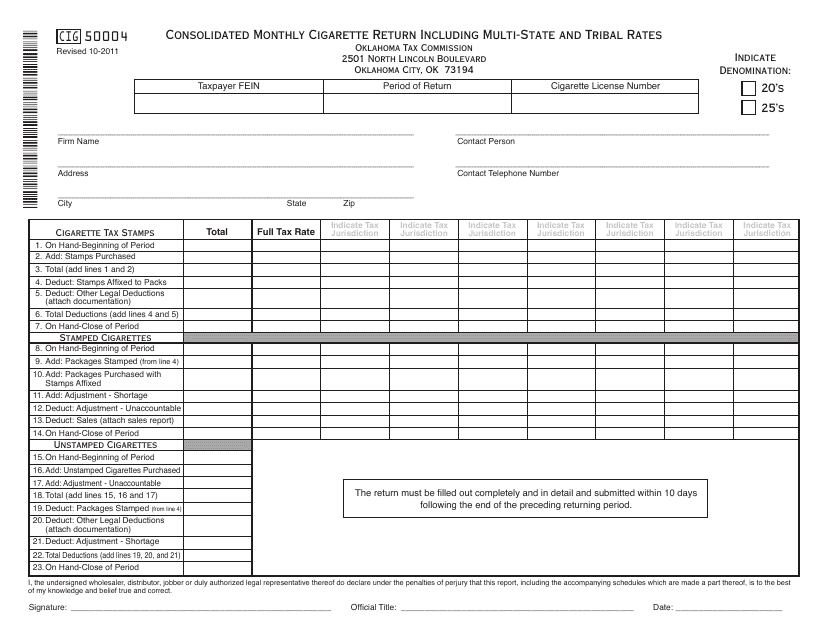

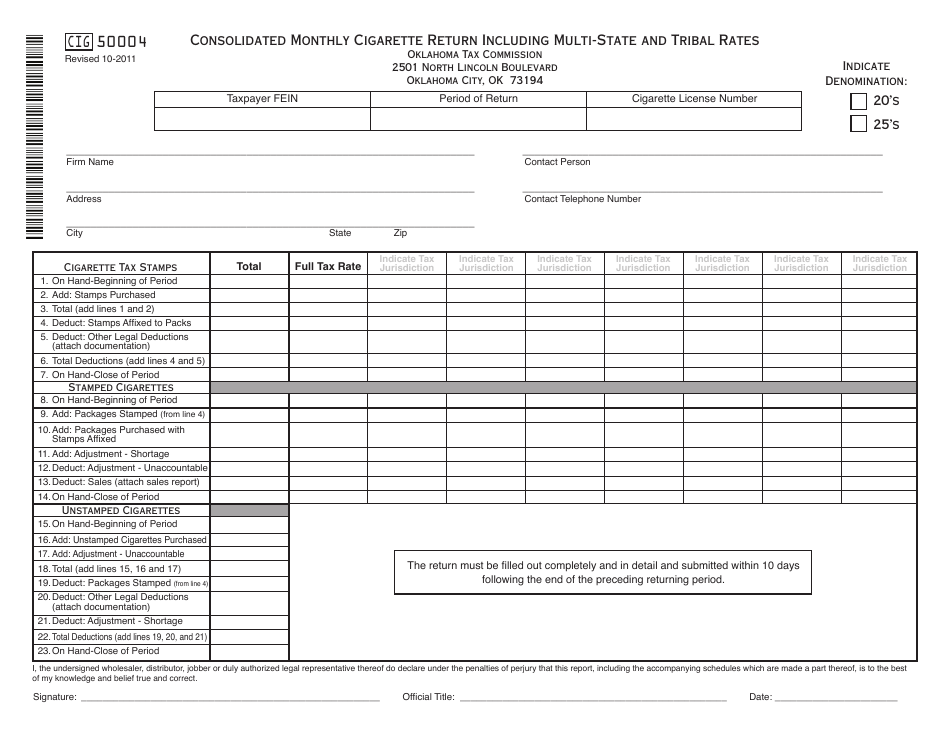

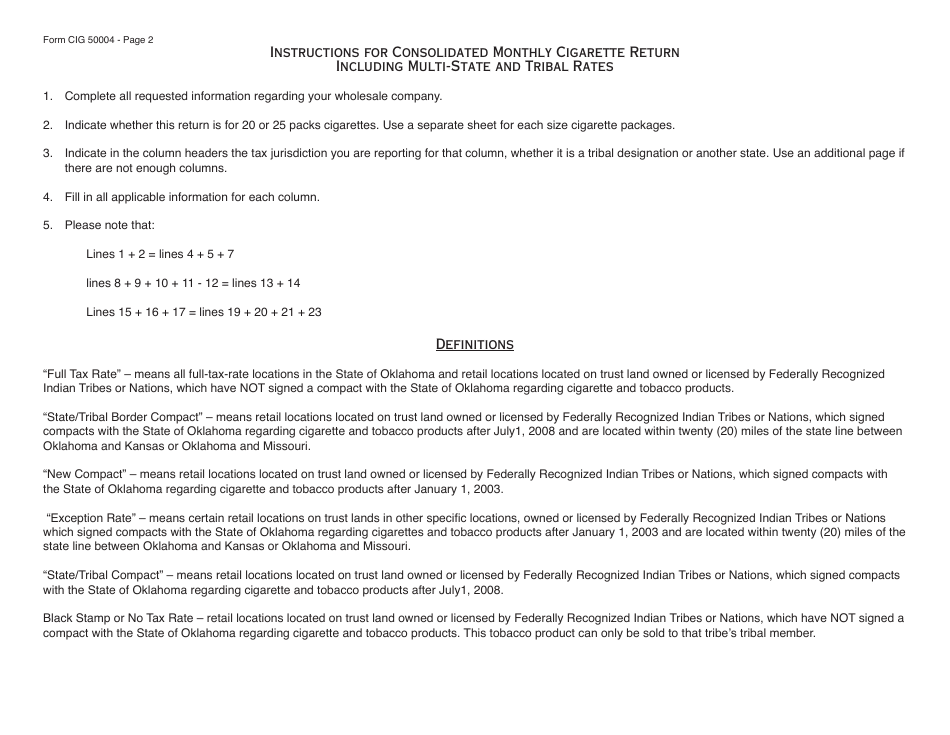

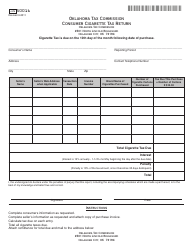

OTC Form CIG50004 Consolidated Monthly Cigarette Return Including Multi-State and Tribal Rates - Oklahoma

What Is OTC Form CIG50004?

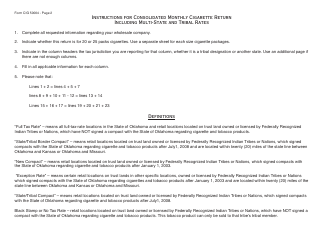

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the OTC Form CIG50004?

A: OTC Form CIG50004 is the Consolidated Monthly Cigarette Return Including Multi-State and Tribal Rates in Oklahoma.

Q: What does the form include?

A: The form includes information related to cigarettes, multi-state and tribal rates in Oklahoma.

Q: Who needs to file the OTC Form CIG50004?

A: Cigarette sellers and distributors in Oklahoma need to file the OTC Form CIG50004.

Q: What is the purpose of the form?

A: The form is used to report and remit taxes on cigarette sales in Oklahoma that have multi-state and tribal rates.

Q: How often do you need to file the form?

A: The form should be filed on a monthly basis.

Q: How can the form be submitted?

A: The OTC Form CIG50004 can be submitted electronically or by mail.

Q: What are the consequences of not filing the form?

A: Failure to file the form or remit the taxes on time may result in penalties and interest.

Form Details:

- Released on October 1, 2011;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of OTC Form CIG50004 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.