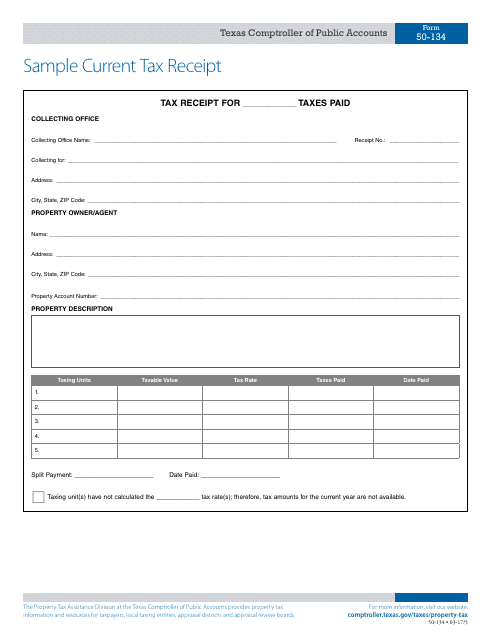

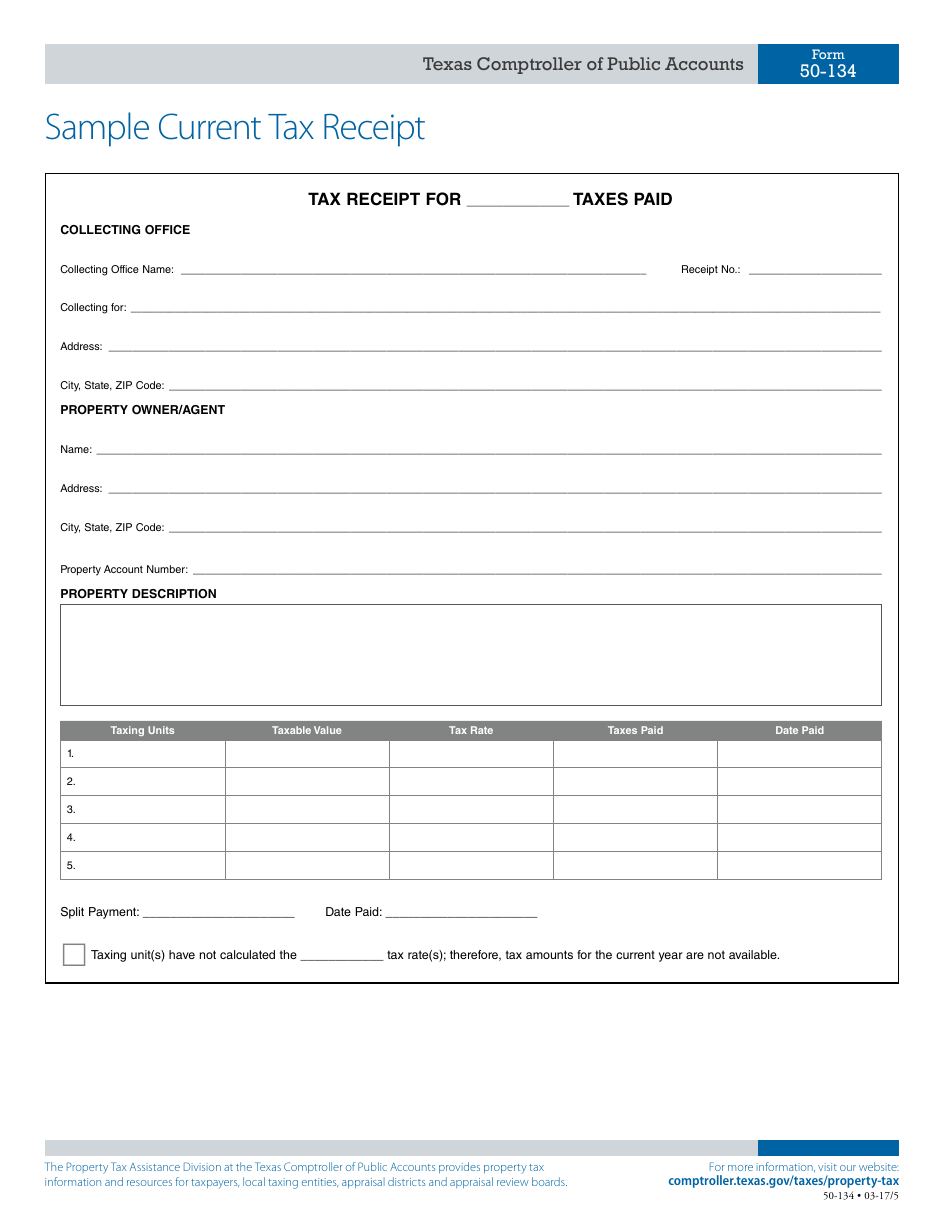

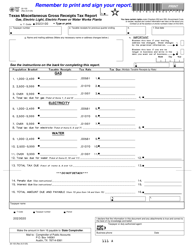

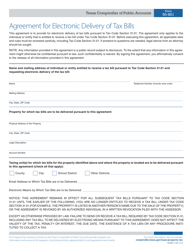

Form 50-134 Sample Current Tax Receipt - Texas

What Is Form 50-134?

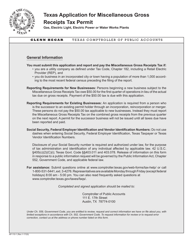

This is a legal form that was released by the Texas Comptroller of Public Accounts - a government authority operating within Texas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 50-134?

A: Form 50-134 is a sample current tax receipt for the state of Texas.

Q: What is the purpose of Form 50-134?

A: The purpose of Form 50-134 is to provide taxpayers with a sample current tax receipt for their records.

Q: Do I need to submit Form 50-134?

A: No, Form 50-134 is for informational purposes only and does not need to be submitted to the tax authorities.

Q: Can I use Form 50-134 as proof of payment?

A: No, Form 50-134 is a sample receipt and cannot be used as an official proof of payment. You should retain your original tax payment receipts for that purpose.

Q: Can I request an official tax receipt?

A: Yes, if you need an official tax receipt, you should contact the Texas Comptroller of Public Accounts or refer to the instructions provided by the tax authorities.

Q: Is Form 50-134 specific to Texas?

A: Yes, Form 50-134 is specific to the state of Texas and may not be applicable in other states.

Q: What information is included on Form 50-134?

A: Form 50-134 includes information such as the taxpayer's name, tax account number, payment amount, and payment date.

Q: Can I use Form 50-134 for federal taxes?

A: No, Form 50-134 is specific to state taxes in Texas and cannot be used for federal taxes.

Q: Can I use Form 50-134 for business taxes?

A: Form 50-134 is primarily designed for individual taxpayers, and its applicability to business taxes may vary. It is recommended to consult the tax authorities or a tax professional for specific guidance regarding business taxes.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Texas Comptroller of Public Accounts;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 50-134 by clicking the link below or browse more documents and templates provided by the Texas Comptroller of Public Accounts.