasoline.

Q: What is the deadline for filing Form PDA-46H?

A: Form PDA-46H must be filed by the last day of the month following the month of purchase.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PDA-46H by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.