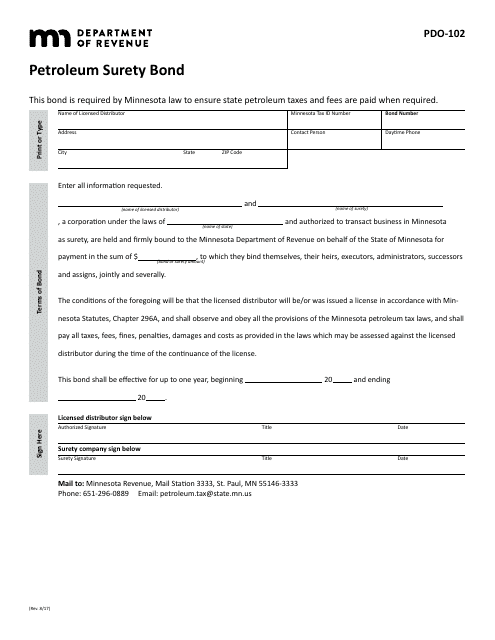

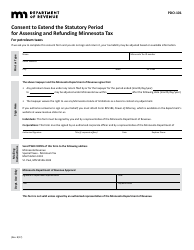

Form PDO-102 Petroleum Surety Bond - Minnesota

What Is Form PDO-102?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PDO-102?

A: PDO-102 is the form number for the Petroleum Surety Bond in Minnesota.

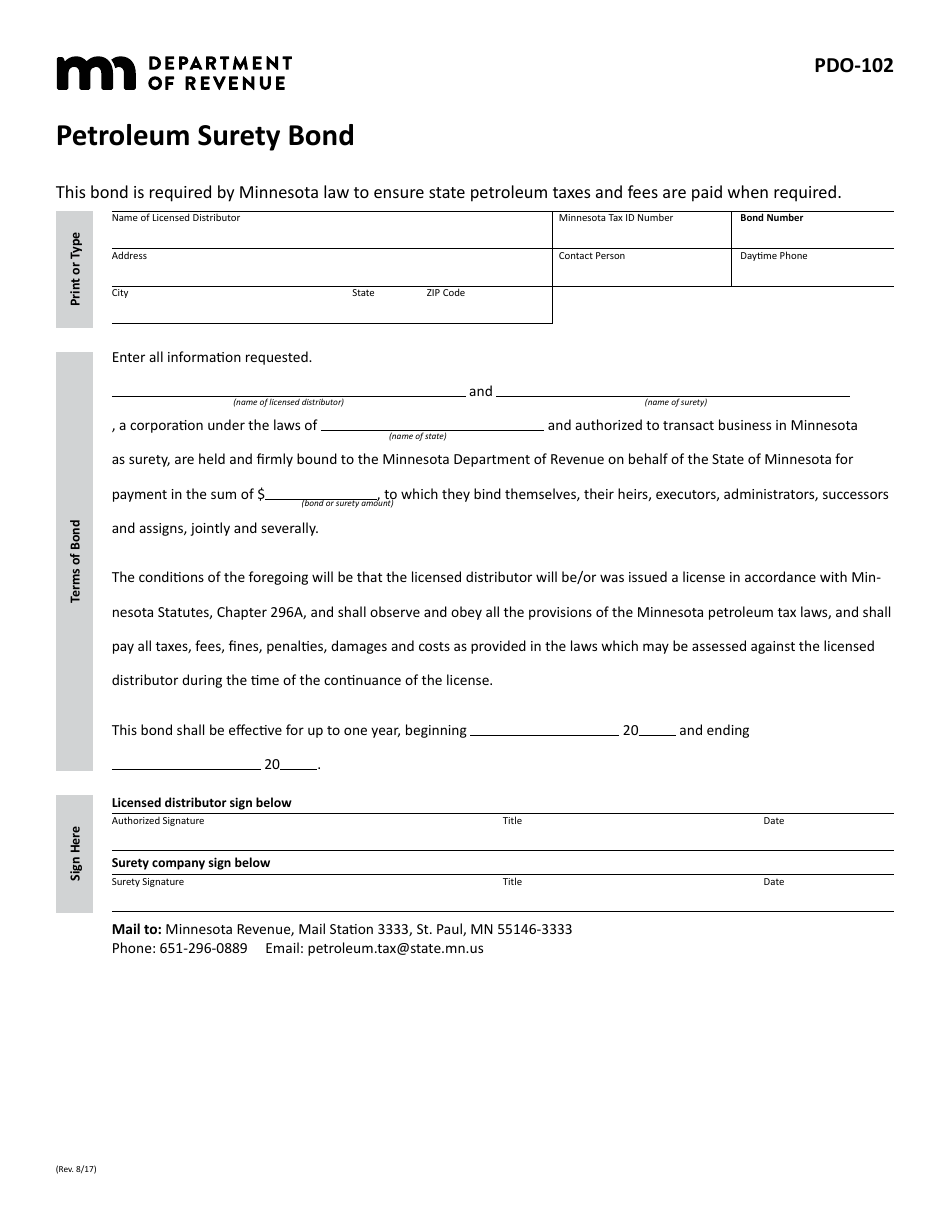

Q: What is the purpose of the Petroleum Surety Bond?

A: The Petroleum Surety Bond is required by the Minnesota Department of Commerce to ensure compliance with state regulations related to petroleum products.

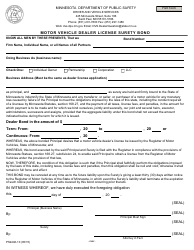

Q: Who needs to fill out the PDO-102 form?

A: Petroleum distributors, jobbers, and retailers in Minnesota need to fill out the PDO-102 form.

Q: What information is required on the PDO-102 form?

A: The PDO-102 form requires information such as the licensee's business name, identification numbers, and financial information.

Q: Is a surety bond required for all petroleum businesses in Minnesota?

A: Yes, all petroleum businesses in Minnesota are required to have a surety bond.

Q: How much does the surety bond amount need to be?

A: The surety bond amount is determined by the Minnesota Department of Commerce, based on the licensee's monthly average petroleum sales.

Q: What happens if I don't submit the PDO-102 form or the required surety bond?

A: Failure to submit the PDO-102 form or the required surety bond can result in penalties or license revocation.

Q: Does the surety bond need to be renewed?

A: Yes, the surety bond needs to be renewed annually.

Q: Can I use a different form of financial assurance instead of a surety bond?

A: No, a surety bond is the required form of financial assurance for petroleum businesses in Minnesota.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PDO-102 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.