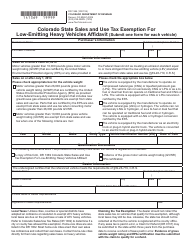

Form DR1192 Colorado Machinery and Machine Tools State Sales Tax Exemption Declaration - Colorado

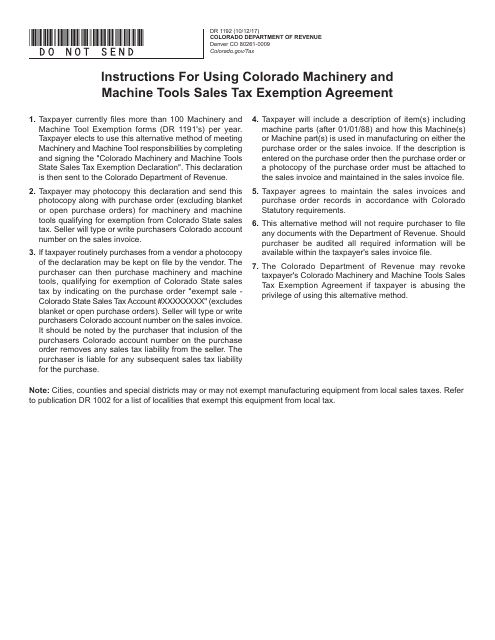

What Is Form DR1192?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form DR1192?

A: Form DR1192 is used to declare a state sales tax exemption for machinery and machine tools in Colorado.

Q: Who is eligible to use Form DR1192?

A: Businesses and organizations in Colorado that purchase machinery and machine tools for manufacturing or industrial processing purposes are eligible to use this form.

Q: What is the benefit of using Form DR1192?

A: Using this form allows businesses to claim a state sales tax exemption on their purchases of eligible machinery and machine tools.

Q: Are there any specific requirements for eligibility?

A: Yes, the machinery and machine tools must be used primarily in manufacturing or industrial processing in order to qualify for the exemption.

