This version of the form is not currently in use and is provided for reference only. Download this version of

Form PTAX-337-R

for the current year.

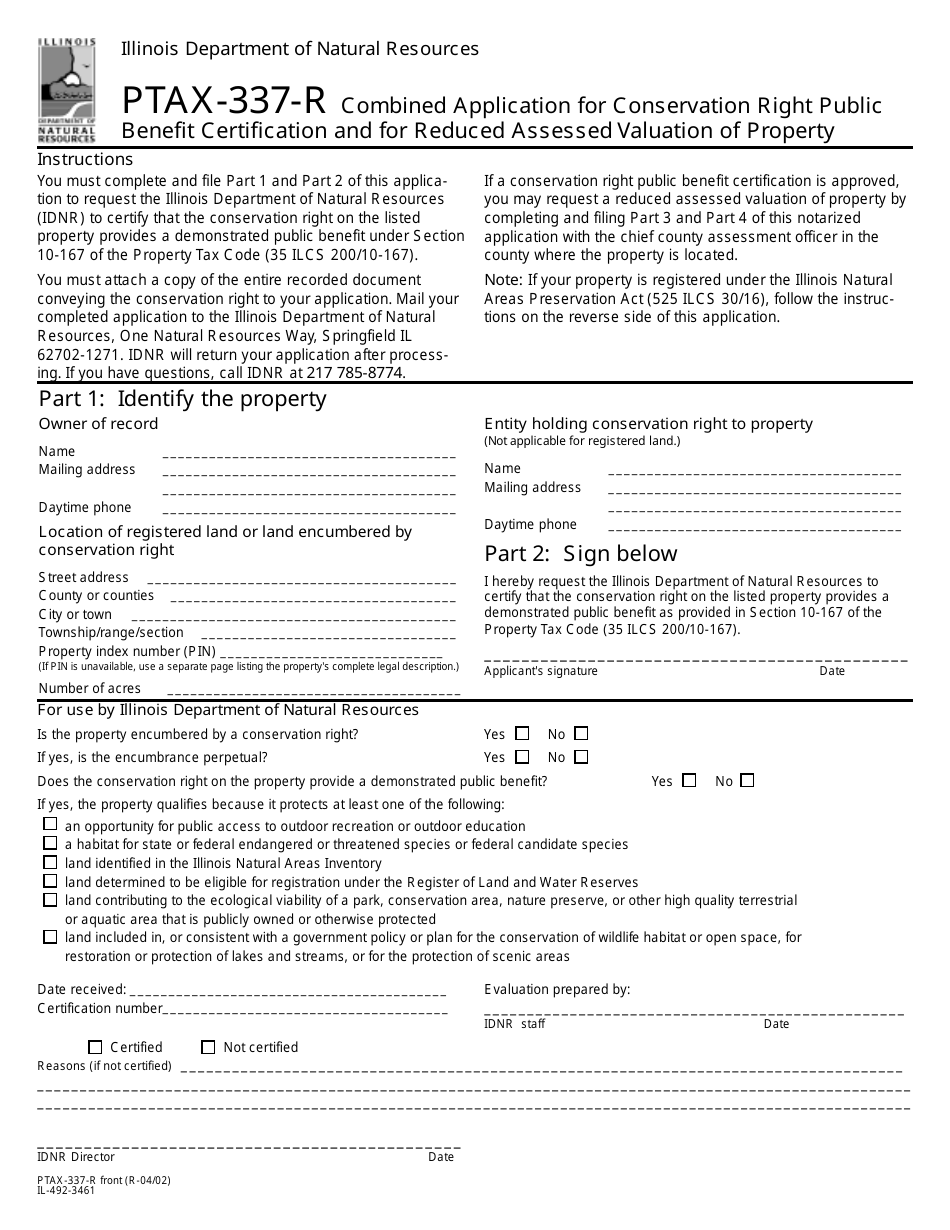

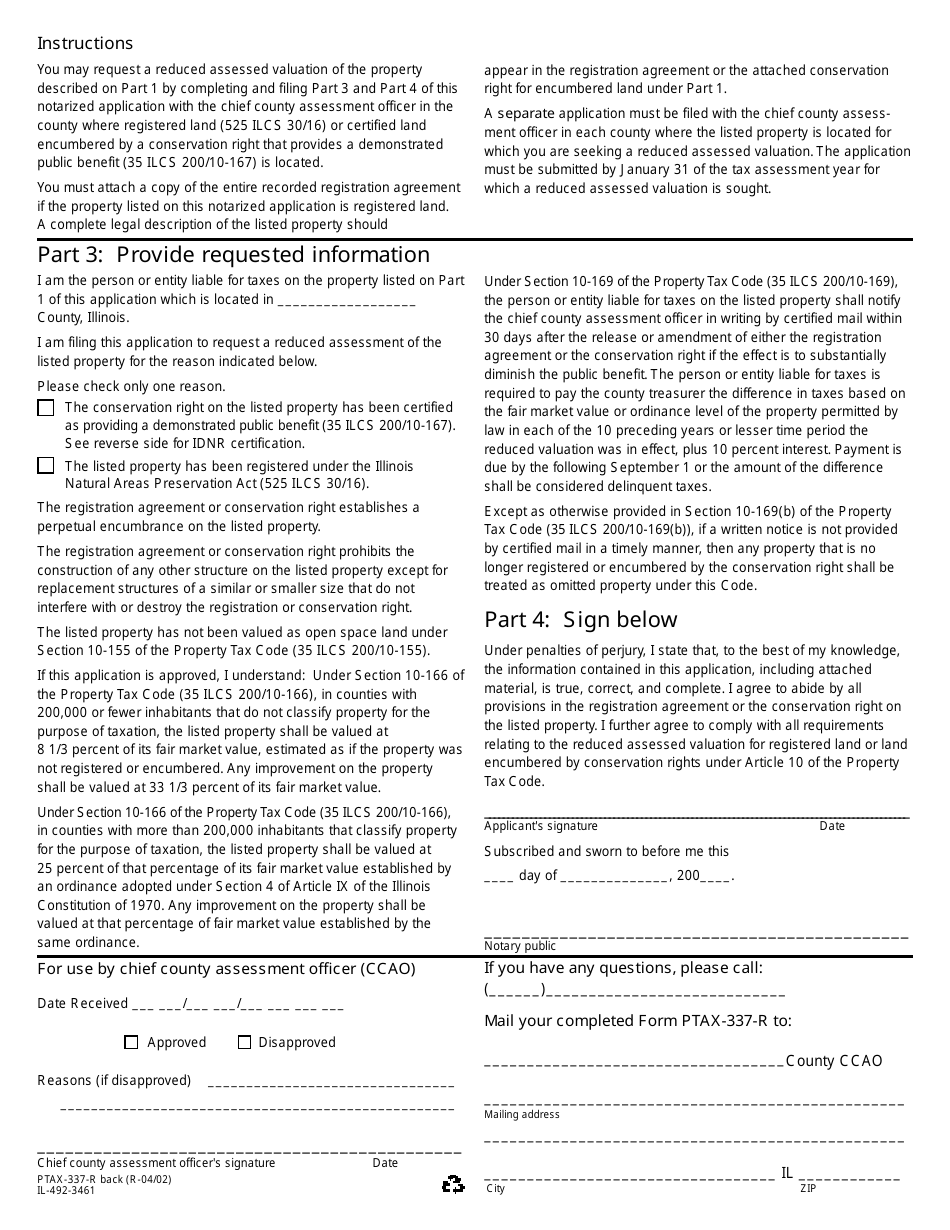

Form PTAX-337-R Combined Application for Conservation Right Public Benefit Certification and for Reduced Assessed Valuation of Property - Illinois

What Is Form PTAX-337-R?

This is a legal form that was released by the Illinois Department of Natural Resources - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTAX-337-R?

A: Form PTAX-337-R is a combined application for Conservation Right Public Benefit Certification and for Reduced Assessed Valuation of Property in Illinois.

Q: What is the purpose of Form PTAX-337-R?

A: The purpose of Form PTAX-337-R is to apply for a conservation right public benefit certification and to request a reduced assessed valuation of property in Illinois.

Q: What does the Conservation Right Public Benefit Certification provide?

A: The Conservation Right Public Benefit Certification provides property owners with a reduction in property taxes for qualifying property that is used for conservation purposes.

Q: What is the Reduced Assessed Valuation of Property?

A: The Reduced Assessed Valuation of Property is a benefit that allows property owners to have their property assessed at a reduced value, resulting in lower property taxes.

Q: Who can apply for Form PTAX-337-R?

A: Property owners in Illinois who have property used for conservation purposes can apply for Form PTAX-337-R.

Q: Are there any fees associated with filing Form PTAX-337-R?

A: There are no fees associated with filing Form PTAX-337-R.

Q: When should I file Form PTAX-337-R?

A: Form PTAX-337-R should be filed with the county assessor's office between January 1 and the last working day in June of the assessment year.

Q: What are the requirements for qualifying property for the Conservation Right Public Benefit Certification?

A: Qualifying property must meet certain criteria, such as being used primarily for conservation purposes and being subject to a conservation right held by a qualified organization.

Q: Can I apply for both the Conservation Right Public Benefit Certification and the Reduced Assessed Valuation of Property on the same form?

A: Yes, Form PTAX-337-R allows you to apply for both the Conservation Right Public Benefit Certification and the Reduced Assessed Valuation of Property.

Form Details:

- Released on April 1, 2002;

- The latest edition provided by the Illinois Department of Natural Resources;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTAX-337-R by clicking the link below or browse more documents and templates provided by the Illinois Department of Natural Resources.