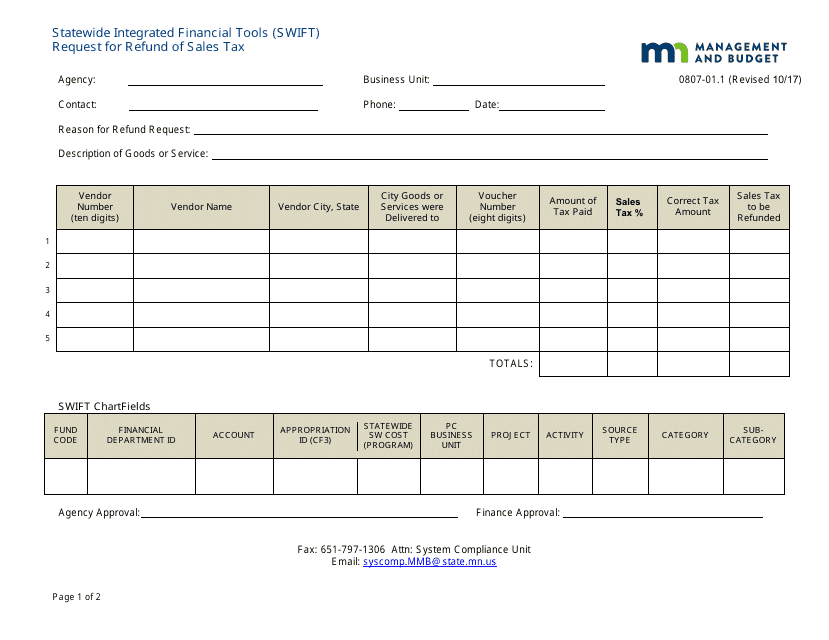

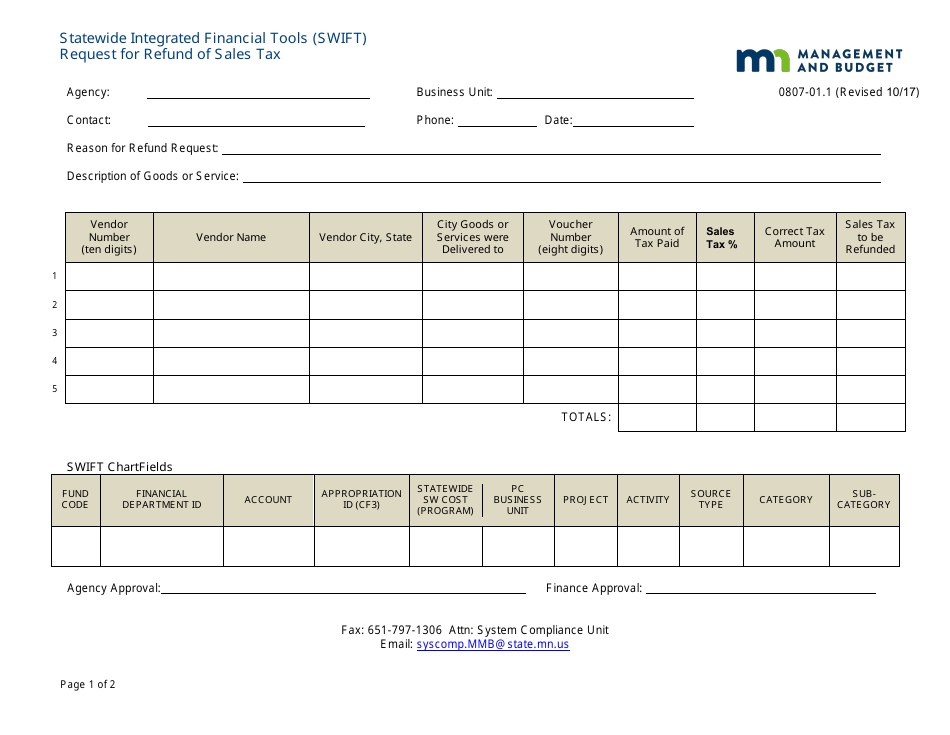

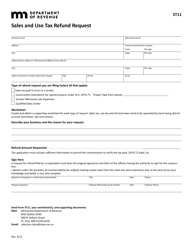

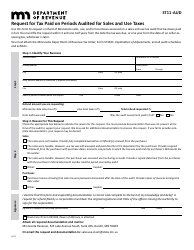

Form 0807-01.1 Statewide Integrated Financial Tools (Swift) Request for Refund of Sales Tax - Minnesota

What Is Form 0807-01.1?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 0807-01.1?

A: Form 0807-01.1 is the Statewide Integrated Financial Tools (Swift) Request for Refund of Sales Tax in Minnesota.

Q: What is the purpose of Form 0807-01.1?

A: The purpose of Form 0807-01.1 is to request a refund of sales tax in Minnesota.

Q: Who can use Form 0807-01.1?

A: Any individual or business who is eligible for a sales tax refund in Minnesota can use Form 0807-01.1.

Q: Is there a deadline for submitting Form 0807-01.1?

A: Yes, you must submit Form 0807-01.1 within three years from the due date of the return in order to claim a refund.

Q: What supporting documents do I need to include with Form 0807-01.1?

A: You need to include copies of your sales tax returns, invoices, receipts, and any other relevant documentation to support your refund claim.

Q: How long does it take to process a refund request submitted on Form 0807-01.1?

A: The processing time for refunds can vary, but generally, it takes about 30 days for the Minnesota Department of Revenue to review and process a refund request.

Q: Are there any fees involved in submitting Form 0807-01.1?

A: No, there are no fees involved in submitting Form 0807-01.1 for a sales tax refund in Minnesota.

Form Details:

- Released on October 1, 2017;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 0807-01.1 by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.