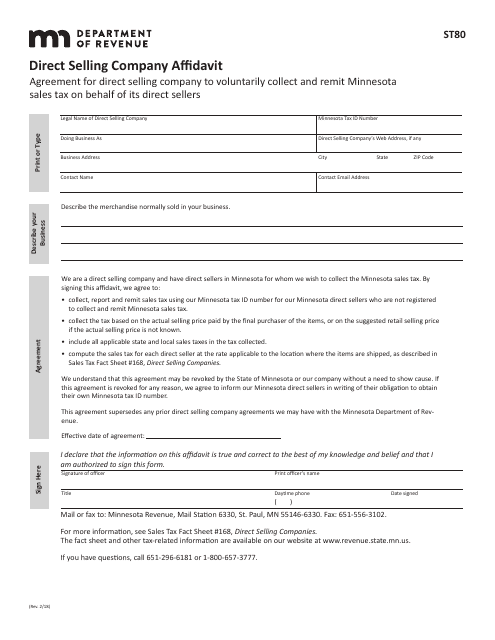

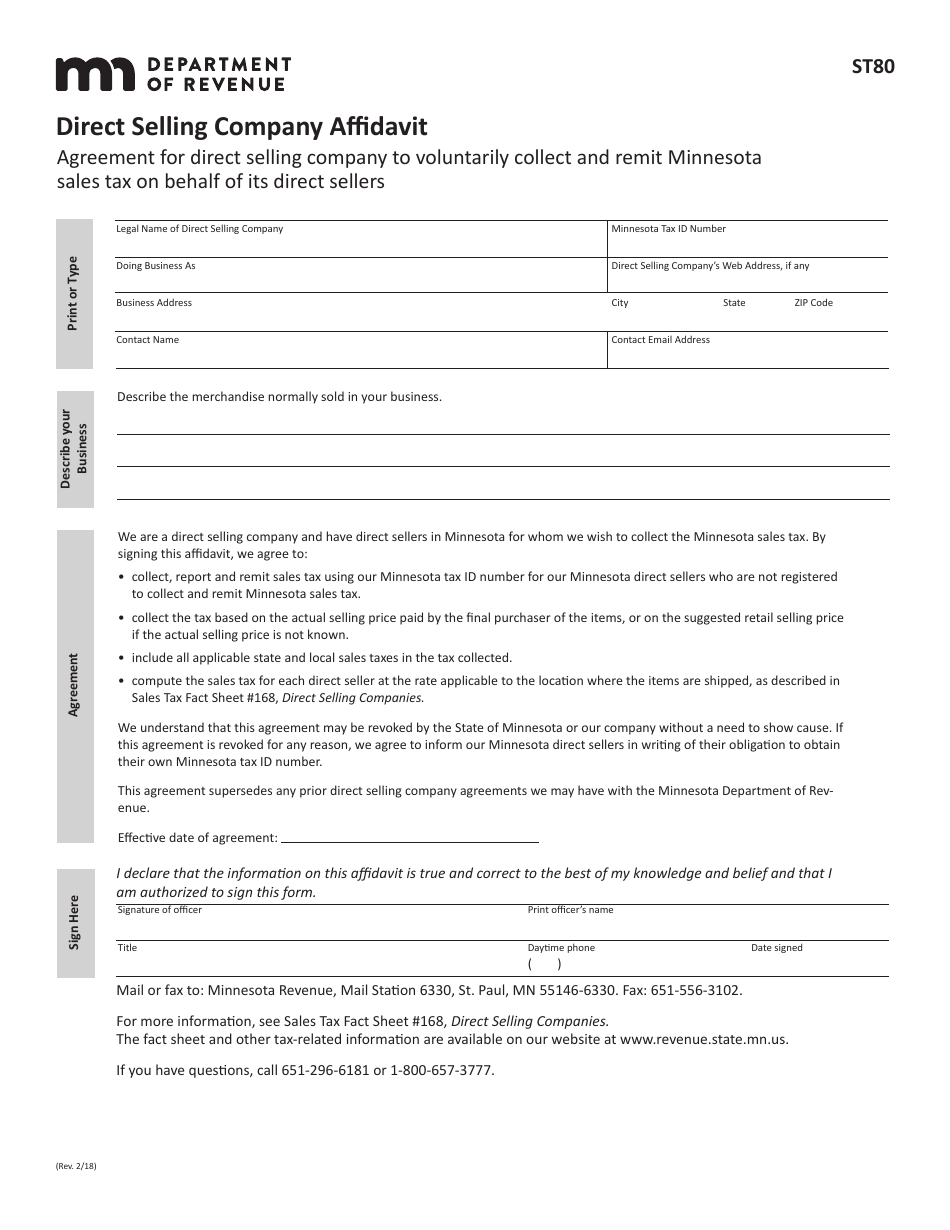

Form ST-80 Direct Selling Company Affidavit - Minnesota

What Is Form ST-80?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-80?

A: Form ST-80 is the Direct Selling Company Affidavit specific to the state of Minnesota.

Q: Who needs to file Form ST-80?

A: Direct Selling Companies operating in Minnesota need to file Form ST-80.

Q: What is the purpose of Form ST-80?

A: Form ST-80 is used to report sales and use tax liability for Direct Selling Companies in Minnesota.

Q: When is Form ST-80 due?

A: Form ST-80 is due on or before the 20th day of the month following the end of the reporting period.

Q: What should I include when filing Form ST-80?

A: You should include information about your company's sales and use tax liability for the reporting period.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there may be penalties for late filing or non-compliance with the requirements of Form ST-80.

Q: Is there an electronic filing option for Form ST-80?

A: Yes, you can file Form ST-80 electronically through the Minnesota Department of Revenue's e-Services system.

Q: Can I amend a previously filed Form ST-80?

A: Yes, you can file an amended Form ST-80 to correct any errors or provide additional information.

Form Details:

- Released on February 1, 2018;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-80 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.