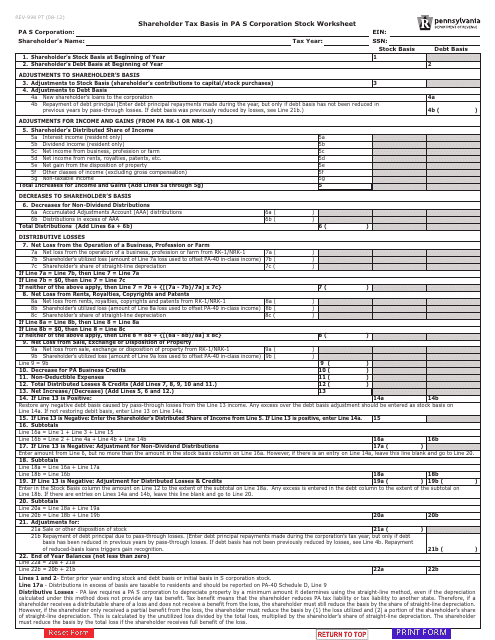

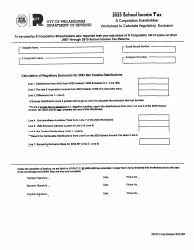

Form REV-998 Shareholder Tax Basis in Pa S Corporation Stock Worksheet - Pennsylvania

What Is Form REV-998?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form REV-998?

A: Form REV-998 is a worksheet used for calculating the shareholder's tax basis in Pennsylvania S corporation stock.

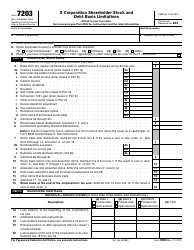

Q: What is a tax basis?

A: Tax basis refers to the initial value of an asset for tax purposes.

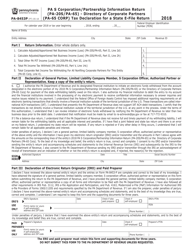

Q: What is an S corporation?

A: An S corporation is a type of business entity that passes through its income, losses, deductions, and credits to its shareholders for federal tax purposes.

Q: Why is calculating tax basis important for a shareholder?

A: Calculating tax basis is important for a shareholder to determine their potential tax liability when they sell or dispose of their S corporation stock.

Q: Who needs to use Form REV-998?

A: Shareholders of Pennsylvania S corporations who want to calculate their tax basis in the stock of the corporation need to use Form REV-998.

Q: What information is needed to complete Form REV-998?

A: To complete Form REV-998, shareholders will need information such as the initial stock basis, annual adjustments, and any stock transactions during the year.

Q: Are there any filing deadlines for Form REV-998?

A: Yes, Form REV-998 needs to be filed by the due date of the shareholder's Pennsylvania personal income tax return.

Q: What if I have questions or need help with Form REV-998?

A: If you have questions or need help with Form REV-998, you can contact the Pennsylvania Department of Revenue or consult a tax professional.

Q: Is Form REV-998 specific to Pennsylvania?

A: Yes, Form REV-998 is specific to Pennsylvania and is used for calculating tax basis in the stock of Pennsylvania S corporations.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-998 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.