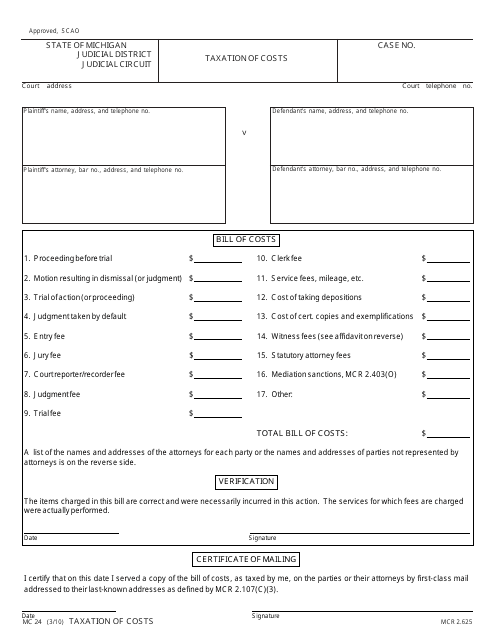

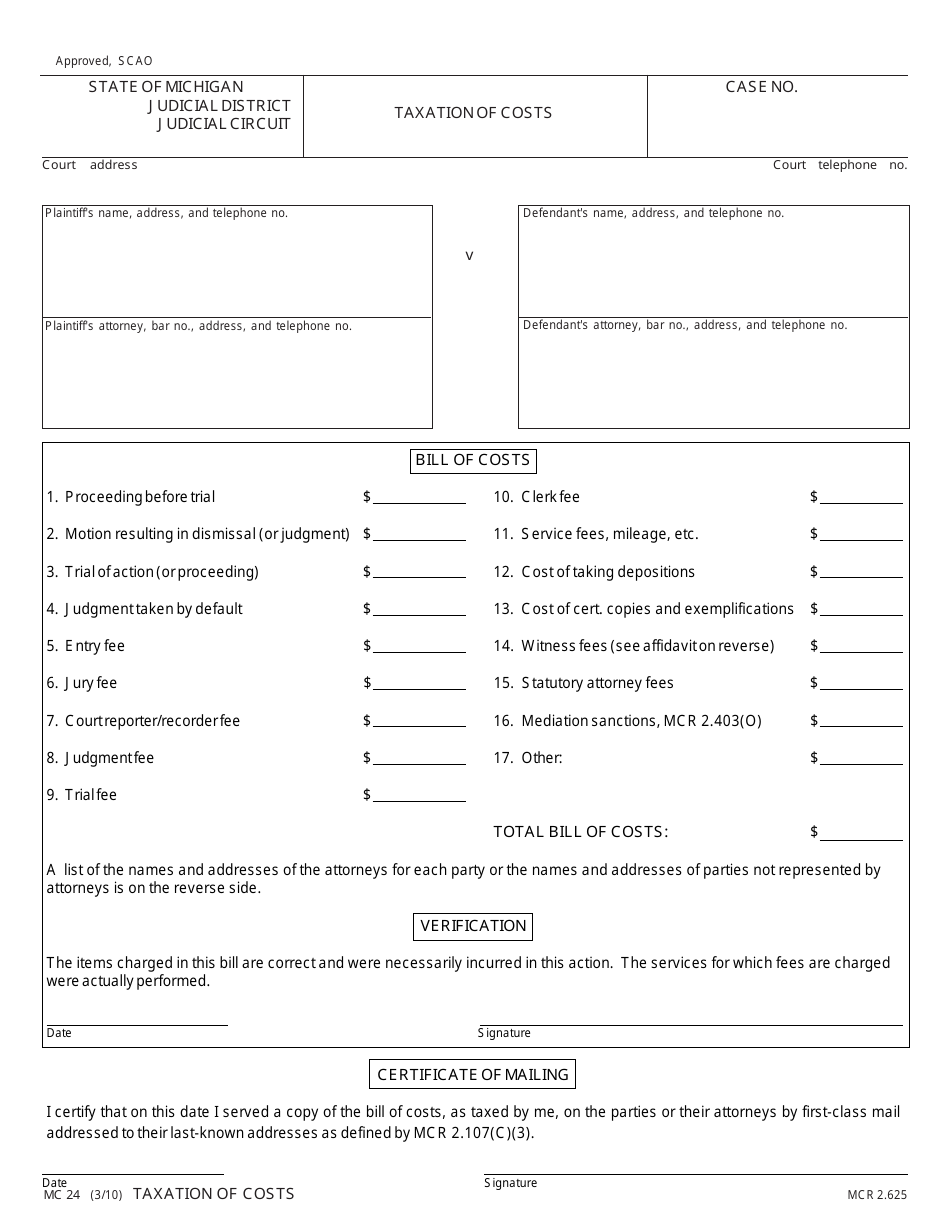

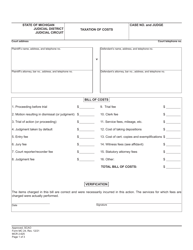

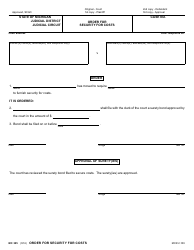

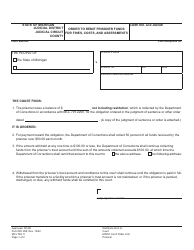

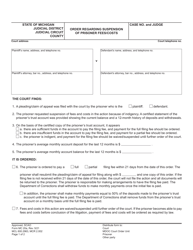

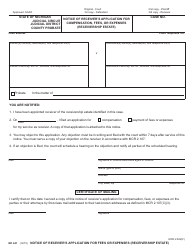

Form MC-24 Taxation of Costs - Michigan

What Is Form MC-24?

