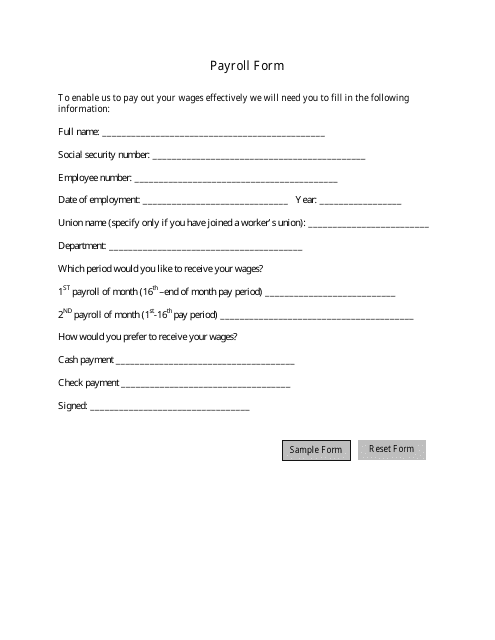

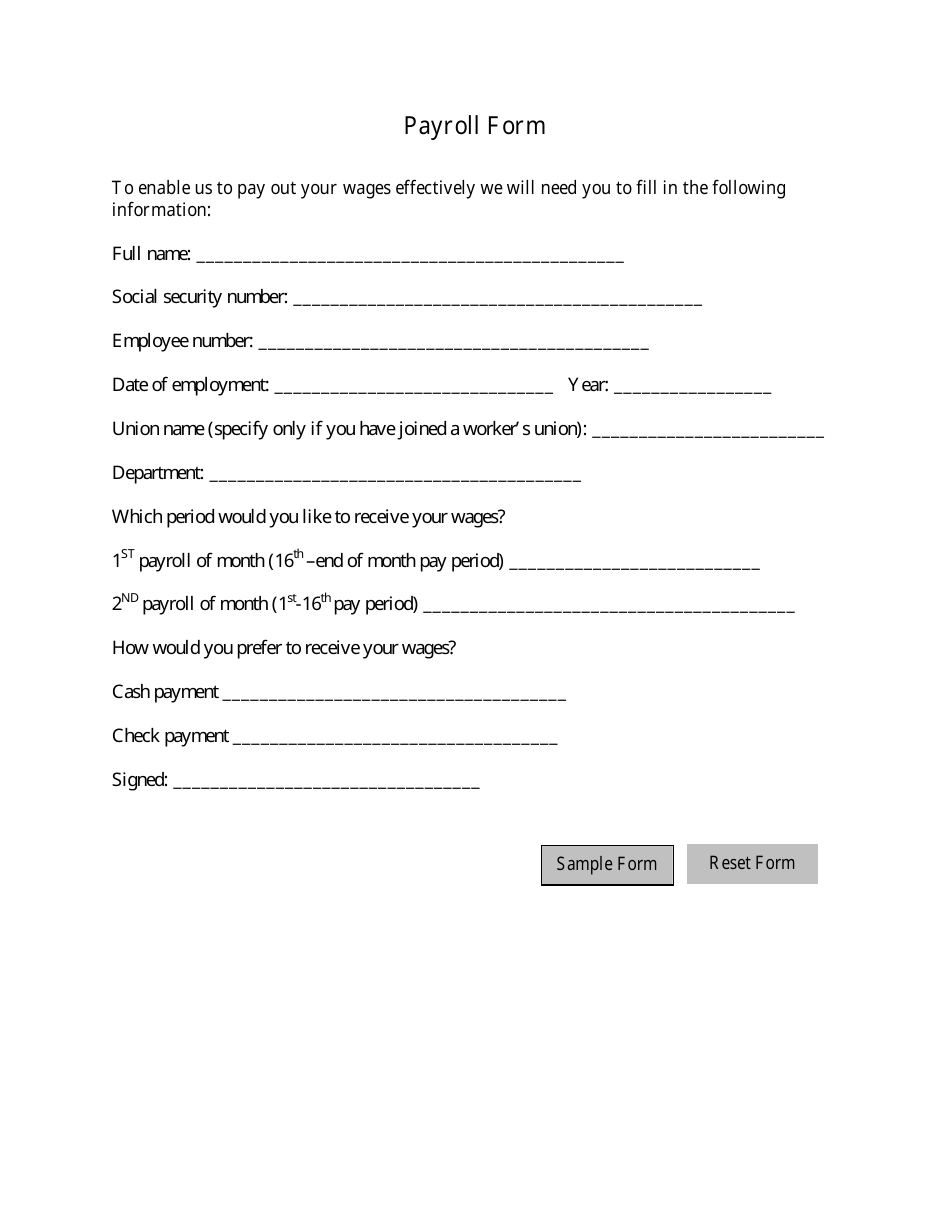

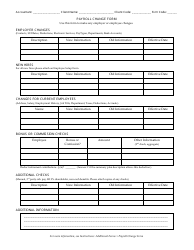

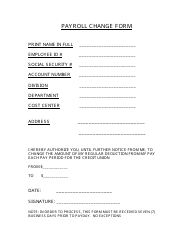

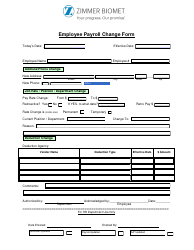

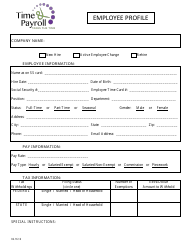

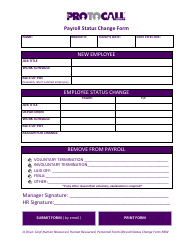

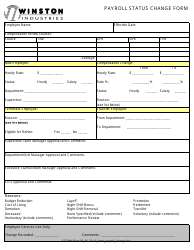

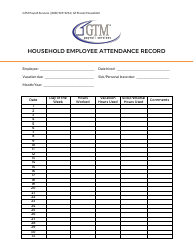

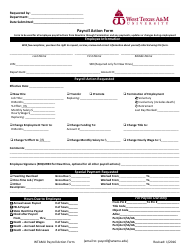

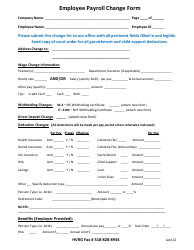

Payroll Form

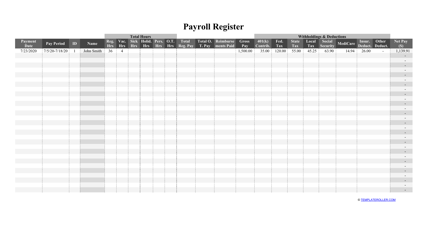

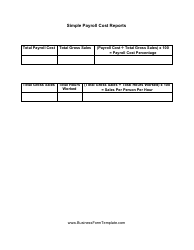

A Payroll Form is used to document and track employee wages, deductions, and tax withholdings. It is used by employers to calculate and report accurate payments to employees and to comply with government regulations.

The employer is responsible for filing the payroll form.

FAQ

Q: What is a payroll form?

A: A payroll form is a document used by employers to report employee wages, taxes, and other information to government agencies.

Q: Why is a payroll form important?

A: A payroll form is important because it ensures accurate reporting and compliance with tax laws.

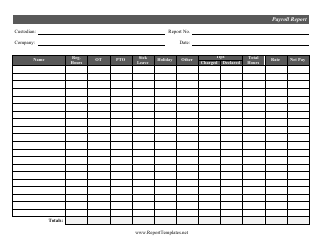

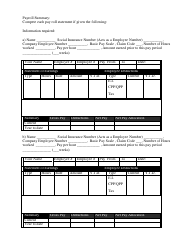

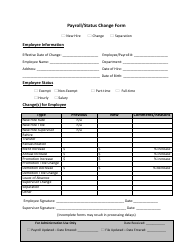

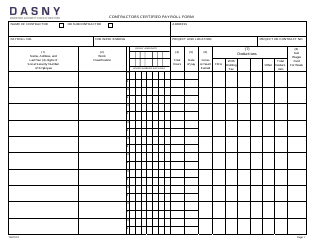

Q: What information is typically included in a payroll form?

A: A payroll form typically includes employee names, wages, hours worked, taxes withheld, and other relevant employment information.

Q: Are there different types of payroll forms?

A: Yes, there are different types of payroll forms, such as W-2 forms for employees and 1099 forms for independent contractors.

Q: When is a payroll form typically filed?

A: A payroll form is typically filed annually, with the deadline usually at the beginning of the year.

Q: Who is responsible for filing a payroll form?

A: Employers are responsible for filing payroll forms on behalf of their employees.

Q: Can individuals access their own payroll forms?

A: Yes, employees can typically access their own payroll forms through their employer's payroll system or by requesting a copy from their employer.

Q: What happens if a payroll form is filed incorrectly?

A: If a payroll form is filed incorrectly, it may lead to penalties or additional taxes owed to the government.

Q: What should employees do if they have questions about their payroll forms?

A: Employees should reach out to their employer's HR or payroll department for any questions or concerns about their payroll forms.