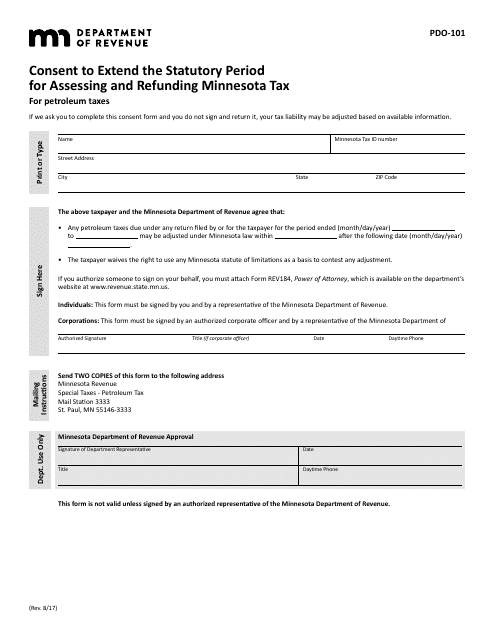

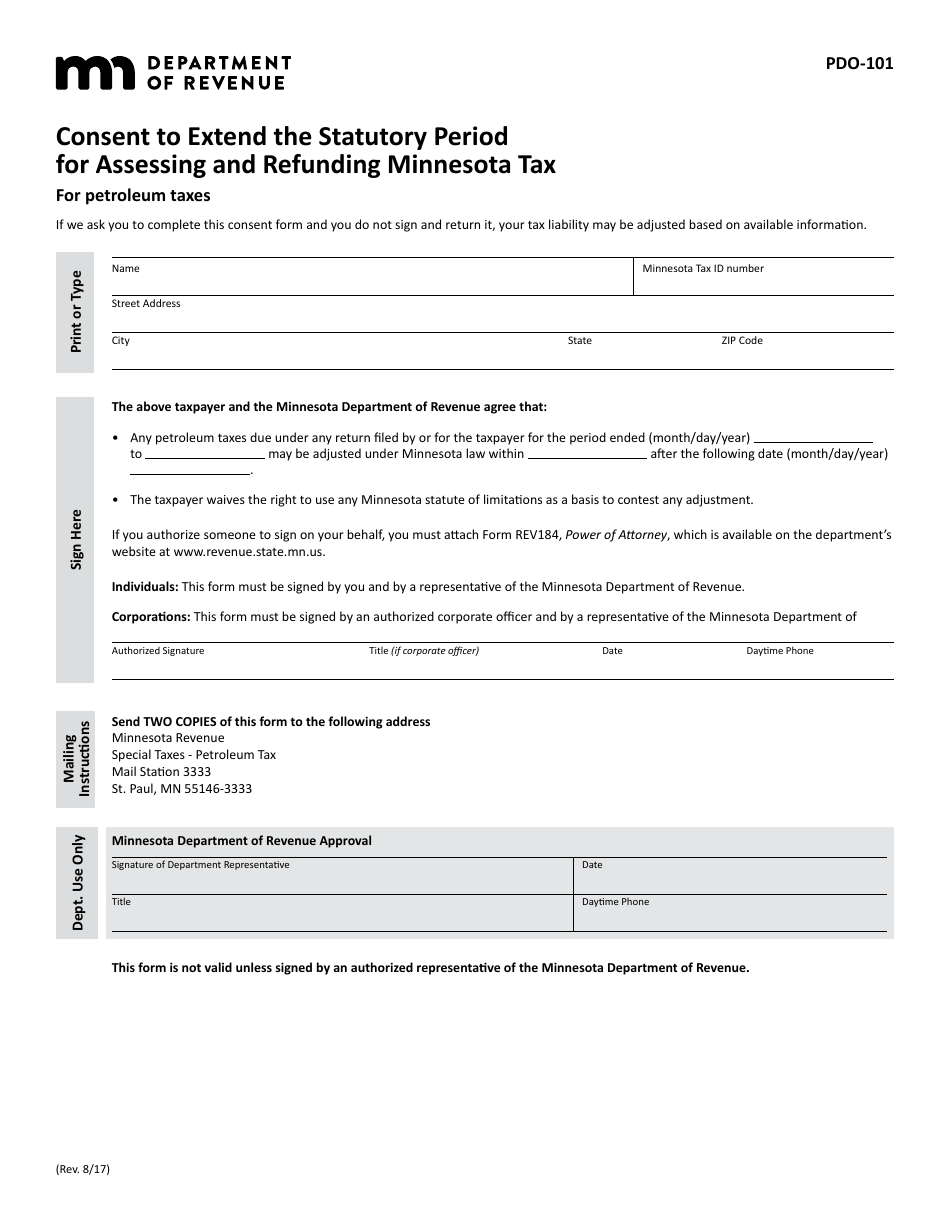

Form PDO-101 Consent to Extend the Statutory Period for Assessing and Refunding Minnesota Tax for Petroleum Taxes - Minnesota

What Is Form PDO-101?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PDO-101 Consent to Extend the Statutory Period for Assessing and Refunding Minnesota Tax for Petroleum Taxes?

A: PDO-101 is a form used in Minnesota to request an extension of the statutory period for assessing and refunding petroleum taxes.

Q: Who needs to file PDO-101?

A: Individuals or businesses who want to extend the assessment and refunding period for petroleum taxes in Minnesota need to file PDO-101.

Q: Why would someone file PDO-101?

A: PDO-101 is filed to request an extension for assessing and refunding petroleum taxes in Minnesota.

Q: Is there a fee to file PDO-101?

A: There is no fee to file PDO-101.

Q: Are there any specific instructions for completing PDO-101?

A: Yes, there are specific instructions provided with the form to guide you through the completion process.

Q: What is the deadline for filing PDO-101?

A: The deadline for filing PDO-101 is determined by the Department of Revenue. It is important to check the instructions and guidelines provided with the form.

Q: Can I request multiple extensions with PDO-101?

A: Yes, you can request multiple extensions using PDO-101. Each request will be reviewed separately.

Q: What happens after I submit PDO-101?

A: After submitting PDO-101, the Department of Revenue will review your request and determine whether or not to grant the extension.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PDO-101 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.