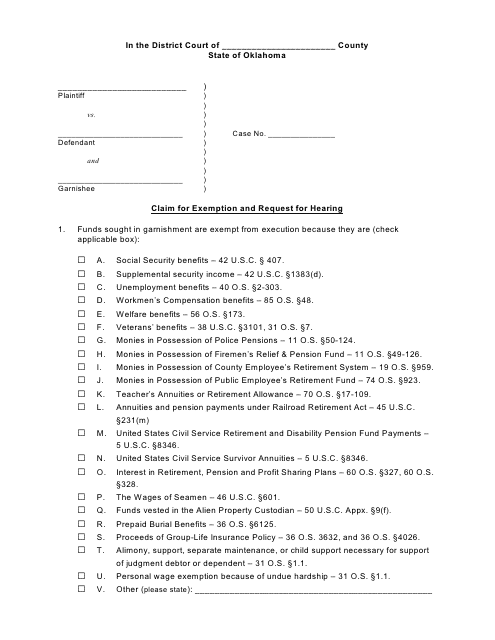

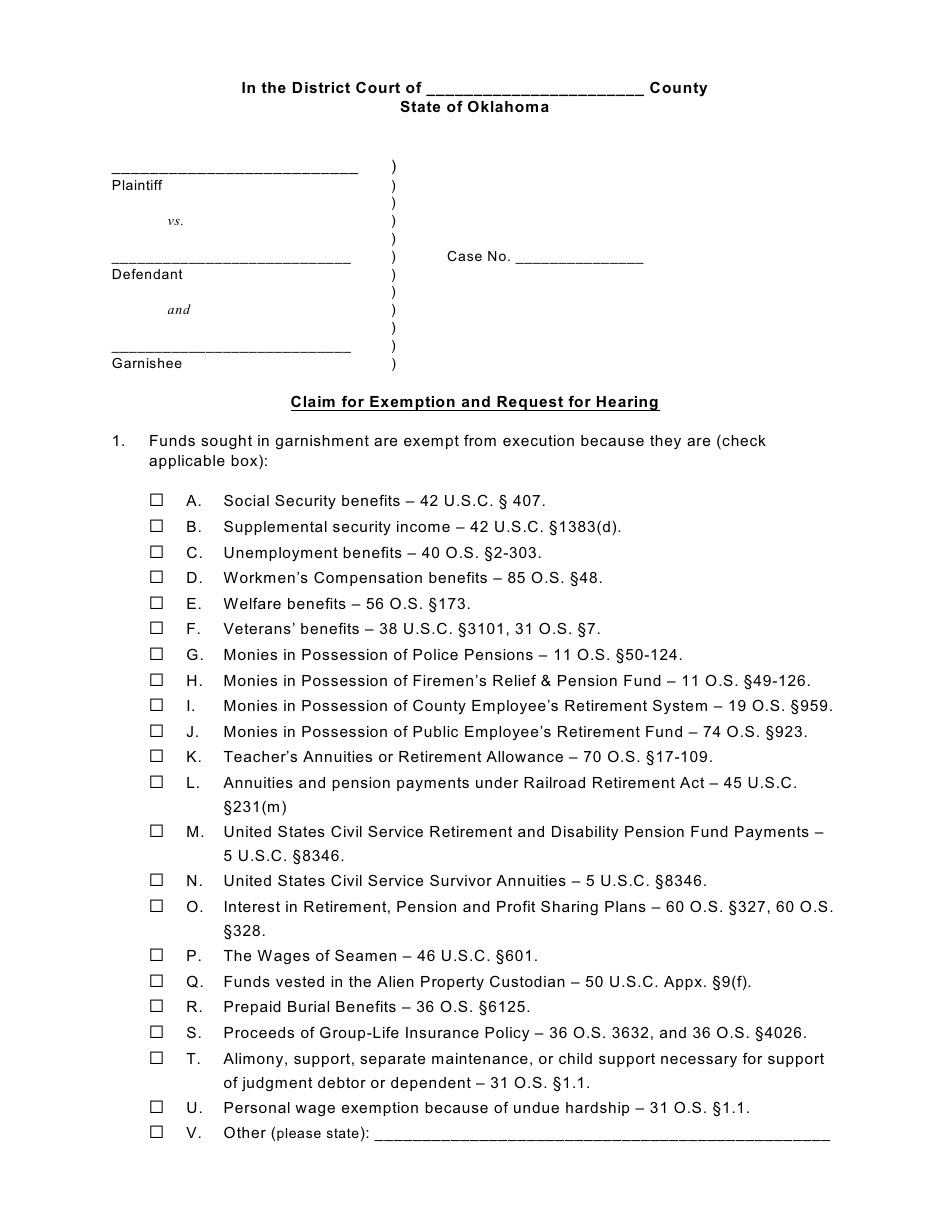

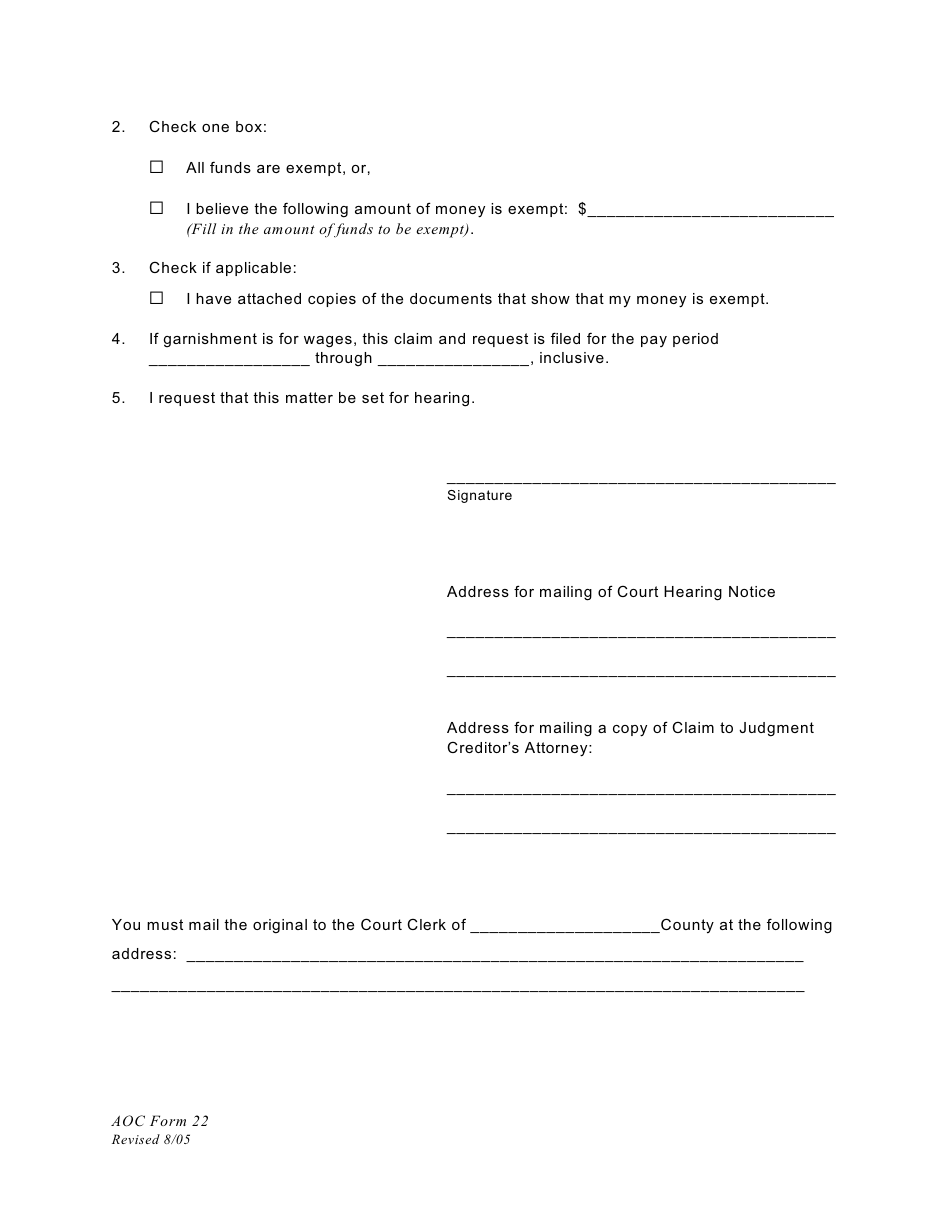

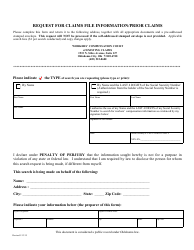

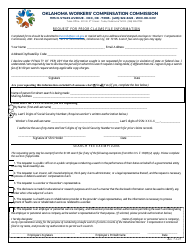

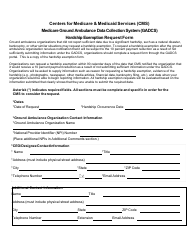

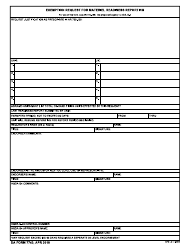

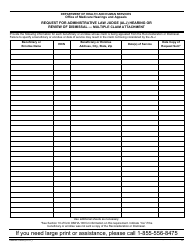

Form 22 Claim for Exemption and Request for Hearing - Oklahoma

What Is Form 22?

This is a legal form that was released by the Oklahoma Court System - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 22?

A: Form 22 is a document used in Oklahoma to claim exemption and request a hearing.

Q: What can I use Form 22 for?

A: You can use Form 22 to request an exemption from certain taxes or fees and to request a hearing if your exemption is denied.

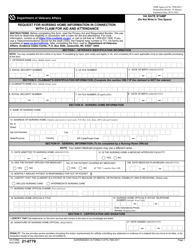

Q: What information do I need to provide on Form 22?

A: You will need to provide personal information, information about the tax or fee you are seeking exemption from, and a detailed explanation of why you believe you qualify for the exemption.

Q: What happens after I submit Form 22?

A: After you submit Form 22, the Oklahoma Tax Commission will review your request and determine whether to grant or deny your exemption. If your exemption is denied, you may request a hearing to appeal the decision.

Q: Is there a deadline for submitting Form 22?

A: Yes, you must submit Form 22 within the specified timeframe outlined by the Oklahoma Tax Commission. Check the form instructions or contact the Tax Commission for the deadline.

Q: Can I get help filling out Form 22?

A: Yes, you can contact the Oklahoma Tax Commission for assistance with filling out Form 22 or with any questions you may have about the process.

Q: Is there a fee for submitting Form 22?

A: No, there is no fee required to submit Form 22.

Q: What should I do if my exemption is denied?

A: If your exemption is denied, you have the option to request a hearing to appeal the decision. Follow the instructions provided by the Oklahoma Tax Commission to initiate the hearing process.

Form Details:

- Released on August 1, 2005;

- The latest edition provided by the Oklahoma Court System;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 22 by clicking the link below or browse more documents and templates provided by the Oklahoma Court System.