This is a legal form that was released by the Michigan District Court - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MC-24?

A: Form MC-24 is a tax form used in Michigan for the taxation of costs.

Q: Who needs to fill out Form MC-24?

A: Form MC-24 is typically filled out by individuals or businesses who have incurred costs related to a legal case.

Q: What is the purpose of Form MC-24?

A: The purpose of Form MC-24 is to provide information to the court regarding the costs incurred during a legal case, which may be reimbursed.

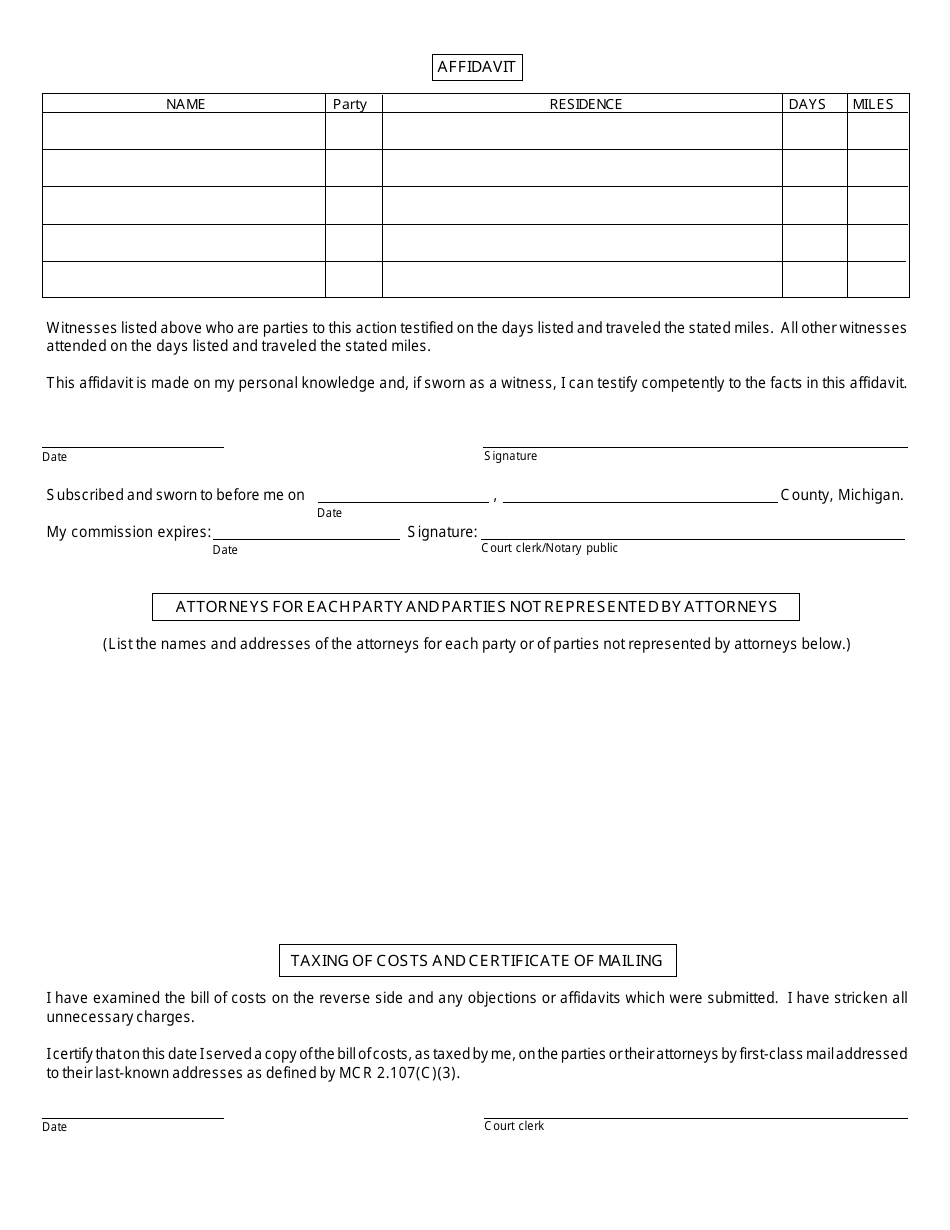

Q: What information is required on Form MC-24?

A: The form requires information such as the case number, the type of cost incurred, the amount of the cost, and any supporting documentation.

Q: When should Form MC-24 be submitted?

A: Form MC-24 should be submitted within a certain time frame as determined by the court. It is best to check with the court or consult with an attorney for the specific deadline.

Q: Are there any fees associated with filing Form MC-24?

A: There may be filing fees associated with submitting Form MC-24, but the specific fees will depend on the court's filing fee schedule.

Q: What happens after I submit Form MC-24?

A: After you submit Form MC-24, the court will review the information and determine whether to award reimbursement for the costs you have incurred.

Q: Can I appeal a decision regarding the taxation of costs?

A: Yes, you may be able to appeal a decision regarding the taxation of costs. It is advisable to consult with an attorney for guidance on the appeals process.

Q: Is there a deadline for filing an appeal?

A: Yes, there is typically a deadline for filing an appeal. The deadline will be set by the court and you should consult with an attorney to ensure you meet the deadline.

Form Details:

- Released on March 1, 2010;

- The latest edition provided by the Michigan District Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MC-24 by clicking the link below or browse more documents and templates provided by the Michigan District Court.