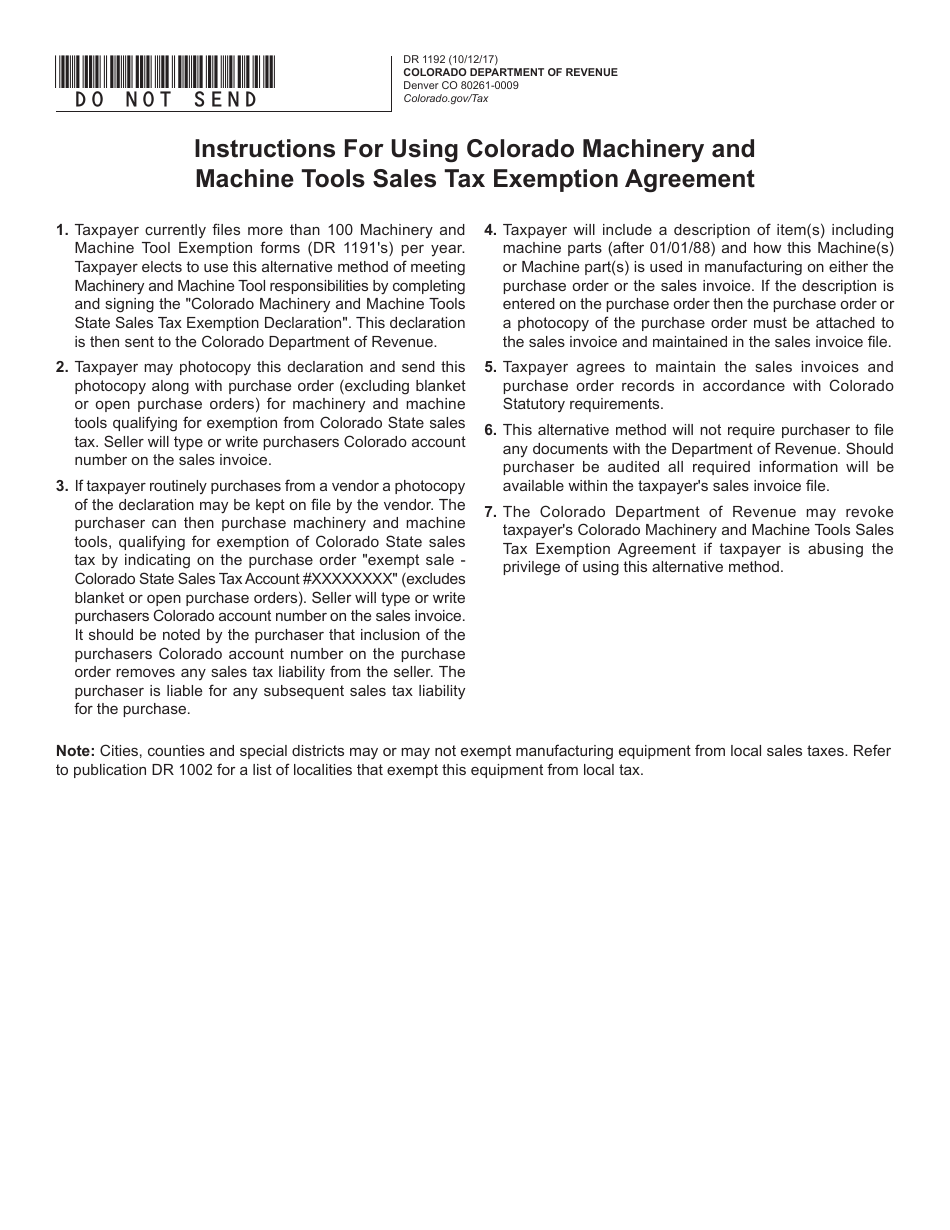

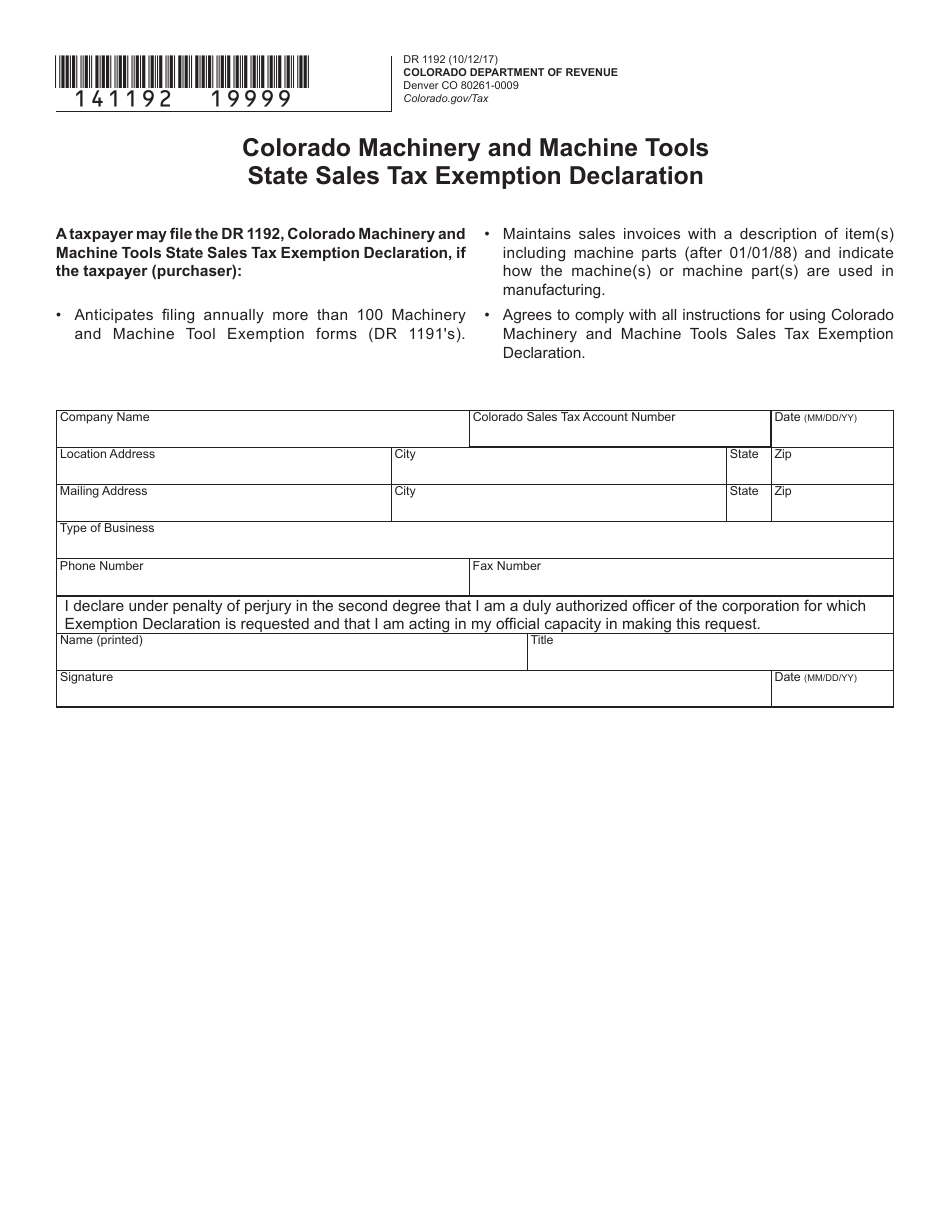

Q: How should Form DR1192 be filled out?

A: The form requires information such as the purchaser's name and address, the vendor's name and address, a description of the machinery or tools being purchased, and a statement of the intended use for the items.

Q: Is this exemption applicable only to Colorado sales tax?

A: Yes, Form DR1192 is specifically for claiming a state sales tax exemption in Colorado.

Q: Are there any time limits for using this exemption?

A: No, as long as the machinery or machine tools are being used for eligible purposes, the exemption is valid for each purchase.

Q: Can this exemption be used for other types of purchases?

A: No, this exemption is specifically for machinery and machine tools used in manufacturing or industrial processing.

Form Details:

- Released on October 12, 2017;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR1192 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.